- MicroStrategy is increasing its Bitcoin holdings with huge purchases, strengthening its portfolio.

- Bitcoin value hits new highs, fueled by MicroStrategy's daring shopping for technique.

- MicroStrategy funds Bitcoin investments by inventory gross sales, thereby persevering with its funding plan.

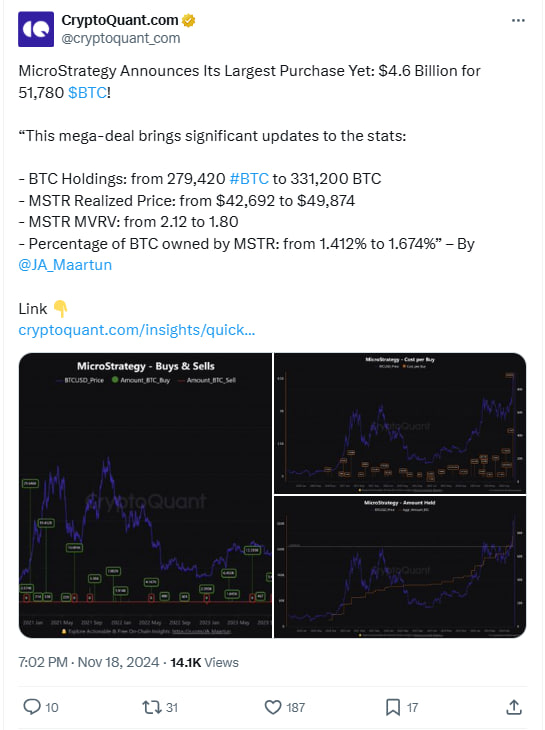

MicroStrategy simply made historical past with one of many largest Bitcoin purchases ever, buying 51,780 BTC for $4.6 billion. Much more exceptional, the complete buy was executed in only one week, at a median value of $88,627 per Bitcoin.

This newest buy brings MicroStrategy's complete Bitcoin holdings to 331,200 BTC, up from the earlier 279,420 BTC, at a median value of $49,874 per coin.

The market worth to realized worth (MVRV) ratio elevated from 2.12 to 1.80, demonstrating the affect of this huge quantity buy on its portfolio metrics. Notably, MicroStrategy now holds roughly 1.674% of the circulating Bitcoin provide, up from 1.412%.

MicroStrategy Bitcoin Acquisition Technique

MicroStrategy financed this buy by inventory gross sales. Between November 11 and 13, the corporate offered 13.6 million shares, elevating $4.6 billion.

Regardless of the dimensions of this transaction, MicroStrategy nonetheless has $15.3 billion in shares out there on the market, in line with SEC filings. Earlier this yr, MicroStrategy acquired 27,200 BTC for $2 billion at a median value of $74,463 per coin.

These belongings have already generated a revenue of just about $200 million, highlighting the effectiveness of its systematic strategy to elevating capital for Bitcoin investments.

Bitcoin Worth Rises

MicroStrategy's newest transfer coincided with Bitcoin breaking by the $90,000 stage for the primary time on November 12, later reaching $92,400. At present, Bitcoin value stands at $89,782.54, reflecting a weekly acquire of 9.74% regardless of a slight day by day decline of 0.84%.

Additionally learn:MicroStrategy to speculate an extra $42 billion in Bitcoin

With a market capitalization exceeding $1.77 trillion and a 24-hour buying and selling quantity of $59.6 billion, Bitcoin continues to point out strong exercise.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses arising from using the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.