On this article we analyze collectively 3 crypto initiatives and their tokens: The Graph (GRT), Sprint (DASH) and Radiant (RXD).

Let’s examine what they’ve to supply the blockchain and Web3 world, whereas looking on the charts to know the path of those tokens.

The newest information for The Graph (GRT), Sprint (DASH) and Radiant (RXD)

We begin by looking on the newest market information for the three crypto belongings The graphic (GRT), Sprint (DASH) and Radiant (RXD).

The graph (GRT) is a indexing protocol which is used to question information for networks resembling Ethereum and IPFS. Anybody can create and publish APIs, known as “sub-graphs”, that Web3 functions can question to arrange and entry information on the blockchain.

There are 3 current information for this venture:

- The primary is integration of The Graph know-how with the value aggregator in DeFi Paraswap. Sub-graphs have been efficiently built-in into the platform and will be queried to acquire and set up dependable information resembling value feeds from tokens.

- The second issues the brand new partnership with Banxa (from March 23) to permit customers to pay by credit score or debit card to make API calls and get information for decentralized functions. It’s an incentive for adoption in addition to a way of simplify the person expertise for these requesting the companies of The Graph.

- The newest information, however, talks in regards to the progress of labor on “scaling” on the Arbitrum One community: up to now, 5% of the rewards for the indexing work performed by The Graph nodes can be found on this layer 2 blockchain that has been talked about a lot in current weeks given the discharge of the tokens ARB by way of airdrop.

The Graph continues to evolve with L2 🌱

Part 2 is full: 5% of indexing rewards are actually out there on @arbitrum ✨

Complete indexing rewards on Arbitrum One enhance over time, regularly rising from L1.

This marks the following main step in scaling The Graph 🌟 pic.twitter.com/s6BeZANY37

— The graph (@graphprotocol) April 11, 2023

As for Sprint, a open-source blockchain which provides quick and low-cost funds in a decentralized manner with concentrate on privateness and scalabilitythe one novelty price mentioning issues the “itemizing” of the DASH token on the “Change Now” platform, which provides crypto swap companies immediately by paying in FIAT foreign money.

In search of a quick, straightforward and safe option to commerce crypto? Redeem your Sprint $ In @ChangeNOW_io and entry the perfect charges and lowest charges. Redeem now at https://t.co/ucz2YzULci! ⚡ pic.twitter.com/NBr1XK3RIX

— Sprint (@Dashpay) April 7, 2023

DASH, a crypto that was born as a fork of Litecoin in 2014, appears to have similarities in frequent with Venture Radiant (RXD) in that each have been born with the intention of offering a safe, quick and decentralized infrastructure for cryptocurrency transactions.

Each have a objective, albeit a distant one, of catching up with the king of the Bitcoin market and changing him with their applied sciences.

We will see that Sprint has already failed in his mission since, after 9 years of improvement, nothing remotely comparable has been seen with the Bitcoin protocol.

The token is decaying and there are not any indicators that DASH will play a major position within the Web3 panorama.

In distinction, Radiant (RXD) has solely been round for just a few months. May he be the following crypto successor to the throne?

Crypto Radiant (RXD) desires to exchange Bitcoin

Radiant (RXD) is a peer-to-peer digital asset system which permits the direct trade of worth with out going via a central monetary infrastructure, such because the ECB or the Fed.

It’s an open-source protocol that, via the usage of blockchain, goals to create an financial system comprised of free exchanges of digital belongings.

Radiant desires to exchange Bitcoin with its most effective know-how by way of scalability and power consumption. Nonetheless, the problem appears to be very troublesome: many crypto initiatives have tried over time to overhaul Bitcoin however all have failed miserably over time.

Intimately, let’s have a look at what commonalities and variations between the 2 protocols are.

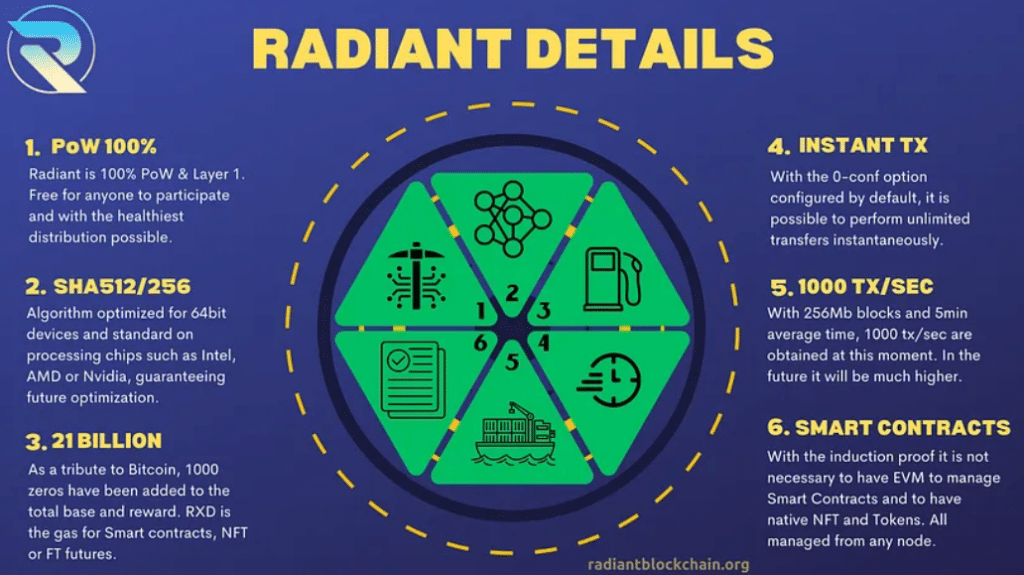

The 2 lay the groundwork for his or her work via the Proof-of-Work (PoW) cross-node consensus mechanism that makes use of {hardware} computing energy to validate blocks throughout the blockchain.

Radiant and Bitcoin require minimal construction and transaction timestampnonetheless, the primary design advantages from a extra environment friendly algorithm (SHA512256D) than the second, able to permitting higher transaction scalability.

By way of energy consumption, it additionally appears that Radiant and its RXD half are technically “higher”. At a time in historical past when Co2 emissions are an issue that each nation on the planet must deal with, a protocol that seems environmentally pleasant may have a head begin in international adoption.

Structurally, there’s a substantial distinction.

About bitcoin all nodes are equivalent and do comparable work, whereas on Radiant there’s high nodes liable for extra delicate duties in an effort to preserve the safety and scalability of the community.

Each initiatives lack a crew to handle them and rely immediately on the neighborhood, though Bitcoin’s is significantly bigger and extra well-known.

The names of the founders of the Radiant venture should not identified, neither is the identification of Satoshi Nakamoto, i.e. the one who first printed the Bitcoin whitepaper.

It appears that evidently Radiant and RXD have been additionally designed to compete with world of sensible contracts.

In truth, whereas for Bitcoin there are nonetheless no native sensible contracts on it (aside from the Chain-Key case adopted by ICP), for the “Bitcoin Killer” there are conditions for the creation of dApps that are based mostly on digital contracts made on the Radiant blockchain.

It is a main benefit when you recognize that up to now Bitcoin continues to be used completely as a decentralized fee system.

Though Radiant appears to be a particularly extra technological and purposeful community than Bitcoin, we should nonetheless contemplate one of the vital vital elements on this context, particularly that of reliability.

Bitcoin has been round for 15 years, it is identified and cherished around the globe, there are a whole bunch of builders devoted to bringing new options to the blockchain (just like the Lightning Community), however most significantly, it was the primary venture to suggest itself as a decentralized infrastructure and can at all times stay the popular alternative of customers and buyers.

The BTC coin has made historical past and enjoys a unparalleled status within the cryptocurrency market. It appears extremely unlikely that any venture, together with Radiant and its crypto RXD, will really exchange Bitcoin.

Crypto Asset Worth Evaluation The Graph (GRT), Sprint (DASH) and Radiant (RXD)

Now let’s have a look at how the three crypto belongings GRT, DASH and RXD behave graphically as a substitute.

GRT and DASH mark damaging developments of round 4% within the final 24 hours whereas RXD travels positivelythough there was an in a single day value drop.

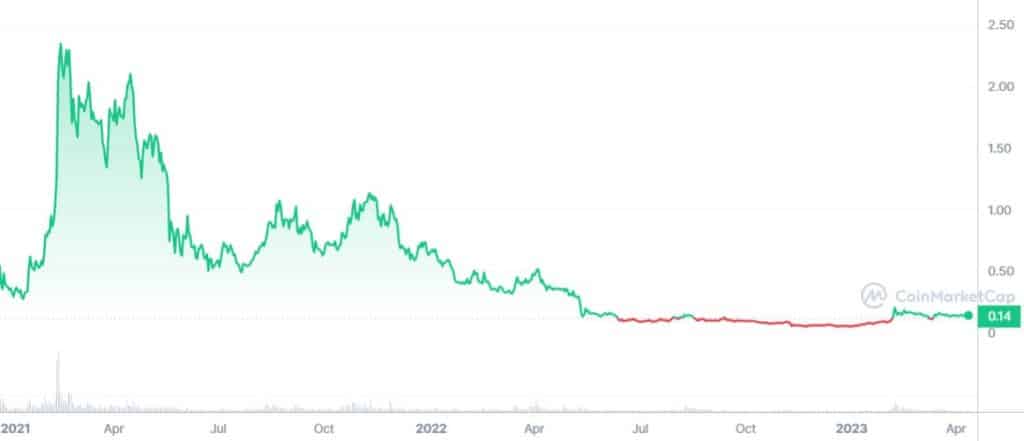

In additional element, GRT is presently buying and selling at $0.144 per token, has a market cap of $1.28 billion, and volumes previously 24 hours down 27% to $48 million.

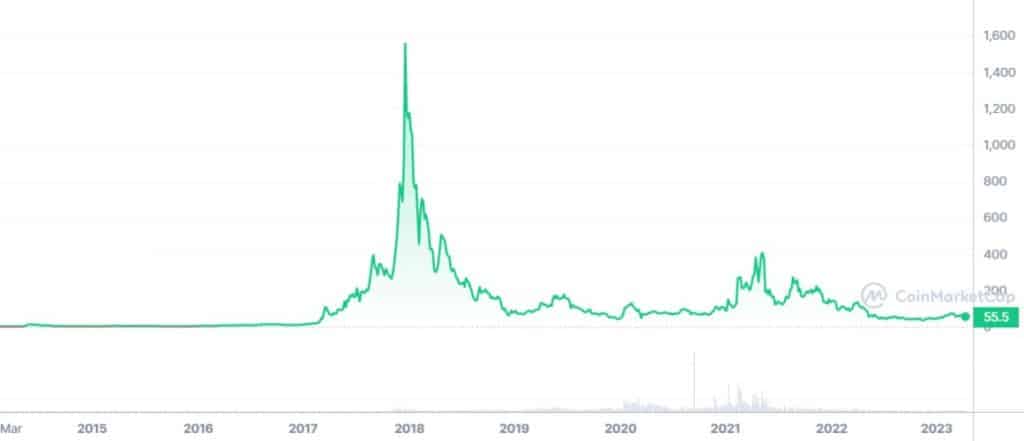

DASH, whose identify is derived from the appellation “digital foreign money”, is buying and selling at $55.54 per token, with a market capitalization of $623 million and volumes down 8% within the final 24 hours for attain a determine of roughly 85 million {dollars}.

Each cryptocurrencies are not thrilling on value motion aspect and do not appear within the temper to provide short-term bullish legs.

Historic highs are distant however have been hit at completely different instances: for GRT the best was reached in February 2021 whereas for DASH in December 2017.

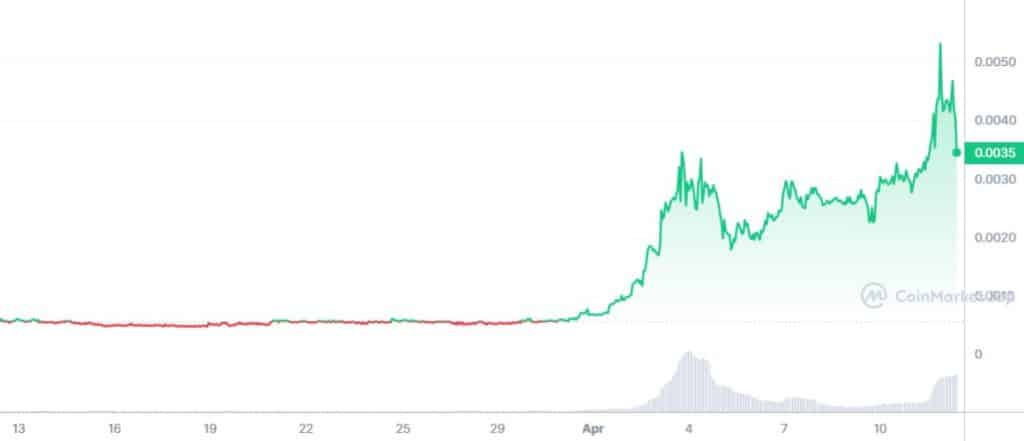

As for RXD, the nemesis of Bitcoin, is presently buying and selling at $0.0033 per coin with a value enhance of seven.48%, the market cap is just $17.3 million (rank #684) and volumes of $1.1 million, up 289% from yesterday’s buying and selling.

Over the previous month, there was an unimaginable rise for this coin, which has seen a rise of just about 10x preliminary worth.

Across the $0.005 mark, an higher development shaped with the standard “peak” sample, adopted by a “decrease excessive” at $0.0047.

Often these formations point out increased chance of a downtrend breakout; nonetheless, in comparison with GRT and DASH, a reversal above the highs appears extra possible on this case.