- On-chain information revealed that Ethereum whales adopted Vitalik’s recommendation to maintain property off exchanges.

- ETH was going through a good buying and selling vary between $1,846 and $1,916 as short-term holders took earnings.

- Whereas the altcoin has moved in the direction of the oversold zone, the long-term outlook stays optimistic.

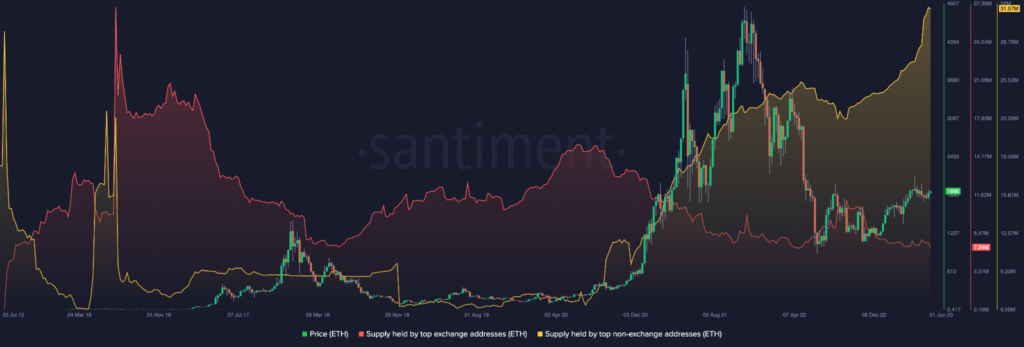

Whale addresses holding Ethereum (ETH) in self-custody added extra altcoins to their wallets. The event, revealed by Santiment on June 5, confirmed that the ten largest whales now maintain a mixed asset value $59.47 billion.

The on-chain analytical platform, through its official account, tweeted“As increasingly Ethereum strikes into Self-custody and DeFi choices, many of those cash have been absorbed by the biggest whale addresses within the community. The ten largest no-exchange addresses now maintain an AllTimeHigh $31.8 million ETH value $59.47 billion”

Based mostly on information shared by Santiment, the numerous uptick began final yr. And this was completed on the expense of the international alternate provide held on the exchanges (purple) which have been in speedy decline since September 2022.

Reply to the Founder’s Name

Apparently, this choice may very well be linked to Vitalik Buterin’s name for self-guard twice.

In November 2022, the Ethereum co-founder urged the crypto neighborhood to maneuver property away from centralized platforms. This occurred a number of weeks after FTX collapsed, calling the exchanges “evil by default”.

On March 17, he doubled his opinion. At the moment, he urged the adoption of multisig wallets. He additionally talked about that ERC-4337 may handle custodial storage considerations.

Multisig wallets, the total that means of which is multi-signature, require totally different cryptographic keys to execute transactions. Thus, selling higher safety. Then again, ERC-4337 is an Ethereum commonplace that permits biometric signing of transactions to assist with asset safety.

Moreover security, the motion of those whales might function a long-term bullish pattern indicator. If the provision on the exchanges had elevated on this method, ETH might face a attainable decline in worth.

On the time of writing, the intraday buying and selling value of the altcoin is $1,869. This represents a decline of 1.68% over the previous seven days, in keeping with CoinMarketCap.

ETH’s momentum is heading in the direction of the bearish zone

Between Might 29 and the time of writing, the buying and selling vary for ETH has been between $1,846 and $1,916, primarily based on the 4-hour chart. The June 1 rally adopted resistance at $1,903 on June 3.

Though it solely barely reversed the market construction from the interval, ETH principally pulled again from the higher vary. So, except the bear succumbs to the stress or Bitcoin (BTC) breaks above the $26,000 vary, the bulls could battle to bypass the downtrend.

Moreover, patrons struggled to regain management, as indicated by the Relative Energy Index (RSI). At press time, the momentum indicator was at 40.43.

Which means it was nearer to the oversold stage of 30. This was attributable to attainable revenue taking across the $1,908-$1,904 area.

Due to this fact, the present pattern of ETH helps a possible bearish transfer. However in the long term, if the whale accumulation continues, the altcoin might rally.

Disclaimer: The views, opinions and knowledge shared on this value prediction are revealed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be answerable for any direct or oblique damages or losses.