How is the value of Avalanche (AVAX) performing crypto? Does it proceed the bullish momentum of the previous few days? And what are the prospects for the longer term? Under are all of the solutions.

We recall that Avalanche is a decentralized open supply proof-of-stake blockchain with sensible contract performance. AVAX, however, is the native cryptocurrency of the platform.

Avalanche (AVAX) Crypto Worth Rises to $17.06

Avalanche (AVAX) Crypto Worth Evaluation: It has been rising sharply for the previous few hours, with bulls driving the value up greater than 1.44%. Particularly, the bullish momentum has been fueled by elevated demand for the digital asset, with many traders seeking to capitalize on its potential.

Sturdy shopping for strain pushed the value of Avalanche to a excessive of $18, breaking by the earlier resistance degree of $17.06. The worth has been steadily rising since yesterday, when it was buying and selling at a excessive of $16.

Right this moment’s market began buying and selling at $17.06 on the time of writing. Nevertheless, a transfer in both route may set off the crypto’s subsequent transfer, as Avalanche’s value is now in a breakout zone.

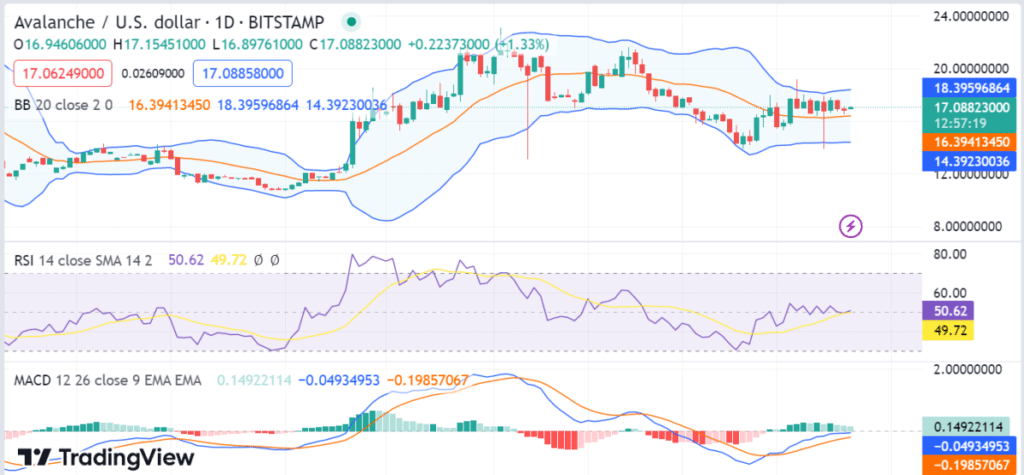

So bullish individuals must be cautious as a result of a bearish transfer may make the uptrend illegitimate. Anyway, to be extra exact, the 1-day avalanche value evaluation reveals that the AVAX/EUR pair is buying and selling in a good vary between the $17.08 and $17.06 ranges.

Bullish merchants have been controlling the market since yesterday’s open, which might be a sign of additional bullish momentum within the coming days. Although volatility is on the rise, which is nice information for bidders anticipating future value motion.

Bullish Bidders Watch Avalanche (AVAX) Crypto Worth

The higher portion Bollinger the bands are at the moment at $10.014 and the decrease Bollinger bands are buying and selling at $6.640. The convergence and divergence of the transferring common (MACD) within the 1-day value chart are additionally in inexperienced, indicating bullish momentum.

These indications recommend that the bulls are firmly in market management and should proceed to push costs greater if they’ll break by the resistance degree. The Relative Energy Index (RSI) is buying and selling at 50.62 indicating that the market is neither oversold nor overbought.

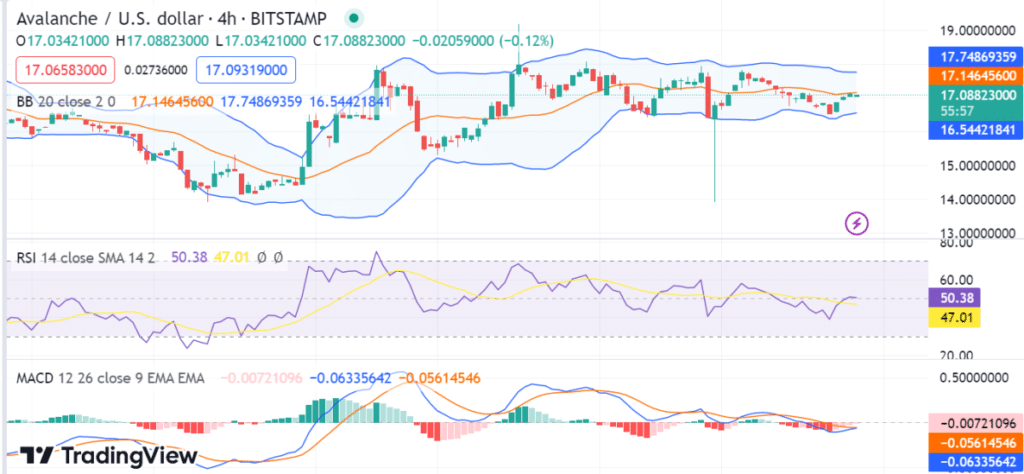

The 4-hour AVAX/USD value chart additionally supplies proof that the bulls are firmly underneath management. The AVAX/USD pair has focused the $17.06 degree on this transfer, which is the present buying and selling degree on the time of writing.

The important thing assist degree to observe might be $16.43, whereas the important thing resistance degree might be $17.15. Different actions in buying and selling quantity may additionally present additional clues about the place the value will transfer subsequent.

Furthermore, the technical indicators additionally verify the upward development, with the relative power index (RSI) rising above 60. The Shifting Common Convergence and Divergence (MACD) indicator within the 4-hour value chart signifies that Avalanche value is gaining momentum because the fast paced line intersects the sign line.

Moreover, the higher Bollinger band is now at $17.748, whereas the decrease band is at the moment at $16.544. In conclusion, so long as the bulls are in management, we count on the market to proceed greater within the close to future.

Nevertheless, additional upside potential will current itself if the bulls handle to interrupt the $17.15 resistance degree within the subsequent few days. Nevertheless, if as an alternative the bears handle to interrupt the $16.43 assist degree, we may see a value correction.

Joe DEX and the affect on AVAX within the brief time period

As we all know, Avalanche (AVAX) has struggled to persuade customers of its protocol in latest months. As such, dApps on the Avalanche Community could possibly assist the protocol enhance on its present scenario as they progress.

For instance, Dealer Joe, one of the in style DEXes within the Avalanche Community, has seen an enormous surge in quantity in latest weeks, in response to the info. Certainly, the amount generated on the platform reached a peak of $100 million throughout this era.

Together with this, there was a 22.13% enhance within the variety of distinctive wallets on the TraderJoe community final week, in response to DappRadar. Moreover, different in style dApps on the Avalanche Community, reminiscent of Benqi and GMXadditionally skilled an analogous spike in exercise.

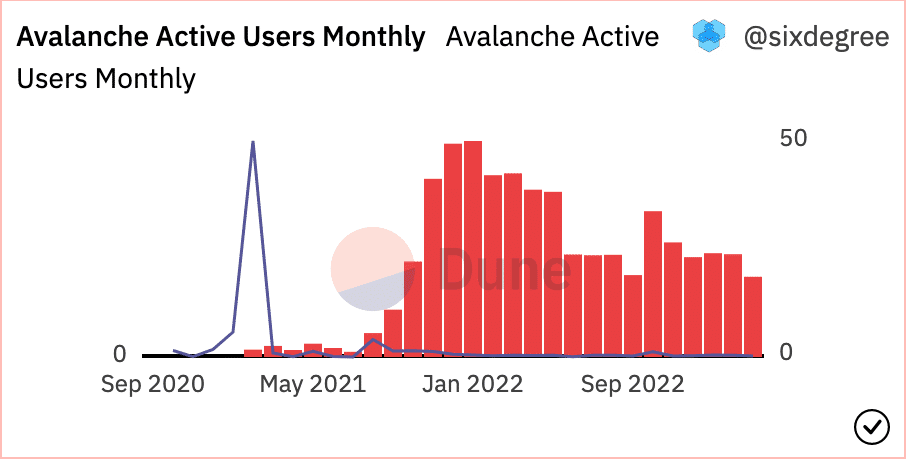

Nevertheless, for the time being, the recognition of those dApps just isn’t sufficient to extend each day energetic customers on the Avalanche community. In line with information from Dune evaluationthe variety of each day energetic addresses on the community has elevated from 340,000 to 238,000 over the previous three months.

This drop in exercise impacted Avalanche’s TVL, which fell from $958 million to $827.29 million over the previous month. Consequently, the income generated by Avalanche was additionally affected by the dearth of exercise on the community.

In truth, in response to the info, income fell 16% over the week. Cumulatively, the full quantity of earnings acquired by the protocol, on the time of writing, was $606,600.