Though Bitcoin lately breached the $28,000 resistance degree, the crypto market has remained comparatively steady over the previous month. The dearth of volatility within the traditionally aggressive market has been an evident underlying development throughout a number of on-chain metrics.

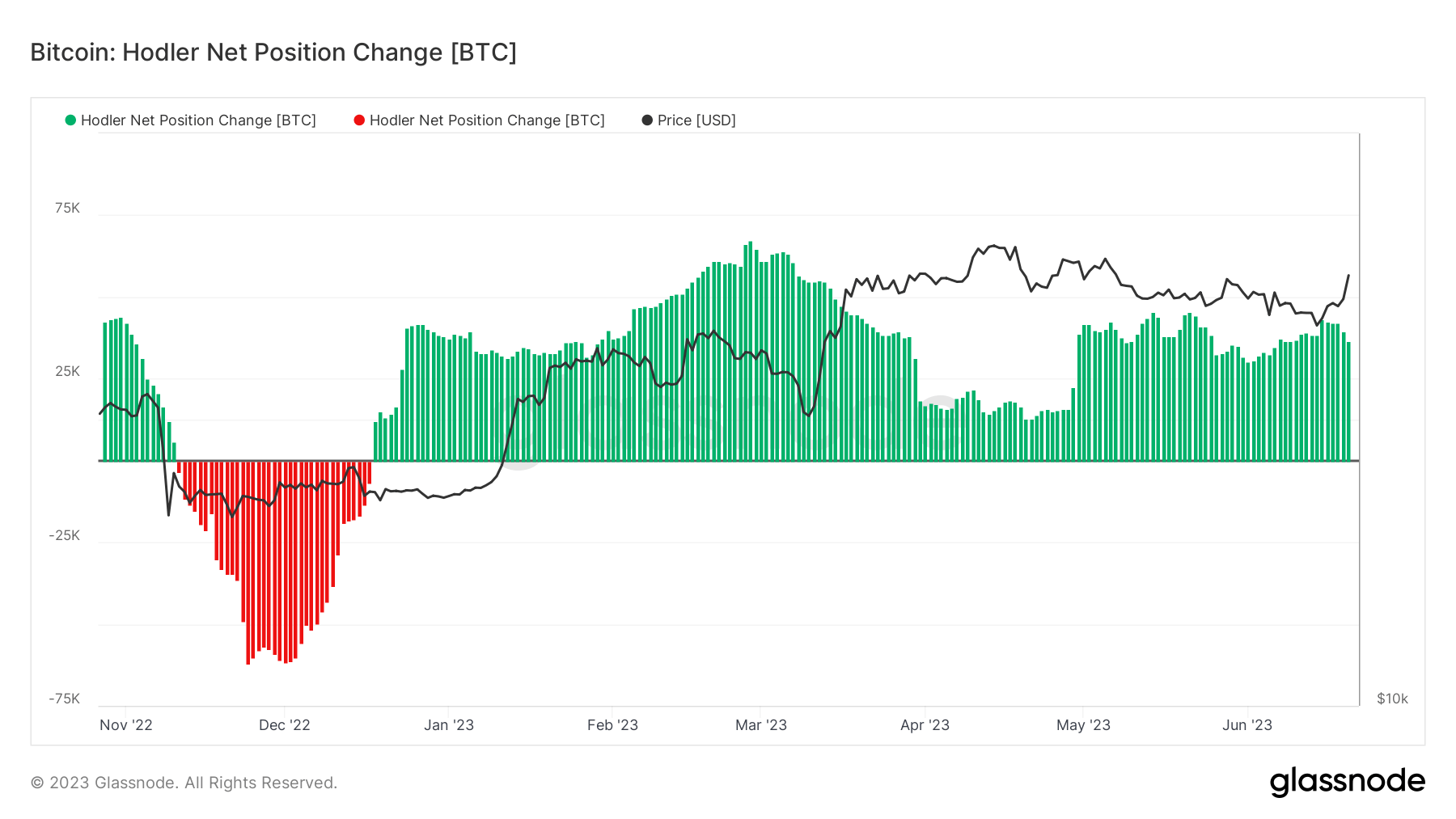

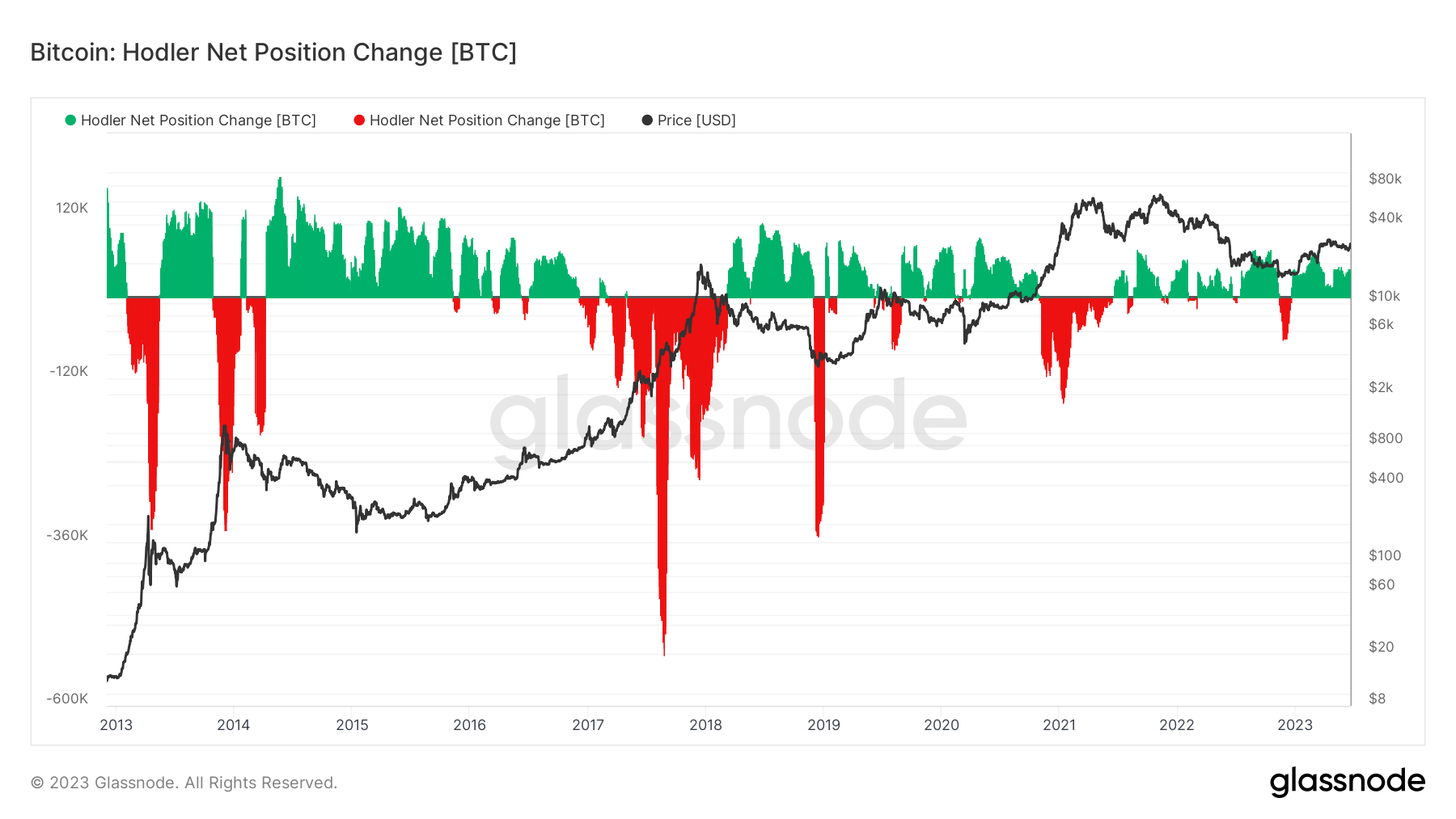

Bitcoin hodlers capitalized on this sideways worth motion, persevering with the regular accumulation that has been the dominant development this 12 months. Information from Glassnode confirmed continued progress in hodler internet positions, with a mean of 36,500 BTC being added to their balances every month.

This accumulation section is nothing new. As an alternative, it was a gradual and regular march from June 2021. Historic knowledge exhibits two related intervals of accumulation – one extending from April 2014 to December 2016 and the opposite from March 2018 to October 2020. With each intervals lasting roughly two years and 7 months, historic fashions recommend that it might be a minimum of six months earlier than the market experiences one other hodler distribution cycle.

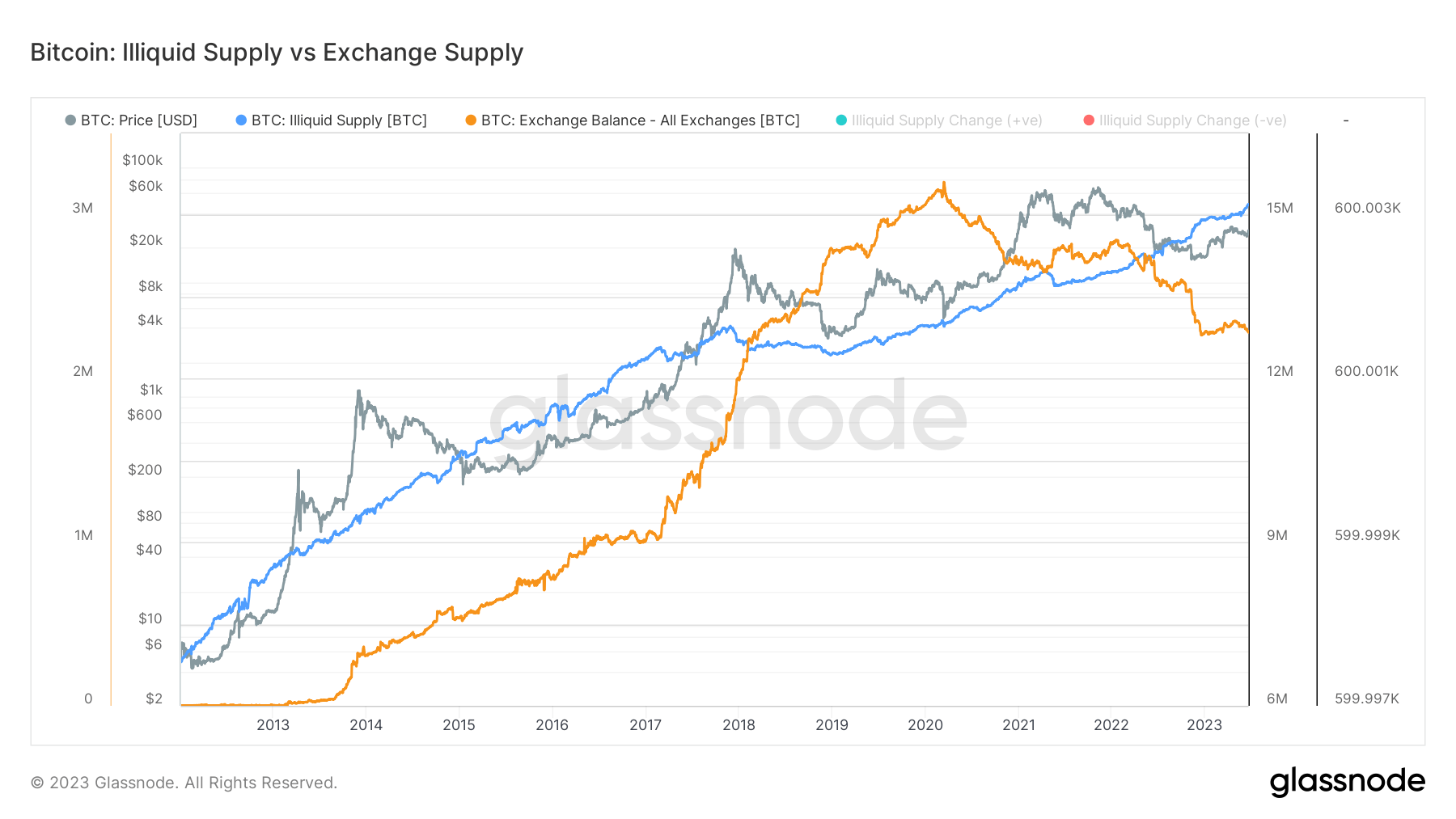

This improve in hodler accumulation can also be seen within the illiquid provide of Bitcoin, or the quantity of Bitcoin that’s not readily that can be purchased, promote, or commerce. On June 20, the illiquid provide of Bitcoin reached its all-time excessive of 15.2 million BTC. This represents 78% of Bitcoin’s circulating provide as of June 20.

There was a 2.2 million BTC improve in illiquid provide for the reason that begin of 2020, a rise of 17%. Whereas this 12 months has solely seen a 2% improve in illiquid provide, the seemingly low quantity equates to over 298,600 BTC added to illiquid wallets.

The quantity of Bitcoin held on exchanges has remained comparatively steady for the reason that begin of the 12 months, posting a decline of 0.85%. Nonetheless, the decline turns into a lot steeper when zoomed out – for the reason that begin of 2020, the quantity of Bitcoin held on exchanges has decreased by 25%.

Illiquid publish Bitcoin provide hits all-time excessive as hodlers proceed to pile up appeared first on forexcryptozone.