- MATIC value drops to 90-day low amid bearish dominance.

- The elevated volatility has drawn short-term merchants into the MATIC market.

- Keltner Channel suggests potential for an upside reversal of the oversold market.

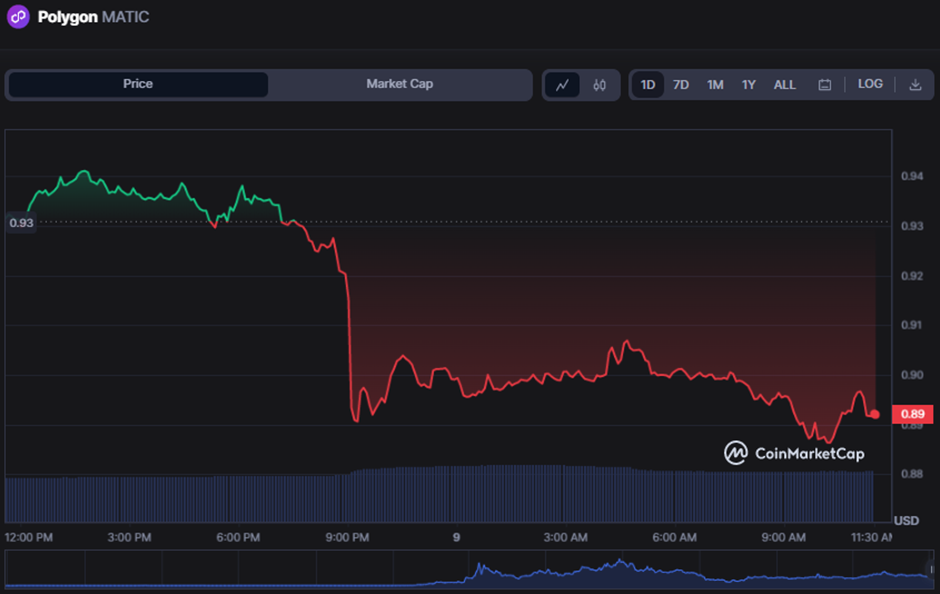

Polygon (MATIC) uptrend pale early when the bulls did not clear the 24-hour excessive of $0.9411. Because of the hesitation of the bulls, the worth of MATIC fell to a 90-day low of $0.886 earlier than regaining help. At press time, the MATIC market was dominated by the bears, dragging down 3.69% to $0.8945.

MATIC’s market cap fell 3.77% to $8,254,089,404, whereas 24-hour buying and selling quantity elevated 15.65% to $436,899,775.

This spike exhibits the potential for merchants benefiting from the elevated volatility by participating in short-term buying and selling ways comparable to day buying and selling or scalping. Elevated volatility might appeal to extra merchants to the market, as these ways depend on frequent value swings to provide features.

With a worth of 0.902, the Arnaud Legoux Shifting Common (ALMA) indicator rises above the worth, supporting the bearish momentum. When the market value falls under the ALMA line, that is thought of a bearish indication, suggesting that the worth is declining on account of promoting stress.

The unfavourable momentum within the MATIC market is powerful, with an Aroon studying down 71.43% and an Aroon studying up 21.43%. This transfer implies better promoting stress and an impending decline.

As a result of this shift, merchants might attempt to shift their holdings to reap the benefits of short-term alternatives.

On the 4-hour MATIC/USD value chart, the bands of the Keltner Channel are shifting south, with the higher, center, and decrease bands touching 0.976, 0.941, and 0.906. This motion of the bands signifies that the market is falling, the volatility is reducing and the worth might consolidate inside a tighter vary.

Nevertheless, the truth that the worth has reached the underside of the vary exhibits that the market is oversold, which signifies that the worth is under its truthful worth and may very well be prepared for an upward reversal.

The Relative Power Index (RSI) of 23.63 signifies that the market is now oversold. This transfer suggests a attainable shopping for alternative for merchants making an attempt to capitalize available on the market’s oversold circumstances.

In conclusion, the MATIC market is bearish with elevated volatility, offering short-term buying and selling alternatives. Merchants can search for potential shopping for alternatives as oversold circumstances counsel a possible reversal to the upside.

Disclaimer: The views, opinions and data shared on this value prediction are printed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at his personal threat. Coin Version and its associates is not going to be chargeable for any direct or oblique damages or losses.