The tiny Himalayan nation of Bhutan has by no means been a stranger to Bitcoin. But Forbes’ newest explosive report has make clear the extent of the Kingdom’s covert mining operation.

The Kingdom itself quashed an investigation into Bhutan’s alleged mining challenge when it confirmed to an area newspaper that it was engaged in digital asset mining. The CEO of Druk Holding & Investments (DHI), Bhutan’s state-owned holding firm, mentioned the corporate entered the mining area “a couple of years in the past” when the value of BTC was round $5,000.

This matches data leaked by sources aware of the matter, who informed Forbes that the nation has been growing sovereign mining operations since not less than 2020.

Nevertheless, Bhutan’s involvement within the crypto business doesn’t cease there.

Behind Bhutan’s Rising Mining

The primary suspicions concerning the nation’s involvement in mining started in 2021 when the Division of Income and Customs reported importing $51 million price of “processing models”. This was a big spike from the $1.1 million price of such models imported in 2020. In 2022, the nation imported $142 million price of pc chips, representing simply over 10% of its complete inbound commerce and 15% of its $930 million annual funds.

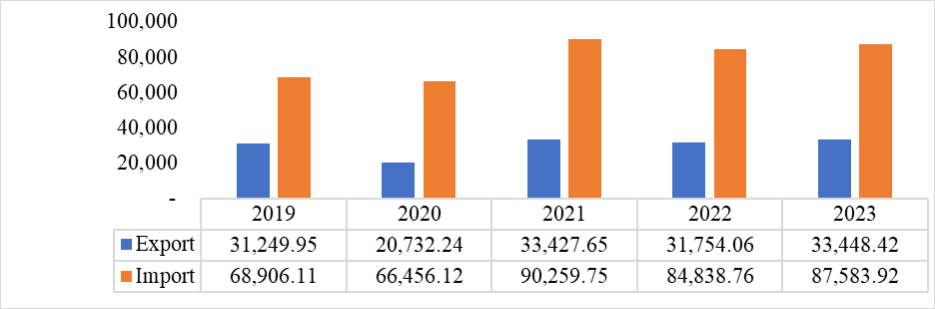

In accordance with the 2022 macroeconomic report of the Ministry of Finance reportcomplete imports in 2022 elevated by 35.8% in comparison with 2020. The primary driver of this development was the “processing and storage models” imported by DHI for “particular initiatives”.

Additional investigation revealed that Bhutan labeled these processing models beneath the identical export labels utilized by Bitcoin mining {hardware} producers in Asia. Official knowledge displaying that the majority of those models originated from Hong Kong and China confirmed suspicions that they have been in reality ASIC miners.

The nation’s involvement in mining was once more confirmed in Bitdeer’s current SEC deposit. The NASDAQ-listed firm revealed that of the five hundred MW improve in energy provide deliberate for this yr, about 100 MW will come from Bhutan.

“We count on to generate 100MW of the 550MW energy provide in Bhutan, the place building of the mining knowledge heart is anticipated to start out within the second quarter of 2023 and be accomplished within the third quarter of 2023.”

Bitdeer is without doubt one of the largest Bitcoin miners on the earth, with its complete hash charge placing it on par with Core Scientific, Riot, and Marathon. About 25% of Bitdeer’s hash charge capability is used for self-mining, with the remaining used for cloud mining. Neither Bitdeer nor Bhutan has commented on the matter, so it stays unclear who will use and personal the additional hash charge.

Confidential sources additionally revealed that the federal government of Bhutan was in talks with different mining corporations in addition to Bitdeer. Sources from different mining departments and swimming pools mentioned that they had “superior discussions” with senior authorities officers, together with representatives from DHI, concerning the building and operation of a hydroelectric mining operation in Bhutan. The nation has additionally employed consultants to advise it on its mining technique. They informed Forbes that Bhutan had inquired about “a 100 MW operation linked to a hydroelectric plant” earlier than Bitdeer’s announcement.

Bhutan additionally seems to have been concerned in an energetic effort to draw extra unbiased miners to the nation. The Singapore Bhutan Affiliation, a membership of a number of Chinese language and Singaporean businessmen supported by a member of the Bhutanese royal household, spear a profitable mining operation to exterior traders final yr. The pre-installed containers could be outfitted with 250 ASIC T17+ miners offering round 700 kW of electrical energy. Payback on an $800,000 funding for a single container would take 12-18 months, and the corporate would retain 10% of the mined elements to cowl upkeep and basis prices.

Dasho Ugen Tsechup Dorji, vice chairman of the Singapore Bhutan Affiliation and uncle of the King of Bhutan, informed Forbes the challenge was on maintain. He mentioned the federal government of Bhutan has not authorised “the personal sector to get entangled on this enterprise”. Affiliation board member Humphrey Chan mentioned FTX’s collapse and logistical points “have soured investor curiosity.”

Financing the fourth industrial revolution in Bhutan

Regardless of Bhutan’s success in stopping a widespread pandemic, the tiny landlocked state has suffered devastating financial penalties after its two-year isolation. Whereas it is unclear if this has been the first driver of its efforts to ramp up mining, its involvement within the crypto business has certainly elevated over the previous couple of years.

Sources aware of the matter informed Forbes that the pandemic was certainly a set off for senior officers in Bhutan to start out talks with miners and mining suppliers.

Court docket paperwork reviewed by Forbes revealed that Druk Holding & Investments was a consumer of BlockFi and Celsius. In February 2023, BlockFi filed a lawsuit with DHI, accusing the fund of defaulting on a $30 million mortgage. DHI reportedly borrowed 30 million USDC in February 2022, depositing 1,888 BTC as collateral. The criticism alleges that DHI “failed and refused” to repay the mortgage even after BlockFi liquidated the collateral, which was price roughly $76.5 million on the time of the mortgage, leaving an impressive stability of roughly $830,000.

In October 2022, Celsius launched data displaying that DHI was one in all its institutional purchasers. The paperwork confirmed that DHI and one other account known as “Druk Undertaking Fund” deposited, withdrew and borrowed BTC, ETH, USDT and different cryptocurrencies between April and June 2022. Through the three months indicated within the Celsius submitting, Forbes reported that Druk retired. over $65 million and deposited almost $18 million in digital property.

Ujjwal Deep Dahal, CEO of DHI, mentioned the borrowed funds have been used to “make some investments” and “every part was repaid and settled with none dues”.

DHI says it hasn’t misplaced cash on loans from Celsius and BlockFi, with Dahal implying that the fund used income from its Bitcoin mining to cowl the losses.

Bhutan’s covert foray into the crypto business has been criticized by many. It seems that DHI has not disclosed any of its involvements with Celsius and BlockFi, and the Treasury Division has by no means revealed the aim of the $142 million price of pc chips it imported.

Whereas some have criticized the secrecy, many appear extra involved concerning the volatility of the crypto market and its potential results on the nation’s struggling financial system.

Dahal mentioned that DHI holds a diversified portfolio and doesn’t consider the chance of mining and managing cryptocurrencies is larger than the chance related to some other asset class. The corporate believes that it has mitigated nearly all of the dangers related to cryptocurrencies as a result of it doesn’t have interaction in buying and selling however mines cryptocurrencies “at a comparatively low price utilizing inexperienced vitality.”

Mining is a part of DHI’s “forward-looking funding technique” to help what the nation calls the fourth industrial revolution. Bhutan’s financial stagnation has brought about a big wave of migration, and the federal government has stepped up efforts to develop a aggressive tech business that might make it economically self-sufficient.

Bhutan’s secret Bitcoin mining operation appeared first on forexcryptozone.