Bitcoin miners are the spine of the cryptocurrency ecosystem as a consequence of their twin function of validating transactions and securing the blockchain. Their operational choices, particularly these associated to their Bitcoin reserves, can considerably affect market dynamics.

The strategic decisions that miners make relating to whether or not to carry or liquidate their Bitcoin earnings can considerably affect the stability between provide and demand out there.

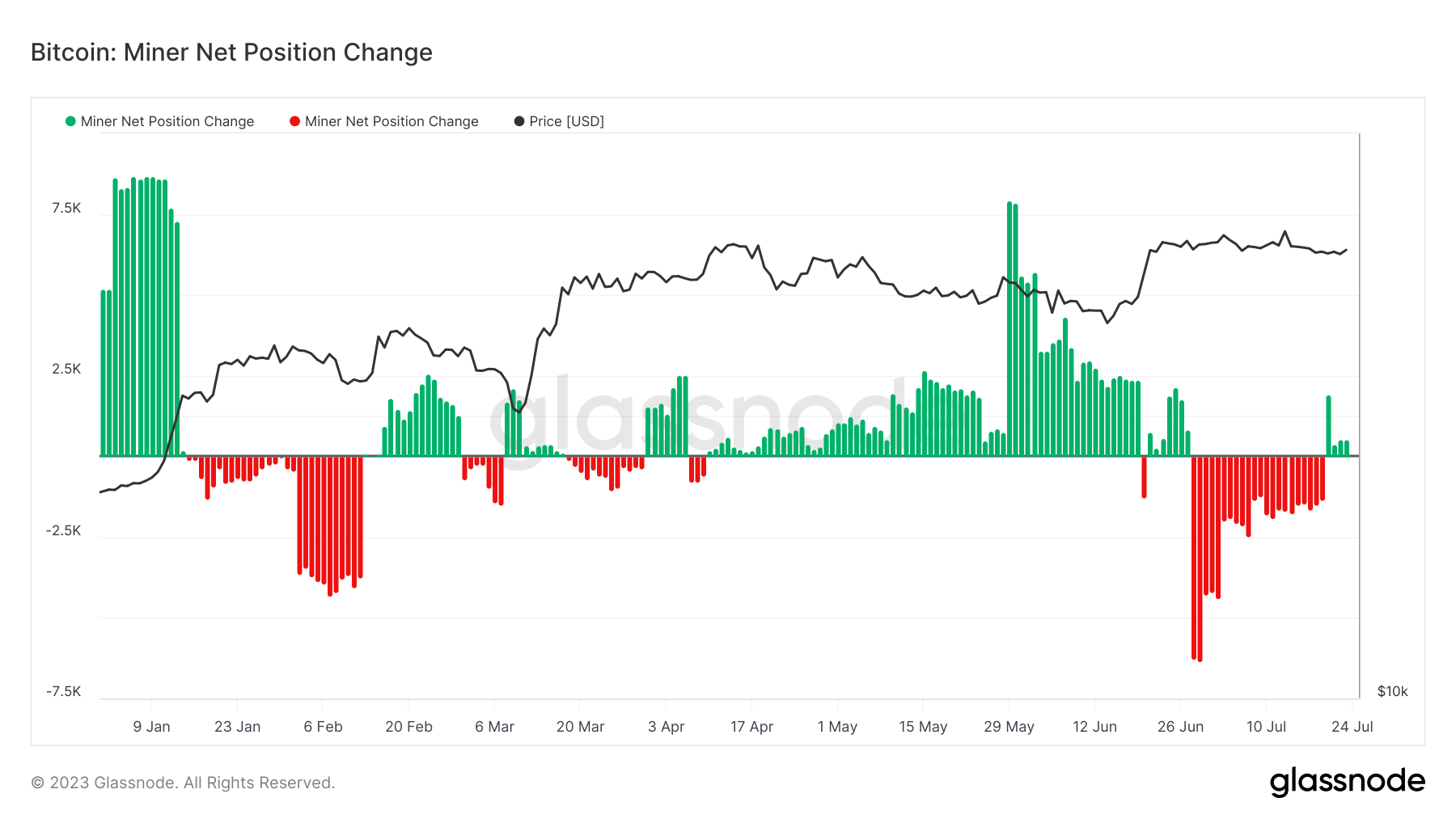

Traditionally, modifications in miner positions have been intently tied to Bitcoin value actions. Unfavorable shifts, the place miners promote extra Bitcoin than they earn, typically correlate with short-term value declines and extended downtrends or bear markets. That is doubtless as a result of such selloffs improve the availability of Bitcoin out there, which places downward strain on the worth.

Alternatively, constructive modifications, the place miners accumulate extra Bitcoin than they promote, can help value will increase. In impact, the buildup reduces the availability of Bitcoin out there, serving to to take care of or improve the worth.

All through 2023, miners have spent many of the 12 months growing their Bitcoin positions, indicating bullish sentiment. Nonetheless, the market has had a number of intervals with unfavorable place modifications, all correlated with elevated value volatility or downtrends.

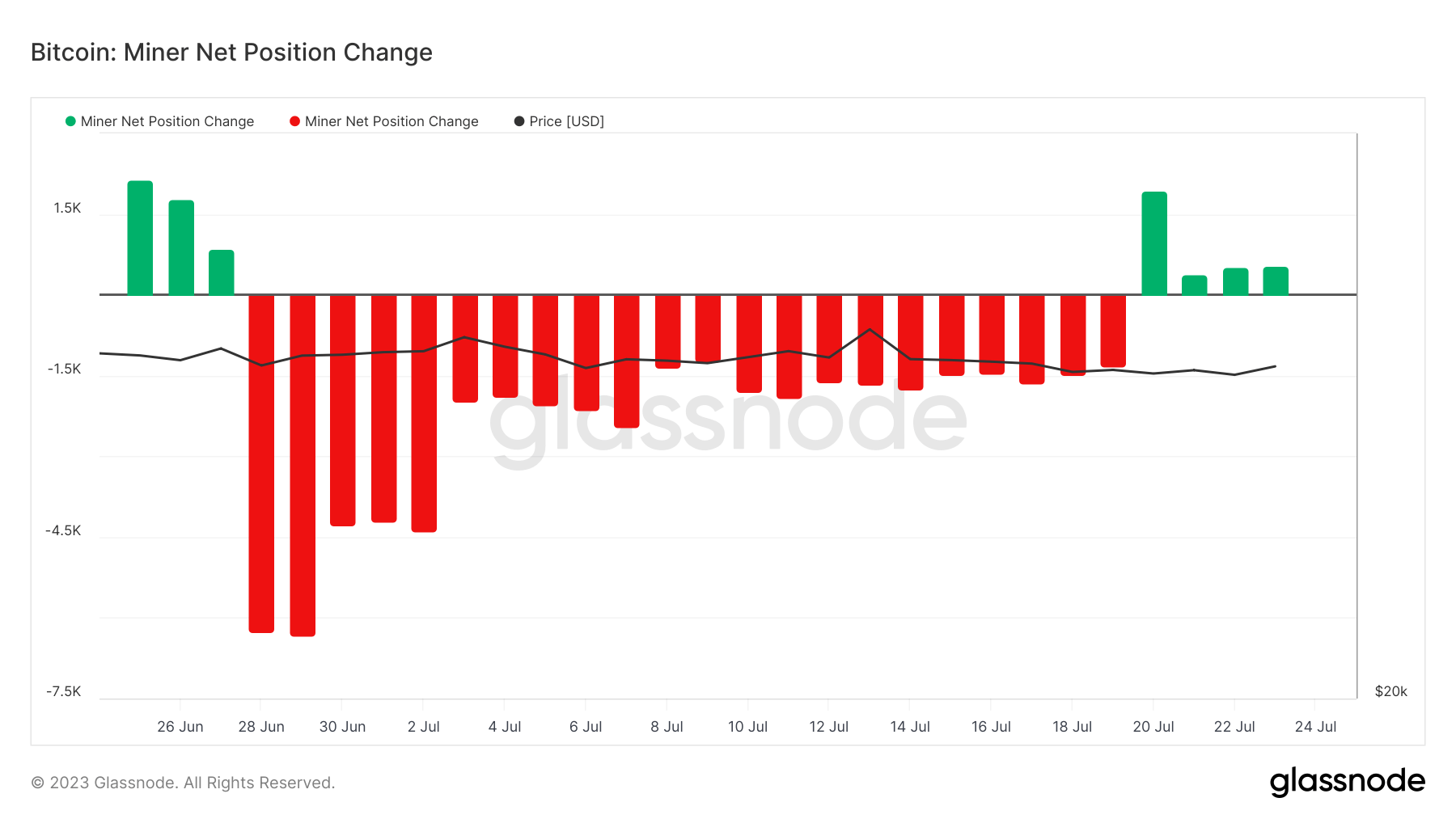

In July, miners spent many of the month growing their holdings.

This pattern modified on July 20, when information from Glassnode confirmed a constructive change in miner positions. Between July 20 and July 24, miners added over 451 BTC to their holdings. This accumulation of Bitcoin by miners could possibly be a bullish signal for the market, because it reduces the availability of Bitcoin out there, supporting and even probably growing the worth.

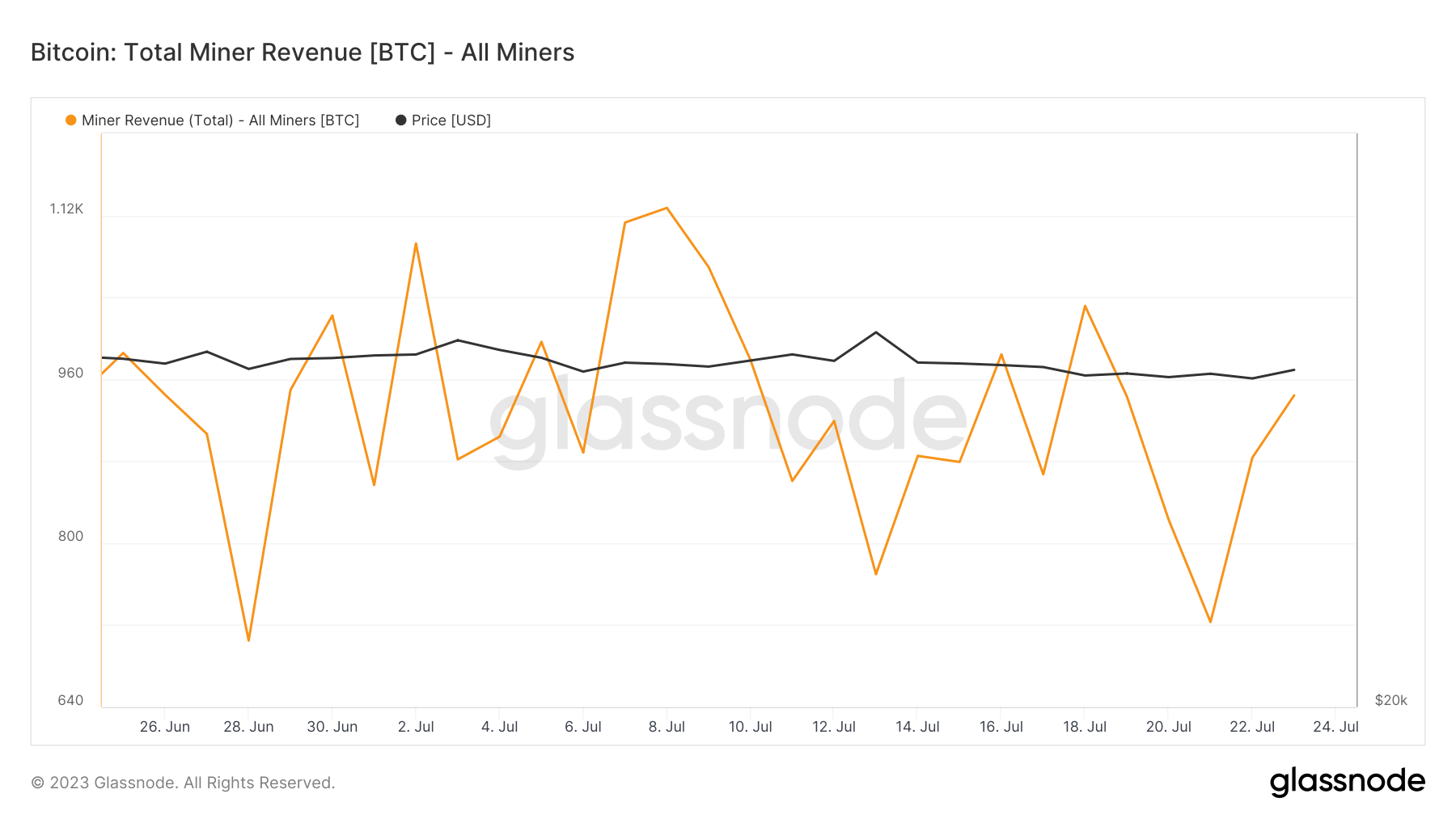

Nonetheless, it’s not solely the conduct of miners that may affect the Bitcoin market, but additionally their earnings. Whole miner income from charges and block rewards noticed a pointy drop on July 21, however has since returned to the degrees seen on July 19 at 944 BTC. Regardless of the continued volatility in miner earnings, earnings recorded on July 24 are in keeping with the month-to-month common.

Curiously, miners elevated their holdings whereas earnings remained basically flat. This might point out a bullish sentiment amongst miners, who’re selecting to carry their Bitcoin reasonably than promoting it for a direct revenue. This conduct could possibly be a response to market expectations or a strategic transfer to affect market dynamics.

Regardless of regular earnings, the current improve in bitcoin holdings by miners suggests bullish sentiment inside this key market group. This might have a constructive affect on Bitcoin costs within the quick time period.

Nonetheless, the conduct of miners alone won’t put sufficient strain available on the market to push the worth of Bitcoin above its present stage.

The publish Miners are growing their Bitcoin balances once more appeared first on forexcryptozone.