- Lawyer Invoice Morgan claims that the choose’s ruling on the Daubert movement targeted on knowledgeable proof for buying and selling within the secondary market of XRP.

- Whether or not XRP will re-list on exchanges is dependent upon whether or not it’s inherently categorised as a safety.

- Ripple could search SEC approval to explicitly exclude secondary gross sales in last judgment.

In a latest tweet, lawyer Invoice Morgan mentioned that in ruling on the Daubert movement, Decide Analisa Torres took a transparent stance on the particular situation she wanted to resolve. The choice revolved round whether or not to permit or deny knowledgeable proof relating to secondary market buying and selling of XRP, quite than XRP itself.

Morgan shares that he hopes the choose will tackle the essential query of whether or not XRP qualifies as a safety, following on from his newest Twitter thread Could 29.

Within the thread, he highlighted the continued dialogue of whether or not or how “secondary market gross sales” of XRP will likely be dealt with within the Ripple case. This facet is vital as a result of the re-listing of XRP on exchanges largely is dependent upon the elemental query of whether or not XRP is inherently categorised as safety is sufficiently handled. Addressing this important situation is essential to constructing belief within the potential re-listing of XRP on exchanges.

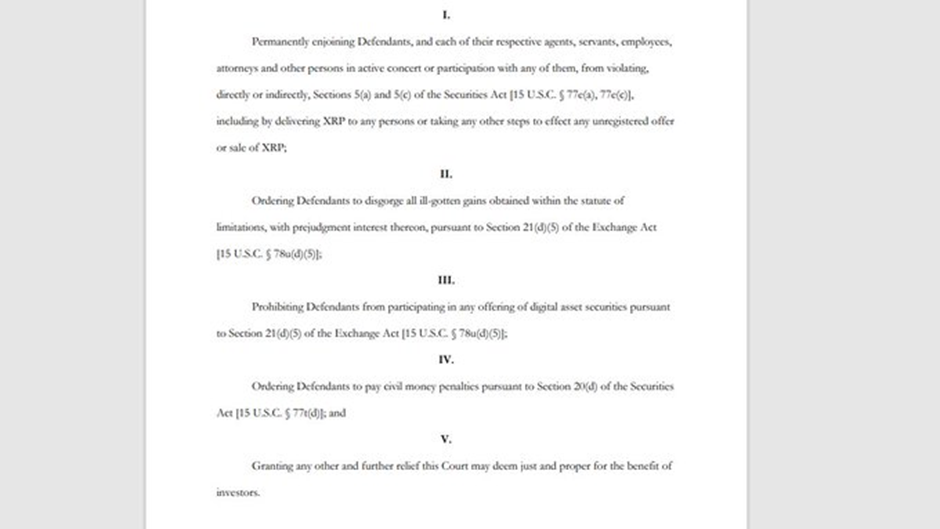

Regardless of the presence of language within the SEC lawsuit that suggests that XRP itself is taken into account a safety, Morgan notes that the purposes made by the SEC to the Court docket don’t search to confer such standing on the asset. .

Based on Morgan, a number of eventualities might tackle the difficulty of secondary gross sales within the Ripple case. First, Ripple might search SEC approval to explicitly exclude secondary gross sales within the last judgment, following the profitable method taken by KIK Interactive.

Second, the lawyer mentions that the choose could contemplate considerations raised by varied events, together with XRP holders represented by lawyer Deaton, relating to secondary gross sales. Given the precedent of the LBRY case, the place secondary gross sales have been addressed to some extent, the same method could also be potential within the Ripple case.

Moreover, if Ripple loses the lawsuit, throughout the “penalties” stage when writing a restitution order, the choose could also be pressured to take care of secondary gross sales. Ripple might argue that solely direct consumers of Ripple ought to recoup their funding, as established within the SEC v. Wang case. Failure to take action would lead to diluted refund quantities for particular person consumers on account of giant secondary gross sales.

Finally, such a transfer would implicitly tackle the difficulty of secondary gross sales and guarantee a good distribution of returned funds, in keeping with Morgan.