- TTX targets $0.30 as Justin Solar's daring declare sparks comparisons to XRP's current 400% surge.

- TRX is exhibiting bullish developments with technical indicators signaling a potential breakout above $0.225.

- XRP evokes TRX momentum as parallels emerge in market developments and investor sentiment.

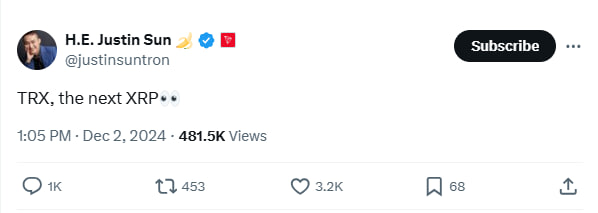

Justin Solar, founding father of TRON, hinted at a vibrant future for TRX, evaluating it to the efficiency of the XRP market. His assertion, “TRX, the subsequent XRP,” grew to become a trending subject amongst crypto traders on X.

Proponents seen this as a optimistic long-term forecast. Skeptics, nonetheless, imagine that this can be a transfer to extend TRX's visibility. Consumer X PC PR1NCIPAL argued that TRX lacks the shopping for conviction crucial for sustained rallies.

The person highlighted the dearth of a significant investor with sufficient liquidity to execute constant high-volume trades. This comes as XRP sees a surge in curiosity, pushed by authorized victories and rising adoption of cross-border funds.

Parallels between XRP and TRX market developments

Knowledge from TradingView exhibits that XRP, at the moment buying and selling at $2.55, has surged greater than 400% over the previous month, marking decisive bullish momentum much like its 2017-2018 bull run. Following this surge, the cryptocurrency surpassed its 2021 excessive of $1.96 and is now eyeing its all-time excessive of $3.84 because the bull market continues.

This resurgence follows years of consolidation pushed by the protracted Ripple-SEC lawsuit, which has capped its worth trajectory to this point. In the meantime, TRX, buying and selling at $0.209, has proven regular progress over time, surpassing its 2021 excessive of $0.184.

These technical breakout patterns align with Solar's bullish outlook, indicating that TRX may mirror XRP's progress trajectory. TRX is now concentrating on its all-time excessive of $0.30, a milestone that might validate its long-term upside chance.

Technical evaluation of the TRX market

A more in-depth take a look at TRX's day by day chart reveals a pennant flag sample, usually signaling a continuation of an uptrend. TRX is now consolidating above the 50% Fibonacci stage at $0.205, a key help zone. This stage aligns with a consolidation section after a robust rally initially of the month.

Technically, the Relative Power Index at 65.67 signifies bullish momentum, though it’s approaching overbought territory. This means that whereas shopping for stress stays robust, merchants ought to stay cautious of doubtless short-term pullbacks or profit-taking.

The Directional Motion Index reinforces the bullish narrative, with the +DI line at 27.8762 positioned above the -DI line at 10.5865, indicating that consumers are dominating the market. Moreover, the typical directional index at 47 highlights the energy of the present development, suggesting {that a} breakout might be imminent.

Key Ranges to Look ahead to TRX

TRX may attain $0.225 within the coming days. Nevertheless, for this situation to play out, it should shut the day above $0.217, which coincides with the 78.6% Fibonacci retracement stage.

Conversely, a break beneath the 38.2% Fib stage at $0.201 may expose the coin to a retest of decrease help zones, together with $0.195 on the 23.6% Fib stage. A break beneath this zone may invalidate the uptrend sample, pushing the token in direction of $0.185 and threatening to derail its uptrend.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses ensuing from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.