- Lido Finance staking deposits rose 13% after Coinbase misplaced a lot of its share.

- LDO’s momentum remained bullish, nevertheless, a promote candle at $2 pushed the value decrease.

- Because the challenge’s income and TVL have elevated, LDO might backtrack relying on its volatility.

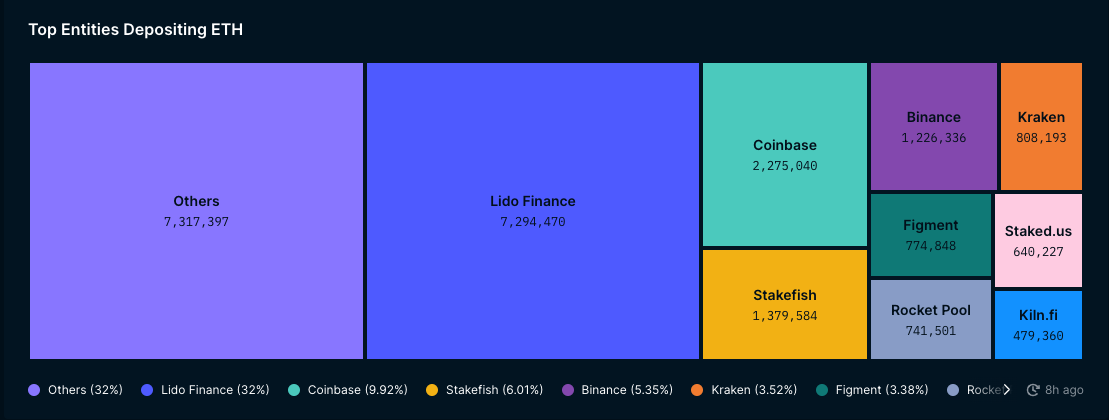

Decentralized Staking Protocol Lido Finance (LDO) has seen a big enhance in its staking share as centralized exchanges face rising challenges. In response to knowledge shared by a pseudonymous crypto analyst, Emperor Osmo, Lido staking market share elevated by 13%.

The Lido takes the lead

This enhance in Lido Finance’s stake share got here at a time when centralized exchanges are grappling with person exit calls for and regulatory strain. On the high of the listing was Coinbase, which leads the cohort of centralized entities providing staking companies to the neighborhood.

The lower in staking on the centralized alternate implies that validators see decentralized platforms like Lido as a safer and various avenue to take part in staking.

Because the Shapella improve of Ethereum (ETH) that enabled staked Ether (stETH) withdrawals, Lido has established itself because the go-to pool for staking. Though different initiatives like Rocket Pool (RPL) additionally grabbed a big share of stETH deposits, none got here near Lido’s share.

At press time, complete staked ETH deposits on Lido had been over 7 million. Because of this, Lido Finance’s share of deposits rose to 32%, based on Nansen knowledge.

In the meantime, the LDO token has risen 19.18% over the previous seven days following an general market rally. However as of this writing, token quantity has shrunk.

LDO stays bullish

When it comes to worth motion, the Shifting Common Convergence Divergence (MACD) remained constructive. When this indicator is above the zero midpoint, it means that the short-term shifting common (MA) is above the long-term shifting common (MA).

Because of this LDO ought to proceed its upward momentum. In flip, merchants might need to chorus from opening quick positions in the intervening time.

LDO tended to halt its upward trajectory with a promote candle showing round $2.02. Furthermore, the value at press time was touching the higher a part of the Bollinger Band (BB). With rising volatility, this might infer an overbought level. Due to this fact, a slight retracement won’t be distant.

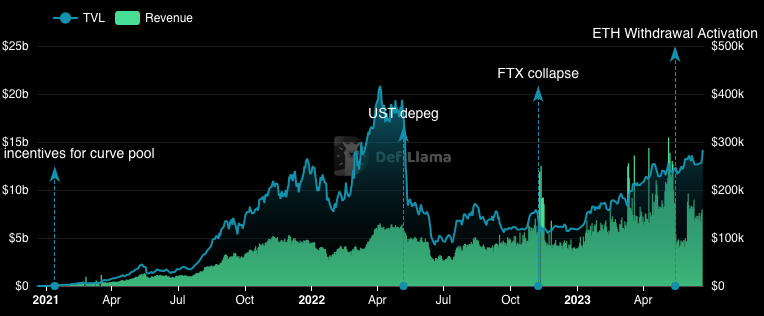

Along with its worth enhance and stake share, Lido’s income has topped $1 million prior to now seven days. This was as a result of 11.93% enhance in its Complete Locked Worth (TVL).

Typically, a rise in TVL means that Lido has turn out to be extra dependable and traders are keen to lock extra property into the DeFi protocol. If it had been the opposite manner round, it could have induced skepticism on the a part of traders.

In conclusion, the general ecosystem of Lido Finance appears wholesome. However on a technical degree, gradual promoting strain might result in a decrease margin in LDO’s worth.

Disclaimer: The views, opinions and knowledge shared on this worth prediction are revealed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at his personal danger. Coin Version and its associates is not going to be chargeable for any direct or oblique damages or losses.