The macro analysis supervisor of the worldwide market investor Julien Bittel offered an attention-grabbing overview of the Bitcoin market after a significant value loss in final week. In a daring choice, the monetary analyst supported the primary cryptocurrency to quickly make a rebound connecting the current value fall below wider macroeconomic situations.

Why the drop in bitcoin beneath $ 80,000 may have made the top of the sale

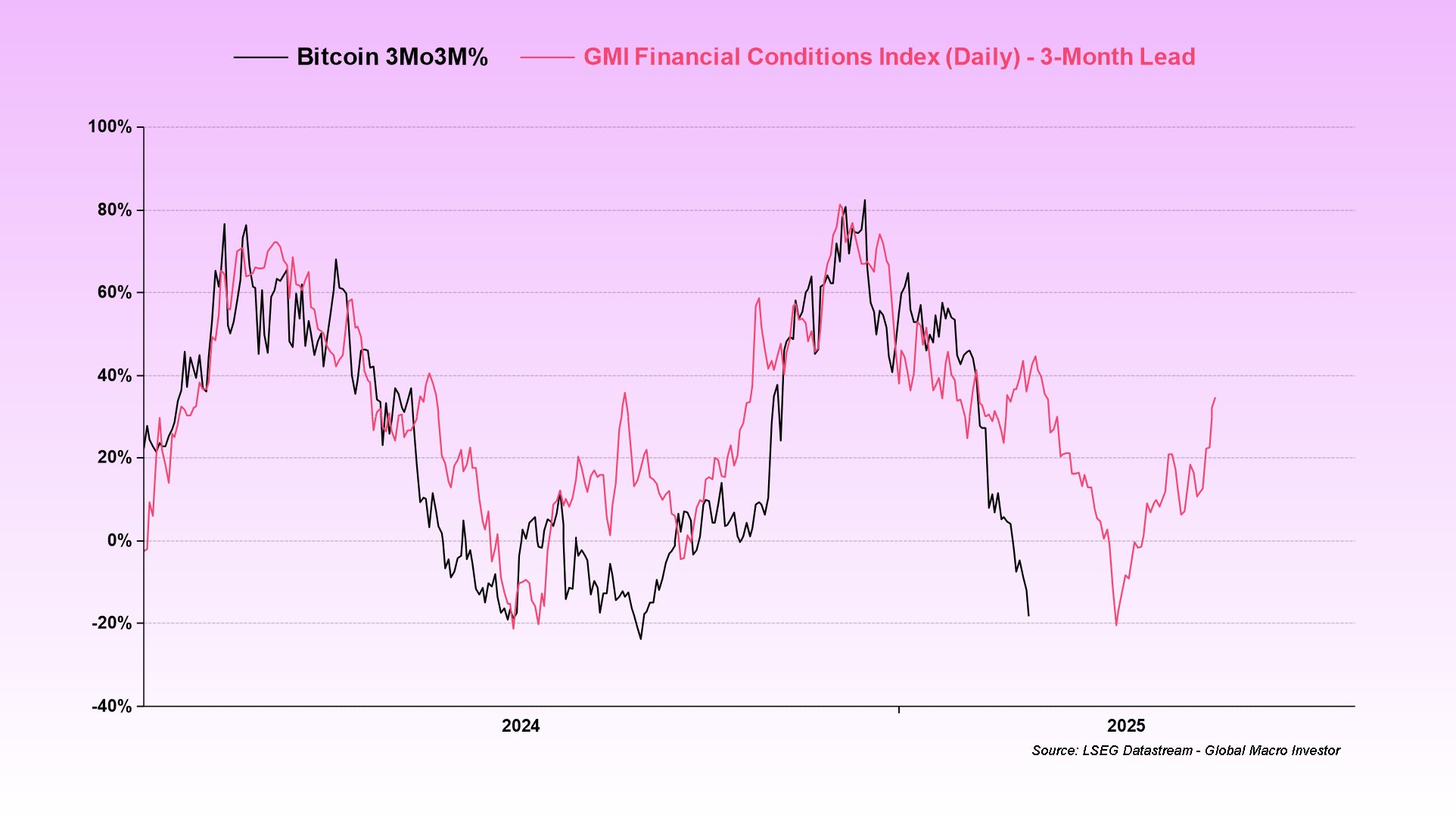

Throughout final week, the BTC market recorded an essential lower cost motionCosts from greater than $ 96,000 to $ 80,000. In a submit X on February 28, Bittel awarded this drop in value to the tightening of economic situations within the fourth quarter of 2024, which has drained market liquidity, which makes speculative belongings tougher like Bitcoin to take care of momentum upwards.

When the liquidity of the market reduces, financial surprises leading to considerations a couple of potential recession and in the end induce market uncertainty and danger conduct. Nevertheless, Bittel expects the sensation of those buyers to be reversed in March by asserting a Bitcoin rebound.

The analyst notes that market situations up to now two weeks have rapidly softened as indicated by a weakened greenback, the lower in bond yields and the drop in oil costs. These macroeconomic developments recommend that liquidity is as much as the monetary system reporting a possible rebound within the feeling of the market.

Particularly, with the current drop in Bitcon beneath $ 80,000, Julien Bittel signifies that the consequences of tightening liquidity situations have been absolutely mirrored. And though a possible value drop is all the time potential, feeling indicators report little room for extra decline. For instance, Bitcoin's relative power index (RSI) has just lately touched 23 representing its the preferred stage since August 2023. Such market situations help the idea of incoming value rebound.

The BTC market: a opposite alternative?

Within the last remarks of an intriguing evaluation, Bittel urged buyers to be too comfortably down however reasonably pushed for a connoisseur way of thinking in the course of the worry of the generalized market.

Particularly, the blockchain evaluation firm, Santiment, notes that the “market crowd” tends to be mistaken on predictions, that’s to say that when merchants present that bitcoin will increase, costs improve and vice versa on the premise of historic information. Consequently, the present Bitcoin market can current a novel alternative to build up regardless of the final expectations of a sustained value drop.

Friday, when writing the editorial's second, Bitcoin is negotiated at $ 84,750 after a number of value good points within the midst of a constructive American inflation report. With a market capitalization of $ 1.68 billion, the primary cryptocurrency stays the biggest digital asset with wonderful domination of the 60percentmarket.

Star picture of the unbiased tradingView card