GFC versus 2023

It appears just like the contraction within the US financial system is beginning to present. Nonetheless, a recession is just not anticipated at the moment. Evaluating previous eras and recessions would possibly go well with human psychology, however it’ll undoubtedly be totally different. However most definitely, the Federal Reserve will proceed to boost charges till one thing materially breaks.

We had a banking disaster, which is essentially totally different from 2008. In 2008, we had mortgage defaults and noticed a ripple impact with a drastic drop in property costs. On the similar time, banks recorded heavy mortgage losses on their steadiness sheets. The SVB was essentially totally different, with depositors panicked by extreme unrealized losses on their money portfolio.

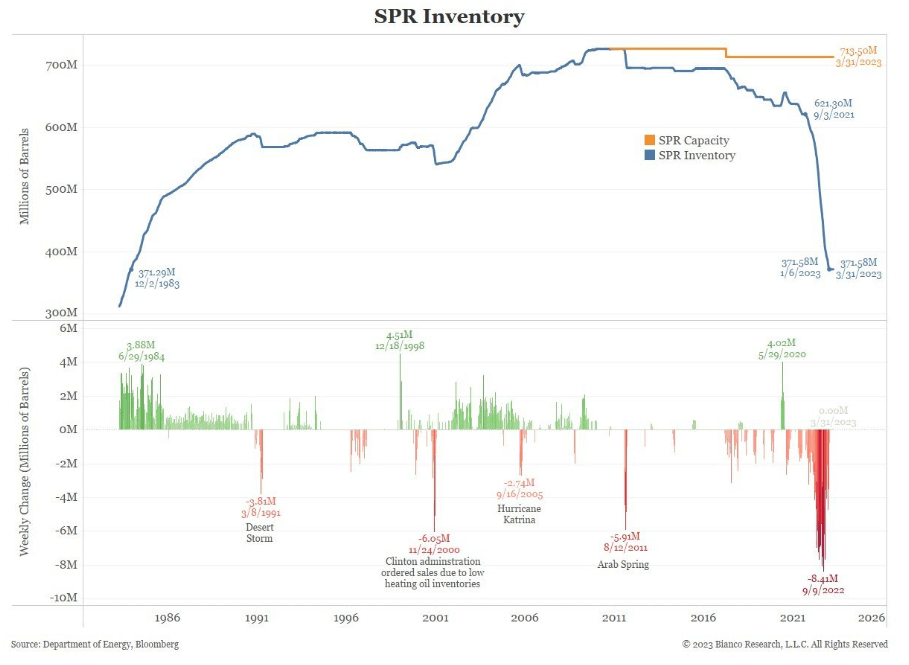

OPEC +

To begin the week, we had the announcement from OPEC+ to chop over 1m bpd beginning subsequent month, whereas 2m bpd will likely be reduce from October. forexcryptozone analyzed the repercussions of those cuts; not solely does this pure demand sign collapse. It additionally left the Biden administration struggling after tapping into the strategic oil reserve whereas failing to faucet the reserves when costs have been breached. WTI Crude Oil (NYM $/bbl) ended the week at $80/bbl from as little as $67, with some analysts anticipating triple digits.

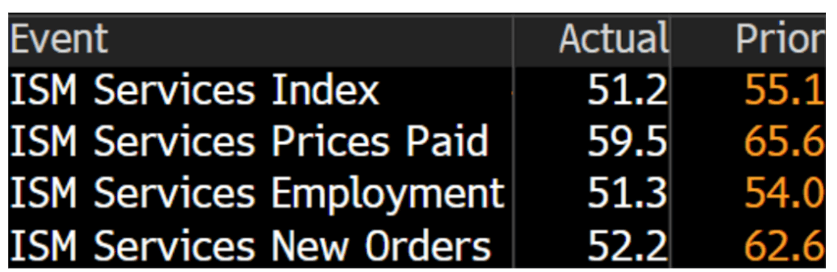

America’s manufacturing business is collapsing

The ISM manufacturing survey for March continued its decline, remaining within the contraction zone of 46.3, beneath expectations. Moreover, JOLTS knowledge printed 9.93 million towards the anticipated 10.5 million. This was the smallest print since April 2021. Whereas each a part of the ISM Providers PMI additionally continued to say no. New orders are right down to 52.2 from 62.6.

Unemployment at historic lows

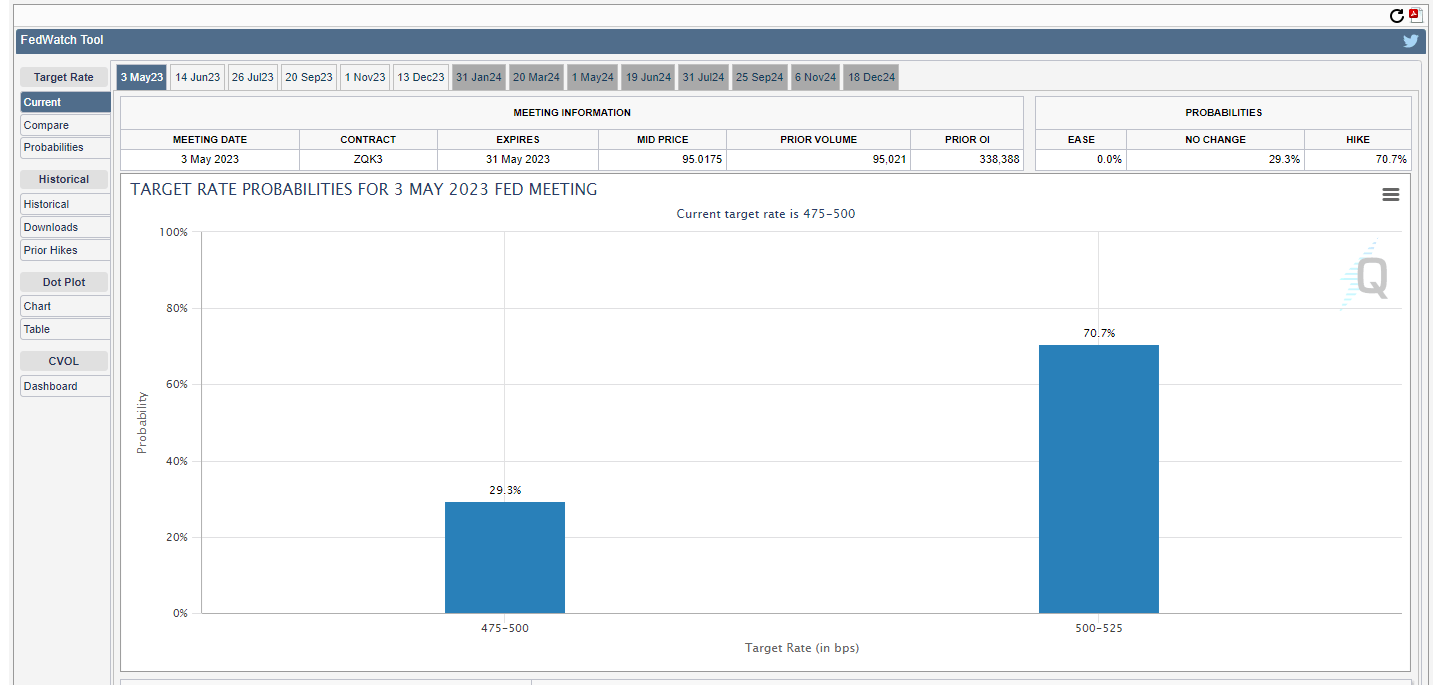

Surprisingly, unemployment fell to three.5% from 3.6%. On the similar time, the US Bureau of Labor Statistics employment report confirmed 236,000 non-farm payrolls added for March. Economists have been relying on 239,000 jobs.

In consequence, we now see a 69% probability of one other 0.25 fee hike on the Might FOMC. This could deliver the federal funds fee to over 5%.

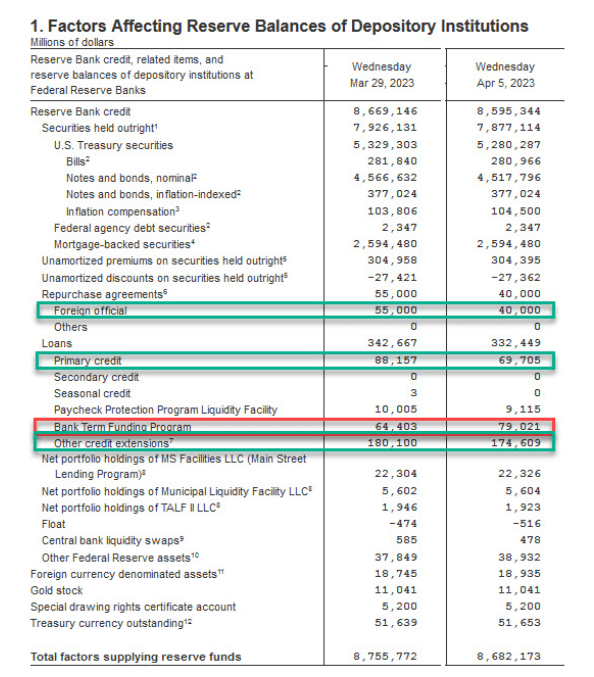

Fed steadiness sheet replace

The Thursday afternoon eve of the Fed’s steadiness sheet is now changing into a serious occasion. The Fed’s steadiness sheet fell by $74 billion this week, decreased by about $100 billion up to now two weeks. The Fed’s steadiness sheet is now shrinking sooner than earlier than the SVB collapse.

This reveals that fewer banks and fewer troubled property are wanted to be supported by the Fed. As well as, BTFP lending fell from $64.4 billion to $79 billion as Fed low cost window utilization fell to $69.7 billion from $88.2 billion. {dollars}.

It’s protected to say that this was not a spherical of quantitative easing, however short-term emergency loans that will likely be repaid.

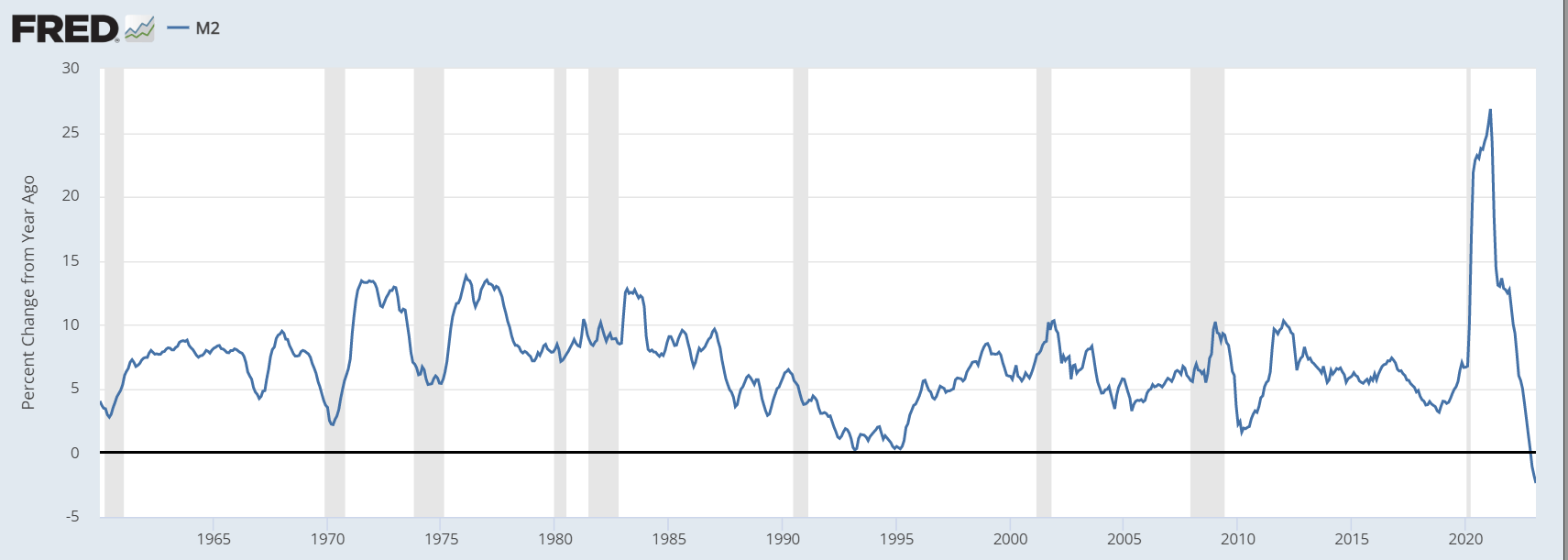

However the primary points listed below are quantitative tightening and the drain of liquidity from the system. We now have seen the quickest tightening cycle in historical past; Cash provide as measured by M2 has fallen 2.5% since final yr, the most important deterioration for the reason that Nice Despair of 1929.

Even small contractions within the cash provide may cause huge financial issues and result in financial institution runs. You’d assume that banks will begin to cut back their lending and maintain additional cash, which may result in a credit score crunch. There isn’t a doubt that lending requirements will tighten.

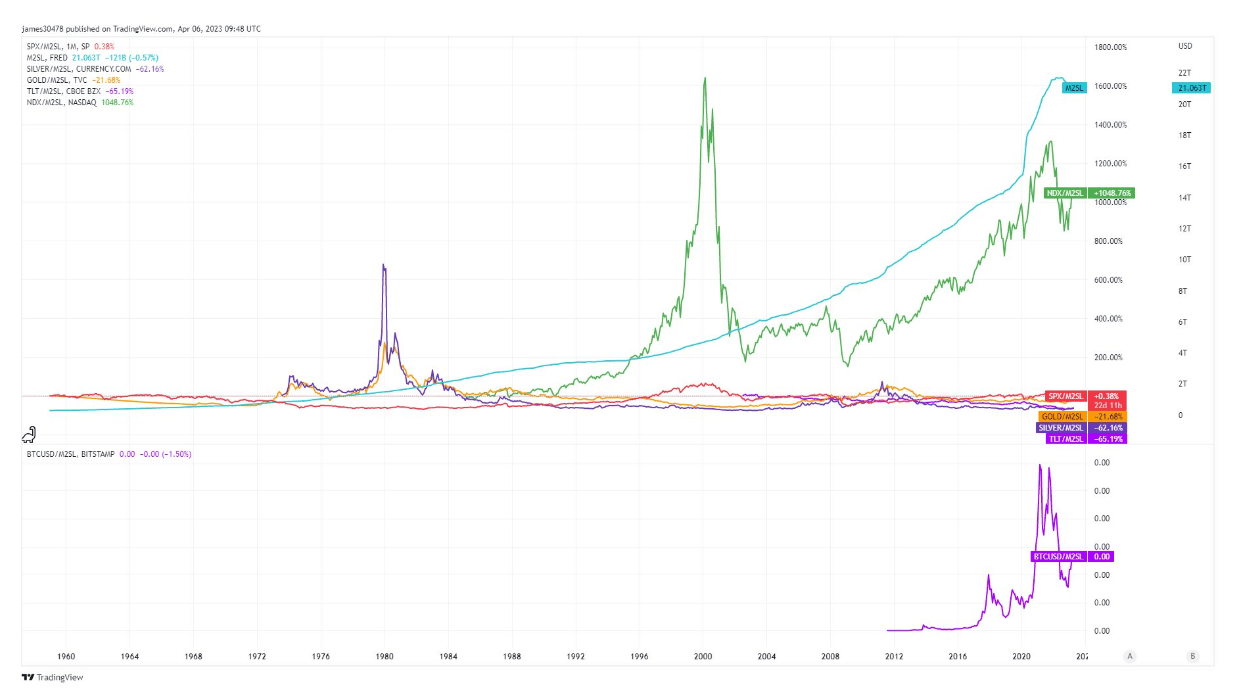

Bitcoin towards M2

Within the quick time period, it is rather tough to present definitive solutions a couple of credit score crunch, a recession, and whether or not Bitcoin will exceed a sure value goal. However we defend Bitcoin as a result of it is an asset that permits you to ignore all of the macro uncertainty and geopolitical video games and concentrate on the larger job at hand. An asset with out counterparty threat doesn’t endure from the contagion potential of TradFi property.

The lengthy recreation is that the cash provide will proceed to extend; the steadiness sheet will develop, inevitably swelling all our property.

forexcryptozone has analyzed the foremost property towards the M2 cash provide, and it’s clear to see a winner on this recreation. The phantasm of printing cash makes you suppose you’re getting richer; nevertheless, in actual phrases, you do not even keep afloat.

Bitcoin stays the primary asset to maintain you forward of foreign money devaluation.