- The destabilization of the USDT peg could have been triggered by manipulation, in response to Kaiko.

- Promoting exercise started days earlier than USDT fell to $0.995.

- Binance’s USDT-USDC pair noticed substantial USDT promoting.

Kaiko, a cryptocurrency knowledge supplier, uncovered insights into latest volatility surrounding Tether (USDT), the world’s largest stablecoin. The corporate’s evaluation means that the destabilization of the USDT peg to the US greenback could have been triggered by manipulation previous the discharge of a significant doc, which make clear the corporate’s banking relationships and its publicity to business paper.

A number of days earlier than USDT plunged to $0.995 on each centralized and decentralized exchanges, a flurry of promoting exercise started. In keeping with Kaiko, some holders could have superior data of the upcoming launch of the doc.

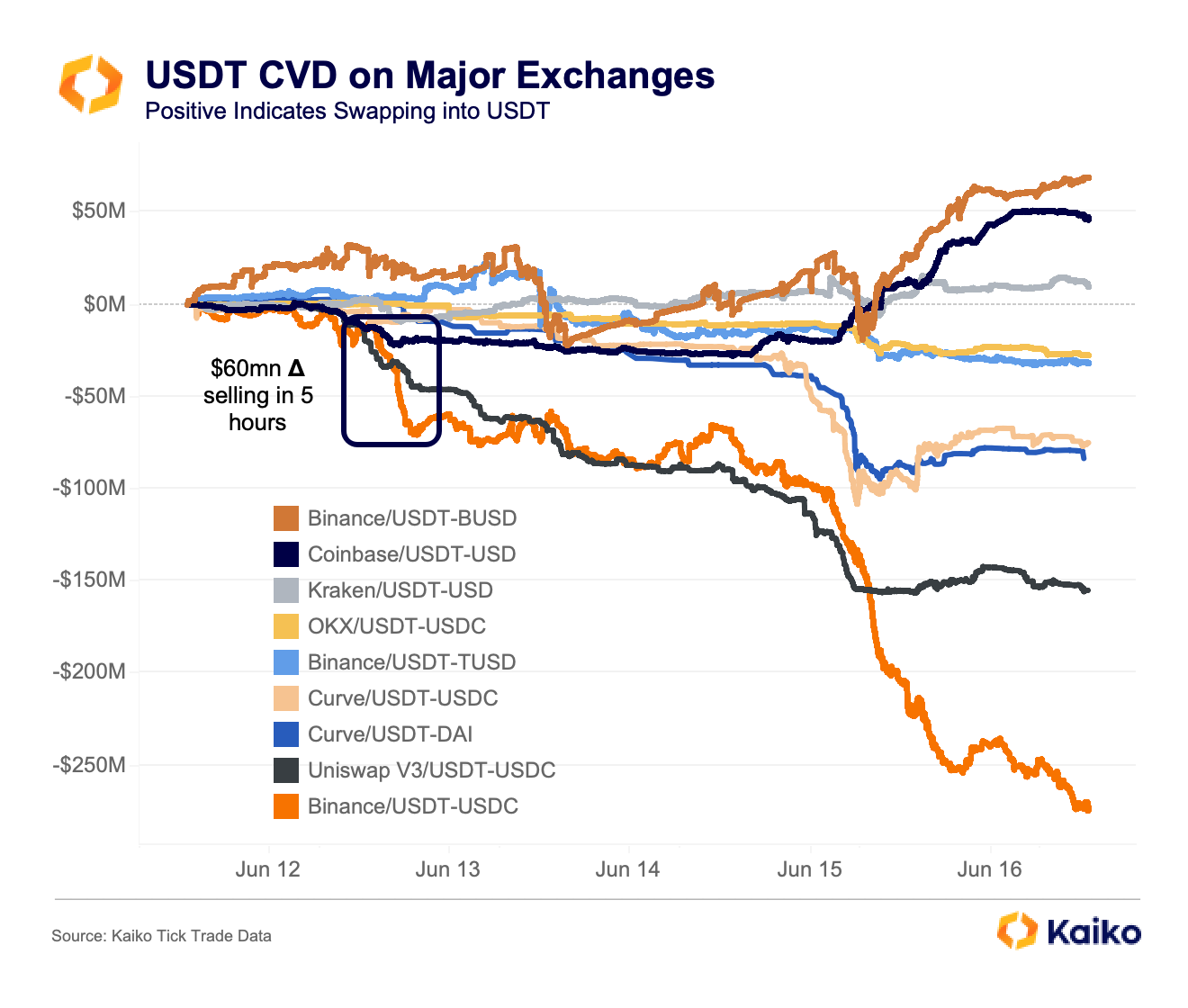

One metric that gives priceless perception into market dynamics is the Cumulative Quantity Delta (CVD) indicator, which depicts shopping for and promoting developments for particular buying and selling pairs. On this context, optimistic CVD values point out a desire for swapping USDT, whereas unfavorable values imply promoting USDT.

Binance’s USDT-USDC pair demonstrated essentially the most USDT promoting exercise, recording a unfavorable CVD of $250 million Monday-Friday. Shut behind was Uniswap V3, which recorded a unfavorable CVD of $150 million.

Conversely, Coinbase and Kraken’s USDT-USD markets confirmed optimistic CVD values, indicating merchants’ willingness to commerce fiat forex for barely discounted USDT. Moreover, Binance’s USDT-BUSD pair confirmed optimistic CVD, suggesting merchants’ tendency to grab a possibility to dump BUSD.

The evaluation additional revealed that Curve, the main decentralized market for stablecoin exchanges, witnessed vital promoting strain on USDT inside the pool, primarily involving DAI and USDC. This buying and selling pair exhibited a unfavorable CVD of $150 million, highlighting the extent of promoting exercise inside the decentralized ecosystem.

Apparently, in the midst of the unpeg occasion, the biggest order recorded was round $12 million of USDC traded in opposition to USDT. This transaction signifies that some shrewd merchants sought to capitalize on the value discrepancy between the 2 stablecoins, in an try and reap the benefits of the prevailing market situations.