On June 15, Chainalysis reported that cybercriminals had been working mining swimming pools to combine their felony proceeds with freshly mined cryptocurrencies.

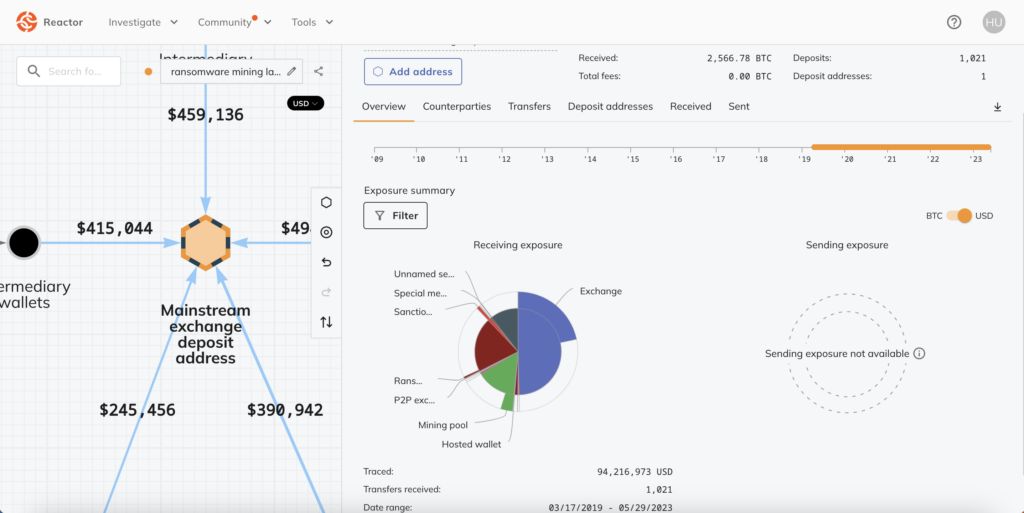

The report indicated a really lively deposit handle at a mainstream crypto change. This pockets has obtained numerous cryptocurrencies from each mining swimming pools and ransomware-related wallets.

The handle obtained a staggering $94.2 million price of cryptocurrency, of which about 20%, or $19.1 million, got here from ransomware-linked wallets. The handle additionally obtained $14.1 million from mining swimming pools.

Chainalysis discovered that the ransomware pockets and mining pool handle despatched funds to the change depository pockets through intermediaries. Nevertheless, in some instances, the ransomware pockets additionally despatched funds on to the mining pool.

This tactic is a “refined try at cash laundering”, Chainalysis stated. Unhealthy actors funnel funds to exchanges via mining swimming pools to create the phantasm that contaminated funds are mining commodities relatively than associated to cybercrime. Subsequently, criminals use mining swimming pools as a crypto mixer to keep away from triggering alarms on the change.

It is a rising development – Chainalysis discovered 372 change wallets that obtained funds from mining swimming pools and at the very least $1 million price of ransomware-linked wallets. In complete, these change addresses have obtained $158.3 million from ransomware wallets since 2018.

Scammers additionally use mining swimming pools to launder funds

Crooks additionally use the identical techniques as ransomware attackers. For instance, funds linked to the BitClub Community rip-off, during which over $700 million was stolen, had been blended with Bitcoin obtained from a Russian-based mining operation in 2019, in keeping with Chainalysis.

Moreover, the wallets on the exchanges additionally obtained funds from BTC-e, a former Russian crypto change. BTC-e was shut down in 2017 for facilitating cash laundering, together with these associated to the Mt. Gox hack.

The criminals allegedly blended funds from BitClub, BTC-e and Russian mining to disguise the origin of the funds. The report acknowledged,

“We consider it’s attainable that the cash launderers on this case intentionally blended funds from BitClub and BTC-e with these from mining to make it seem that each one funds despatched to each purses got here from mining.”

Since 2018, these change addresses have obtained practically $1.1 billion in scam-related wallets. Moreover, these change wallets obtained at the very least $1 million from mining swimming pools through the interval.

To fight this rising drawback of illicit funds, Chainalysis means that mining swimming pools and hashing providers implement strict pockets screening and know-your-customer procedures. Mining swimming pools ought to confirm the supply of funds and reject all deposits from illicit addresses, he stated.

The complete Chainalysis report is on the market right here.