A wave of regulatory strain reverberating by the US crypto market has pushed merchants away from Bitcoin (BTC) and Ethereum (ETH) and in direction of the obvious security of stablecoins.

This alteration aligns with the emergence of a burgeoning political motion in the US to impose strict controls on the crypto and mining sectors. Proponents of the brand new rules say the disruptive nature of cryptocurrencies calls for a tighter regulatory grip to make sure the soundness and safety of the monetary ecosystem.

Then again, critics fear that harsh regulation may stifle innovation and push the business abroad. This polarizing debate has created an environment of uncertainty that’s reshaping enterprise conduct.

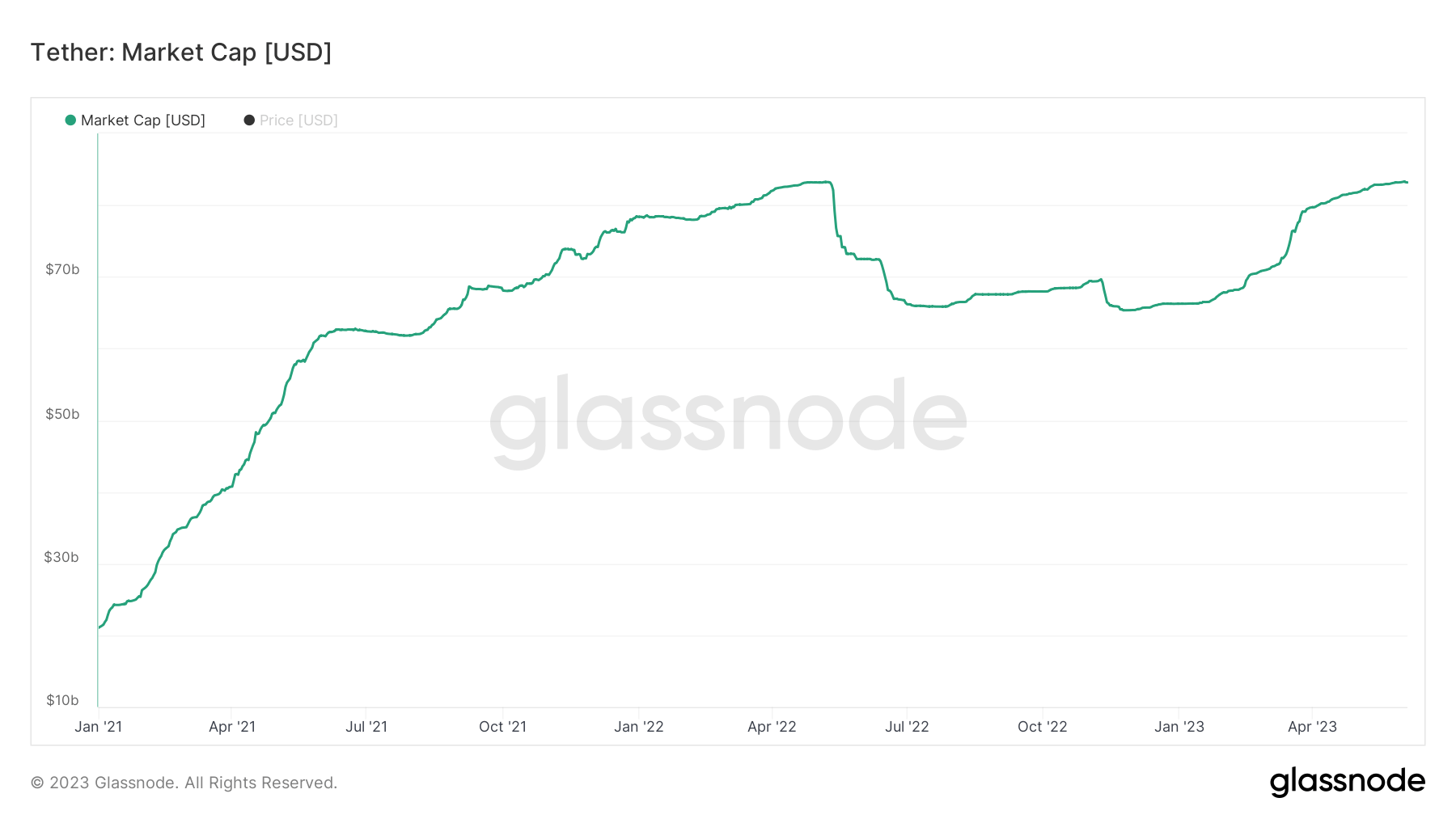

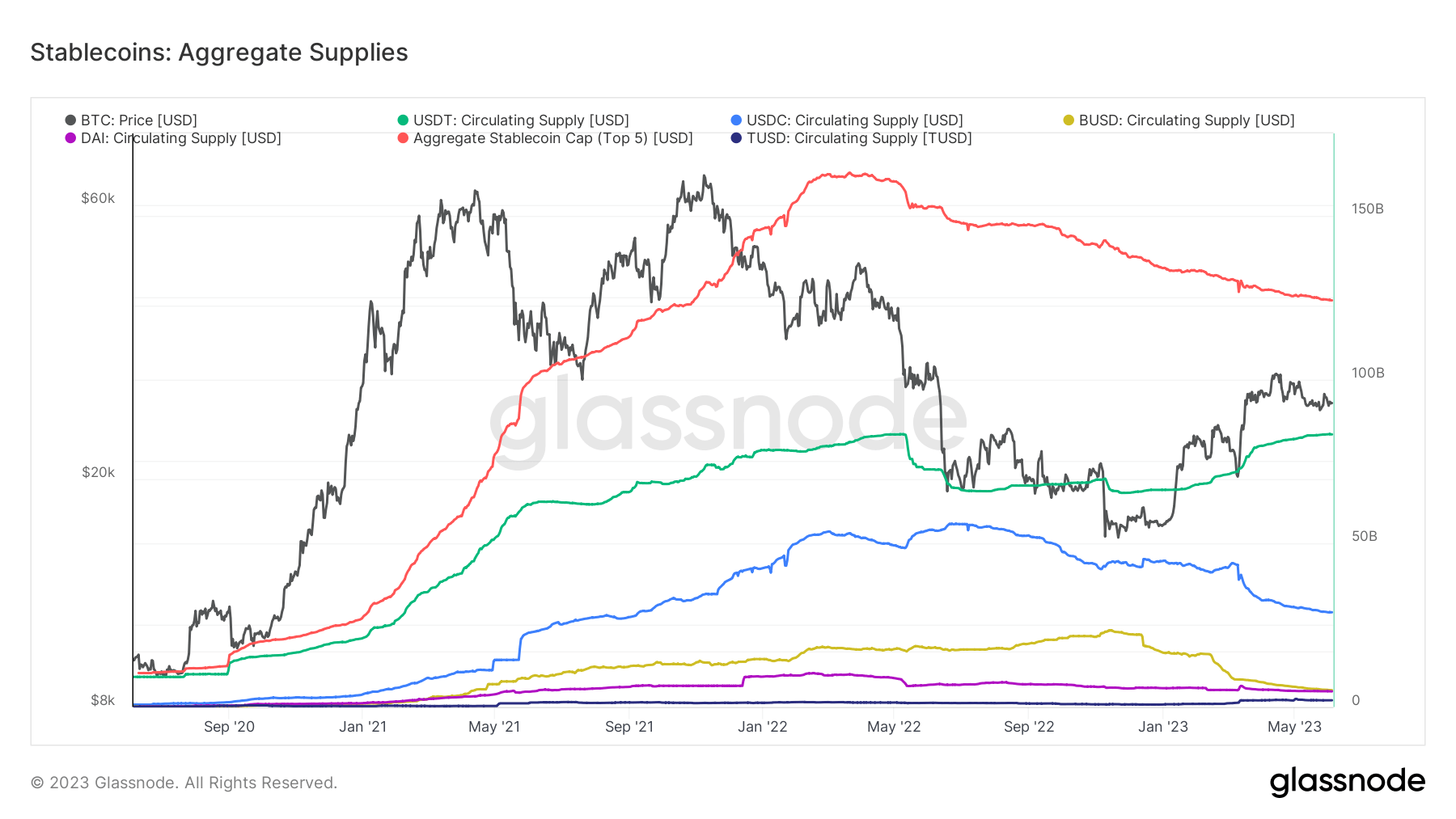

These regulatory pressures look like pushing merchants towards stablecoin stability. That is clearly seen within the conduct of Tether’s USDT, the availability of which reached an all-time excessive of $83.2 billion on June 3. Round $17 billion of that determine was added to Tether’s market capitalization in 2023 alone.

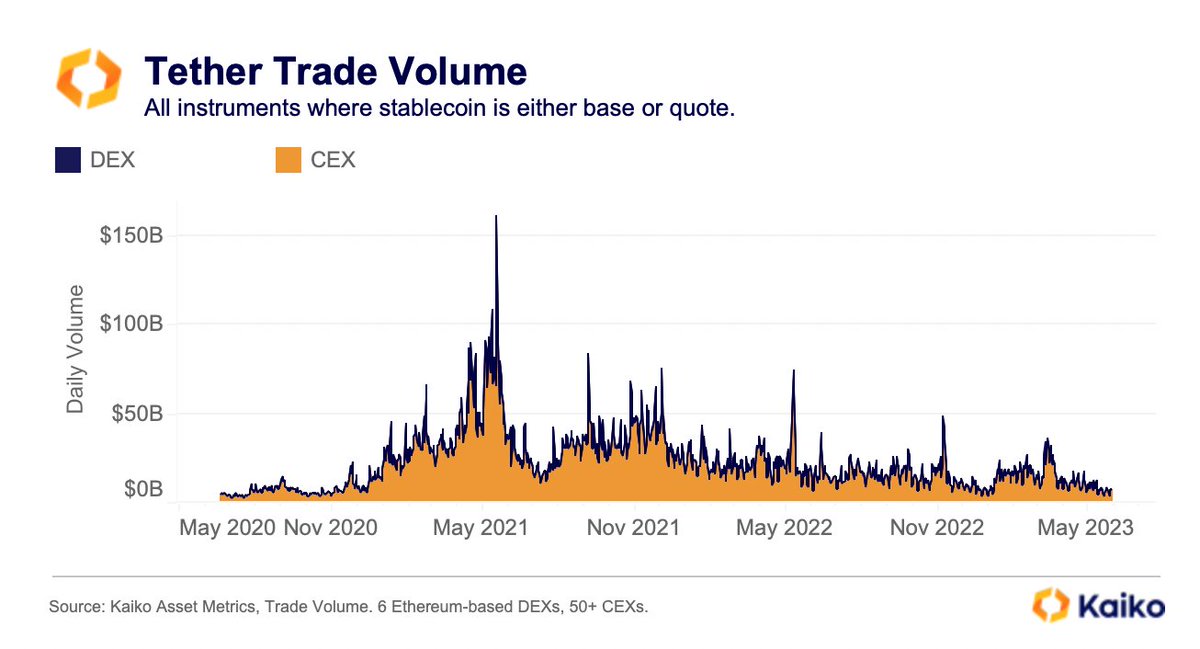

Nonetheless, regardless of Tether’s rising market capitalization, its buying and selling quantity is on a downward development. Knowledge from Kaiko confirmed that on CEX and DEX, every day USDT quantity averaged round $7 billion in Could, hitting multi-year lows. This obvious contradiction signifies that if mixture provide will increase, lively buying and selling of the asset decreases.

Conversely, different main gamers within the stablecoin market, USDC and BUSD, noticed their provide drop to multi-year lows.

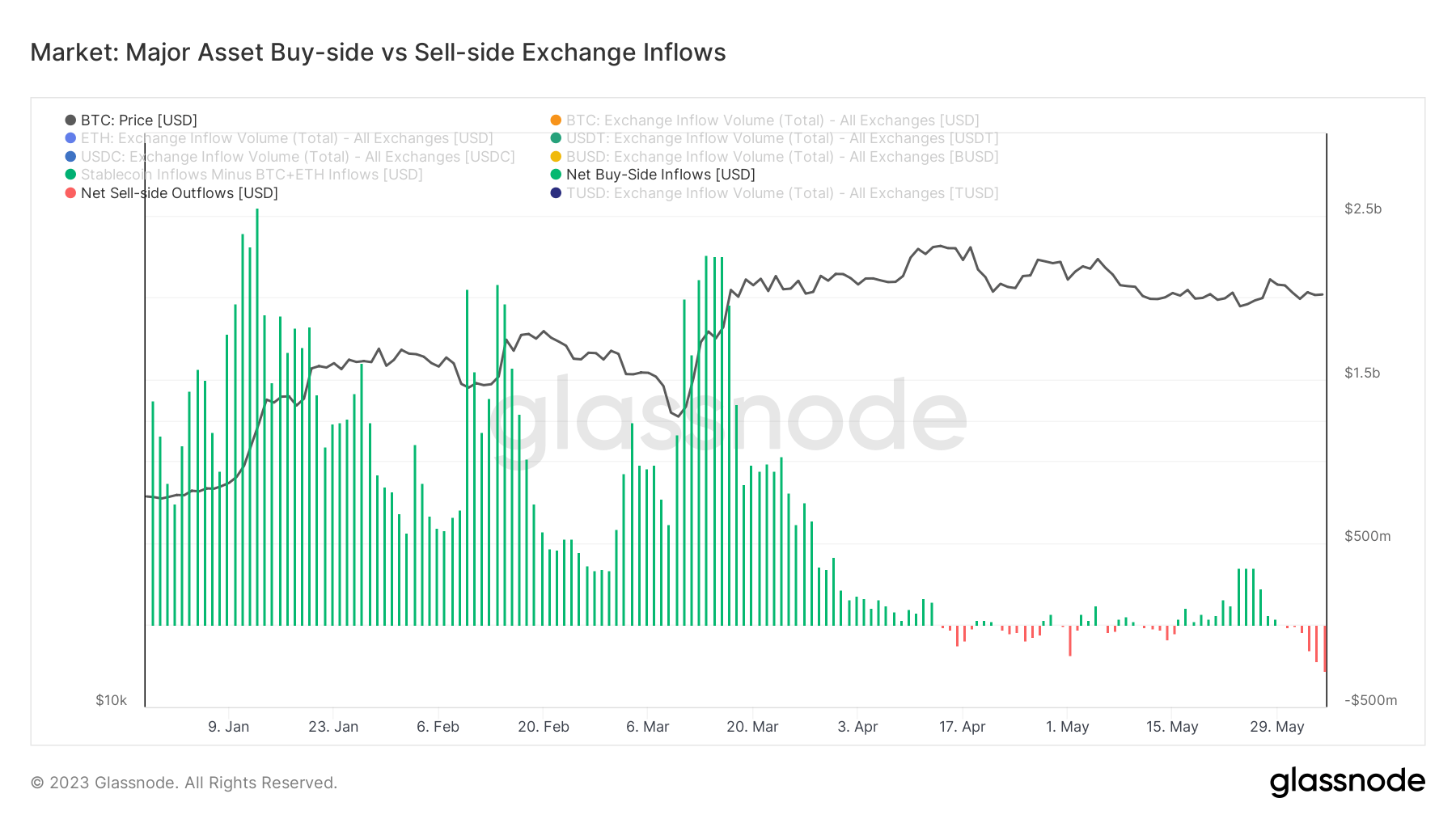

Evaluation of foreign exchange entries reveals an thrilling development. Since April, demand for stablecoins on exchanges has weakened, with inflows of BTC and ETH offsetting this. Regardless of the sustained influx, the 2 cryptocurrencies have largely traded sideways or skilled unfavorable worth motion, indicating that a lot of the inflows are possible on the promote facet.

Stablecoins, that are non-interest bearing and exempt from capital positive factors taxes, supply some attraction to merchants. Their nature doesn’t generate the taxable occasions inherent in buying and selling BTC or ETH, which is especially enticing to US merchants who’re starting to really feel the strain of elevated regulatory scrutiny and potential enforcement motion.

The Put up Merchants Flip to Stablecoins as US Regulatory Stress Intensifies appeared first on forexcryptozone.