Former CTO of Coinbase Balaji Srinivasan sparked hypothesis about US regulatory actions on Twitter, writing: “The assault on Bitcoin is coming.”

The remark was made in settlement with Alexander Leishmanthe CEO of River Monetary, who referred to as on Bitcoiners to remain humble “throughout all this regulatory drama” as a result of regulators would come after Bitcoin in the end.

In separate enforcement actions in opposition to Binance and Coinbase earlier this week, the authorized filings made a number of allegations associated to violations of securities legal guidelines, together with (in each circumstances) working as an unregistered trade.

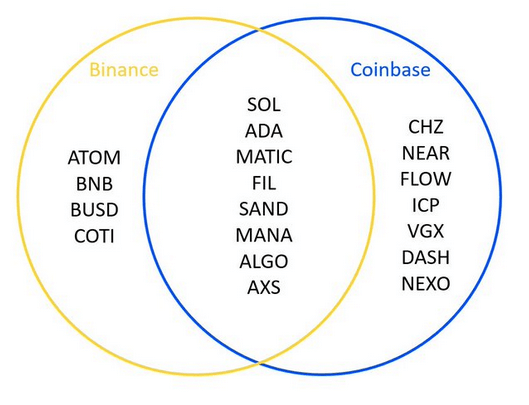

The filings additionally named varied tokens traded on every platform as securities, which may probably influence their US operations or result in widespread delisting.

Analyst Miles Deutscher has compiled the 19 altcoins named by the SEC, displaying them in a Venn diagram as an example the crossovers between the 2 exchanges.

Max Bitcoins

Some bitcoin maximalists have backed the SEC’s enforcement actions, implying that an altcoin purge is required to speed up bitcoinization.

In response, Fortress Island Ventures GP, Nick Carterposted a prolonged tweet berating the maxis who applauded the SEC, claiming that the “cultists” had didn’t keep in mind the efforts of Coinbase and Binance to maneuver your entire business ahead, together with the mixing of Bitcoiners and the adoption of BTC.

“So why are they surprised by the potential obliteration of Coinbase and Binance, which have collectively onboarded 100-200 million folks globally to crypto and, extra particularly, Bitcoin?

Carter likened BTC maximalism to spiritual dogma and the necessity to discover a “ethical superior.” With this, he questioned the motives of BTC maximalism, suggesting that it comes from the must be appropriate.

In any other case, it will imply that they selected a “God (it) was a faux.

Gold confiscations

Thus far, Bitcoin has loved an implied seal of approval as a result of its truthful token launch and perceived decentralization. However Srinivasan steered that regulators will activate Bitcoin quickly sufficient.

He identified that President Franklin Roosevelt, who signed Government Order 6102 in April 1933, additionally created the SEC after passing the Securities Change Act of 1934.

Government Order 6102 required U.S. residents to promote all however a small quantity of non-public gold to the federal authorities for money to bolster the cash provide throughout the Nice Melancholy. Residents who refuse may face stiff penalties, together with jail time or fines of as much as $10,000.

Srinivasan argued that the purpose of the SEC and valuable metallic confiscations”was to determine state management over the economic system,” insinuating a repeat of historical past.