Bitcoin’s illiquid provide hit a brand new all-time excessive as hodlers spend lower than they accumulate.

The rise in illiquid provide speaks to the dedication of Bitcoin buyers at a time of excessive FIAT inflation and macroeconomic considerations.

Historically, “illiquid provide” refers back to the quantity of Bitcoin held by entities and never available for commerce or sale.

Glassnode takes a extra nuanced strategy to figuring out illiquid provide and makes use of statistical strategies to tell apart which entities primarily ship/promote or obtain/purchase Bitcoin and the way lengthy has handed since an entity has spent Bitcoin. It considers Bitcoin to be illiquid if held by entities that traditionally solely spend or promote a small portion of their acquired Bitcoin.

Illiquid provide has reached an all-time excessive, with 15.110 million bitcoins now held by these entities. This determine represents a big enhance from final month’s document excessive of 15.056 million, representing roughly 78% of the circulating provide.

What’s the reason for decreased liquidity?

The rise within the illiquid provide of Bitcoin might be attributed to varied elements. Some of the essential is the conduct of short-term holders who’ve held Bitcoin for lower than six months. This cohort presently holds over 20% of the provision, and their holdings have seen a noticeable enhance in current weeks. This development means that short-term holders, a lot of whom purchased Bitcoin in This autumn 2022 and Q1 2023, are turning into long-term holders. As these folks proceed to carry onto their Bitcoin, the illiquid provide ought to enhance additional.

The rise within the illiquid provide of Bitcoin comes throughout elevated inflation of fiat currencies all over the world. As central banks print cash in response to financial pressures, the worth of conventional currencies is diluted. In distinction, Bitcoin, with its capped provide and stuck issuance, is commonly seen as a hedge towards inflation. Moreover, the rise in illiquid provide means that extra people are recognizing Bitcoin’s potential as a retailer of worth and are selecting to carry their property slightly than commerce or promote them.

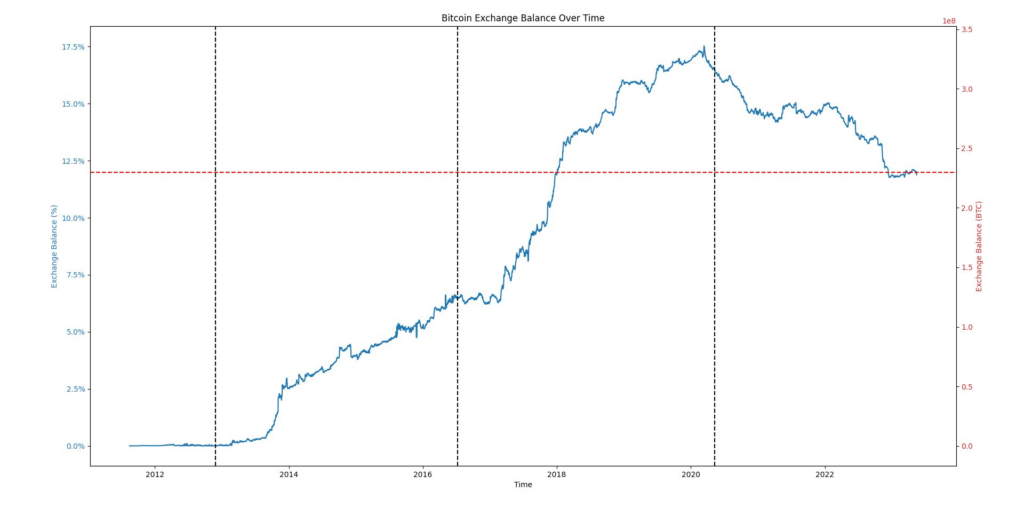

The thesis can also be considerably supported by the correlation with a lower in Bitcoin held on exchanges as illiquid provide will increase. At the beginning of 2020, exchanges held 17.5% of Bitcoin’s provide. This determine has since fallen to round 12%, indicating that increasingly more persons are selecting to carry their Bitcoin in non-public wallets.

The collapse of main crypto exchanges in 2022 has additional accelerated the departure of Bitcoin exchanges. Nonetheless, this will likely even have impacted illiquid provide to some extent, as liquidators are nonetheless holding billions of {dollars} price of crypto in chapter hearings for failed exchanges.

The rise within the illiquid provide of bitcoin displays the rising recognition of bitcoin as an inflation hedge and a retailer of worth. As extra people select to carry their Bitcoin, the illiquid provide will enhance. This development contrasts sharply with FIAT financial savings, because the discount in bills is linked to the next price of residing slightly than the buildup of wealth. You will need to be aware that with a number of international locations such because the UK experiencing a “price of residing disaster”, crypto spending might additionally decline as folks reduce on non-essentials.

Put up-Bitcoin illiquid provide hits all-time excessive as hodler decision appeared first on forexcryptozone.