- A crypto Twitter consumer tweeted yesterday that Huobi’s BTC collateral is getting dangerously low.

- The publish additionally warned {that a} financial institution run may very well be within the offing if Huobi doesn’t improve its reserves quickly.

- At press time, BTC was buying and selling at $30,351.14 after a 24-hour lack of 1.35%.

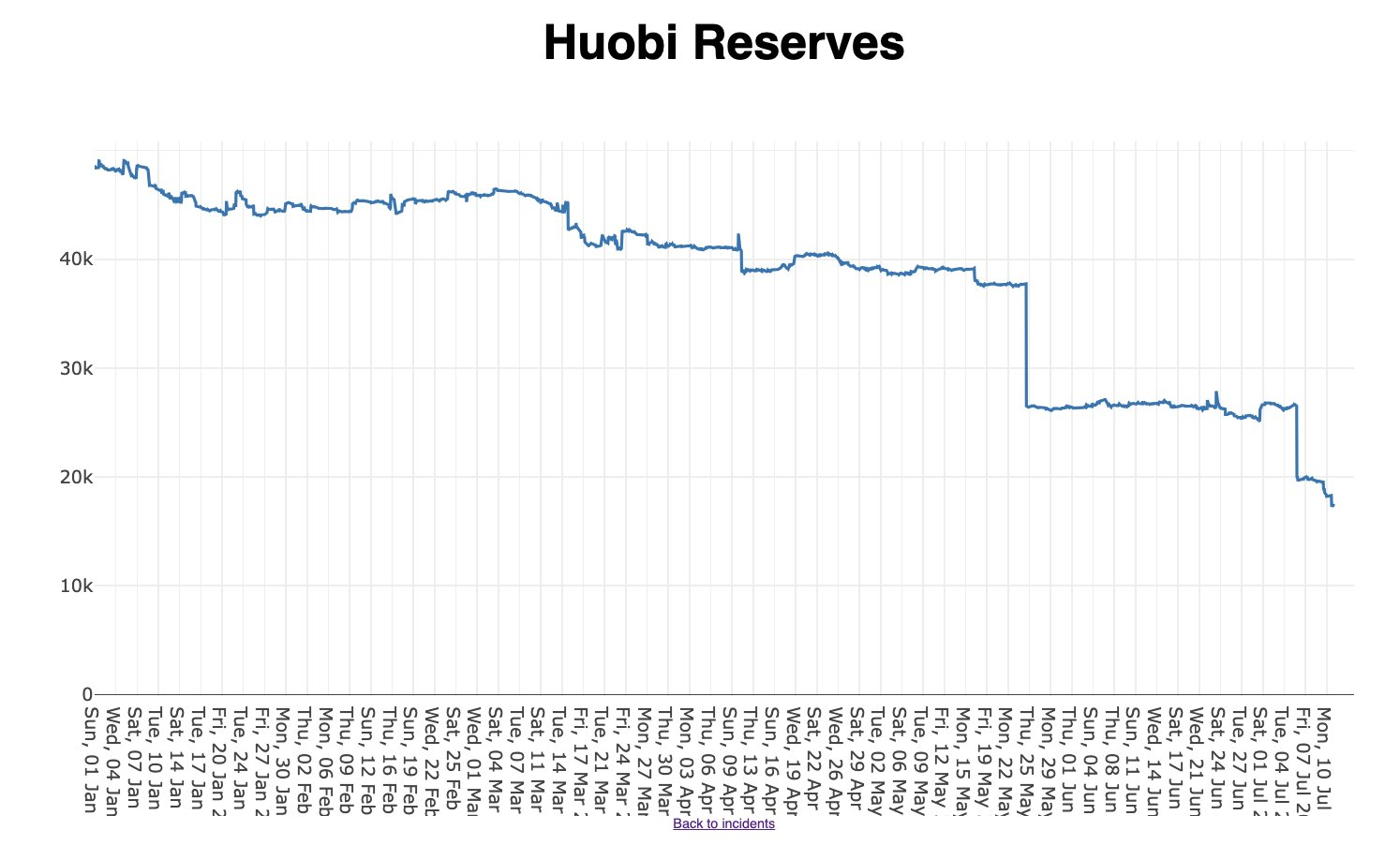

Analyst Willy Woo revealed in a tweet yesterday that Huobi’s Bitcoin (BTC) collateral is “beginning to look dangerously low.” Moreover, he warned that the trade could quickly face a threat of a financial institution run.

Within the publish, Woo revealed that the trade’s reserves have been declining over the previous few weeks. At first of the yr, Huobi’s reserves stood at greater than $40,000. Since then, nevertheless, the full has fallen beneath $20,000.

In associated information, the value of BTC stood at $30,351.14 at press time based on CoinMarketCap. This was after it fell round 1.35% prior to now 24 hours. This adverse every day efficiency additionally dragged the market chief’s weekly efficiency into the pink. Because of this, the crypto has fallen by 0.89% over the previous 7 days.

The 24-hour loss meant the crypto was additionally buying and selling nearer to its every day low of $30,228, whereas its 24-hour excessive stood at $30,959.97. Along with weakening in opposition to the greenback, BTC has additionally been outperformed by Ethereum (ETH) over the previous 24 hours. At press time, BTC was down 0.08% in opposition to the biggest altcoin by market capitalization.

From a technical standpoint, BTC was buying and selling beneath the 9-day EMA line at press time. If it doesn’t shut right this moment’s every day candle above the technical indicator, it’s prone to fall to the 20-day EMA line at round $30,000 inside the subsequent 48 hours. Continued promoting strain could even trigger BTC to fall to the essential assist at $29,550 within the coming week.

Nonetheless, if BTC is ready to shut the following 2 every day candles above $30,400, it’d take into account retesting the key resistance stage at $31,060 within the following days. If the crypto main is ready to flip this key resistance into assist, then it could have a transparent path as much as $32,000.

Disclaimer: Views and opinions, in addition to all data shared on this value evaluation, are revealed in good religion. Readers ought to do their very own analysis and due diligence. Any motion taken by the reader is strictly at his personal threat. Coin Version and its associates won’t be held accountable for any direct or oblique injury or loss.