The Lido (LDO) liquid staking protocol expects its customers to make massive withdrawals of staked Ethereum (stETH) this week after efficiently finishing its V2 improve.

Withdrawal request peaks

Based on 21Shares Researcher Tom Wan, Lido customers have began to extend their withdrawal requests following the profitable testing of the characteristic.

Wan has recognized a pockets that requested the withdrawal of 6,000 stETH tokens. Dune The analytics dashboard confirmed 123 withdrawal requests of 13,740 stETH.

This quantity is predicted to extend considerably, particularly as main Lido-staked entities start processing withdrawals.

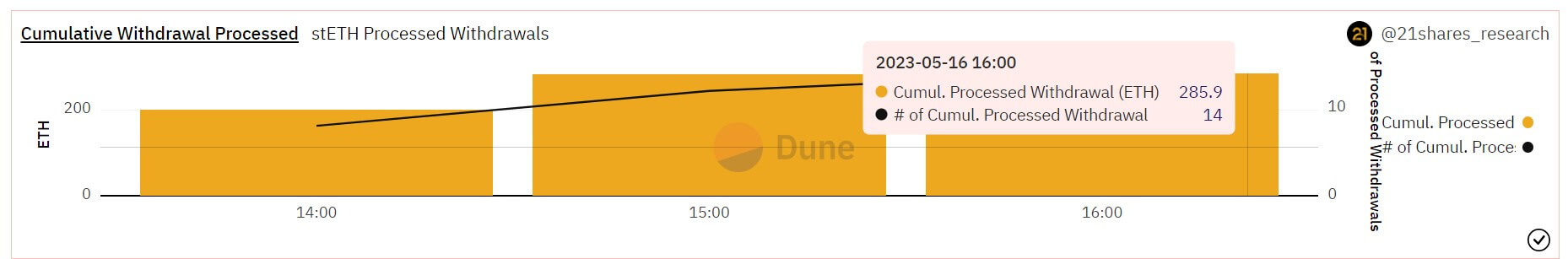

A separate Dune Analytics dashboard confirmed that the protocols efficiently processed 14 withdrawals for 286 ETH.

Celsius moved 428k stETH

Bankrupt crypto lender Celsius moved its 428,000 stETH value $780 million on Could 15, sparking hypothesis that it needs to withdraw from Lido.

At its peak, Celsius staked ETH from its purchasers on Lido for stETH, then used the stETH as collateral on DeFi lending platforms like Aave to generate returns. Whereas a sound enterprise technique in idea, its incapability to transform stETH to ETH led to liquidity points that finally performed a job in its chapter.

With buybacks now potential, a number of analysts predicted that the lender might swap its stETH for ETH and use it for its restructuring plan.

In the meantime, the corporate has but to make a significant withdrawal request from the Lido. Nevertheless, he has achieved a withdrawal of 0.1 stETH.

A researcher at Blockworks Westie famous that if Celsius determined to withdraw all of its stETH by way of the Lido validators, “that might contribute to round 13,000 validators and a 7-day queue.”

Lido defined in a Could 16 Tweeter that he was ready for such huge withdrawals. The protocol claimed that it has round 440,000 ETH in its buffers to “take in” such requests.

The Lido put up anticipates “massive withdrawals” as the rise in Ethereum withdrawal requests staked by customers appeared first on forexcryptozone.