The US Securities and Trade (SEC) lawsuit towards Binance worn out greater than $200 million in a single hour from crypto merchants who held positions out there.

Following the information, by forexcryptozone the information confirmed that the overall market capitalization of digital property decreased by 2.87% to $1.12 trillion.

Practically $300 million within the final 24 hours

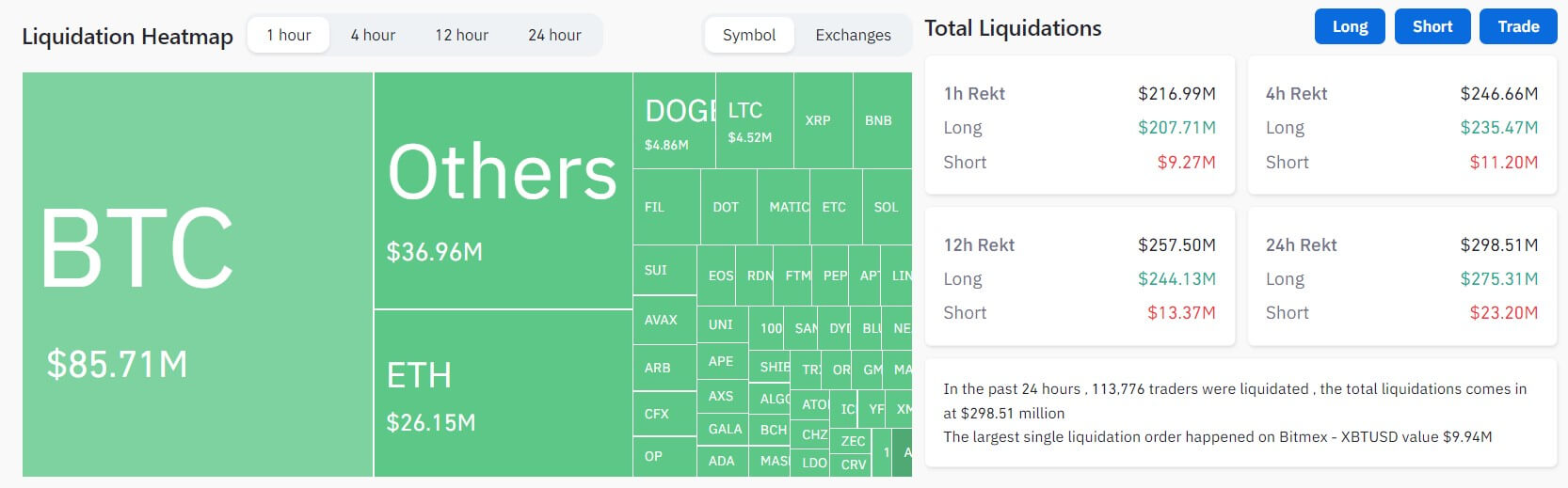

The crypto market noticed $298.51 million liquidated within the final 24 hours, with over 110,000 merchants affected.

Information from Coinglass confirmed that lengthy merchants misplaced $275.31 million, with Bitcoin and Ethereum accounting for $130.46 million of these losses.

In the meantime, quick merchants noticed $23.2 million in liquidations. The highest two digital property have been liable for round 49.5% of those losses.

Different property akin to BNB, Chainlink, XRP, Litecoin, and Solana noticed lower than $2 million in liquidations respectively.

Throughout all exchanges, most liquidations occurred on OKX, Binance, and ByBit. These three exchanges accounted for 75% of the general liquidations, of which 92% have been lengthy positions. Different exchanges like Huobi, Deribit, and Bitmex additionally recorded a big share of the overall liquidations.

The biggest liquidation passed off on Bitmex – XBTUSD, valued at $9.94 million.

pink market

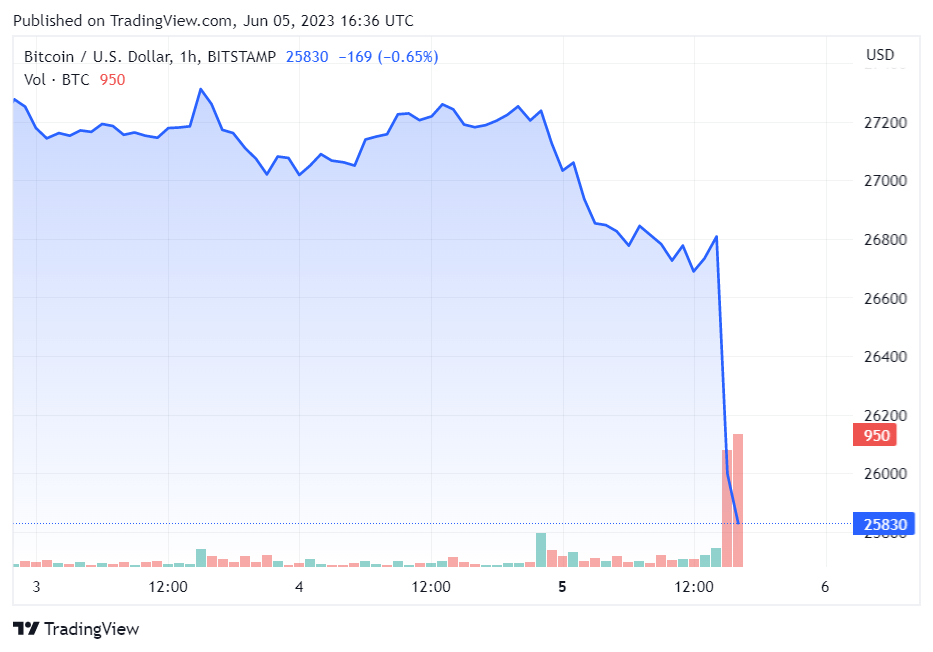

Bitcoin fell from over $27,000 to below $26,000 in an hour and was buying and selling at $25,859 at 4:36 p.m. UTC

The worth of bitcoin is down nearly 5% general within the final 24 hours.

Binance-linked BNBs noticed the largest loss, plunging practically 10% to $281, whereas Ethereum (ETH) fell 3%. Different main digital property akin to XRP, Cardano (ADA), Dogecoin (DOGE) and others additionally noticed vital losses throughout the reporting interval.

Publish liquidations exceed $200 million in 1 hour after Binance SEC lawsuit first appeared on forexcryptozone.