An outline of present and future costs and an summary of the newest information relating to the Casper (CSPR), Fantom (FTM) and Chainlink (LINK) crypto belongings. What is occurring within the cryptocurrency market?

Concentrate on Casper (CSPR), Fantom (FTM) and Chainlink (LINK) crypto belongings

It’s price mentioning that Casper is an open-source blockchain optimized for companies and builders. Particularly, it’s the first proof-of-stake blockchain, constructed from the unique Casper Appropriate-by-Building (CBC) specs, designed to speed up the adoption of blockchain know-how.

Fantom (FTM), however, is an open-source directed acyclic graph community, appropriate with the Ethereum digital machine to have the ability to run present sensible contracts and create new ones that work together with contracts on Ethereum.

Lastly, Chainlink is a decentralized blockchain community constructed on Ethereum. The community is used to facilitate the switch of tamper-proof knowledge from off-chain sources to on-chain sensible contracts.

Will Casper Crypto (CSPR) Hit $0.1 in 2023? The connection with Fantom and Chainlink traits.

caspar has a market capitalization of $383,471,862 and is ranked 99th within the cryptoverse. Nevertheless, CSPR quantity dropped by 25% on the assembly a number of days in the past.

Thus, the amount to market cap ratio of the asset worth is near 0.0155, suggesting a consolidated worth pattern. A undeniable fact that can be confirmed by CSPR’s weekly technical chart, which suggests a consolidated worth pattern.

CSPR is at the moment buying and selling near $0.035 with a 2% decline within the intraday session. In the meantime, the asset’s worth resistance will be seen close to the worth of $0.075.

Furthermore, we see that the CSPR assist will be seen close to the $0.02 worth. It’s at the moment buying and selling under the each day transferring common of fifty and above 100. There could possibly be a detrimental crossover sooner or later which may push the worth of the asset to a new low sooner or later.

The asset’s worth RSI is close to 44, suggesting its presence within the impartial zone, though there’s a small optimistic slope suggesting an upward pattern within the worth.

Anyway, the truth that Casper lately entered right into a partnership with Google Cloud, an element that would push the worth of the asset sooner or later. Actually, a number of analysts anticipate a powerful upward pattern in CPSS going ahead.

Particularly, with this partnership, Google hopes to supply its clients with a dependable and safe blockchain platform able to dealing with large-scale, enterprise-level functions.

Casper Labs has earned a fame as a number one developer of enterprise-grade blockchain options. The corporate’s blockchain platform relies on the Casper Consensus Protocolwhich is designed to supply excessive scalability, low latency and excessive safety.

This makes it an excellent platform for big enterprises and authorities establishments that want a safe and scalable blockchain answer.

Downtrend for Crypto Fantom (FTM)

Ghost (FTM) is a well-liked crypto that has lately attracted quite a lot of consideration from traders and merchants. Actually, the coin has seen spectacular beneficial properties in 2022, hitting an all-time excessive of $3.4 in January.

Nevertheless, the crypto has lately confronted challenges and setbacks which have eroded its momentum and market share. Certainly, the massive traders of Fantom (FTM) are actually speeding on the presale of TMS Community (TMSN)the so-called new DeFi star that goals to revolutionize buying and selling.

Particularly, Fantom (FTM) suffered a blow when Andre Cronjea distinguished developer and advisor to the Fantom Basis (FTM), has introduced his departure from the decentralized finance (DeFi) area.

Cronje was behind a number of profitable initiatives on the Fantom (FTM) platform, equivalent to Securely, Keep3r and Iron Financial institution. Because of this, his announcement sparked a sell-off of FTM and different tokens related along with his work, inflicting Fantom’s (FTM) complete worth locked (TVL) to drop from round $12 billion to $6.7 billion these final weeks.

The crypto thus misplaced its place as essentially the most traded token amongst Ethereum’s whales to the advantage of ENS Area Identify Service.

DeFi Increase: May Chainlink Worth Rebound?

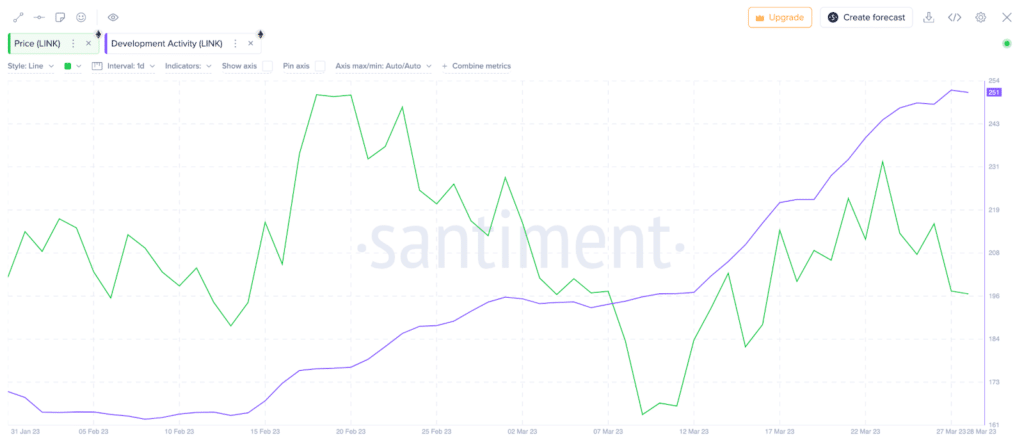

Over the previous week, LINKThe worth of has undergone a ten% correction. An in-depth evaluation of historic on-chain knowledge exhibits that LINK’s worth actions are carefully tied to growth exercise.

Moreover, the current DeFi increase may set off a worth rebound for LINK within the coming weeks. We see LINK gaining momentum as traders flip to decentralized funding protocols amid turmoil within the US banking sector.

Amongst different elements, LINK’s current rally was fueled by the spike in demand for Problem merchandise after the key TradFi financial institution collapses. Certainly, as increasingly more traders flip to decentralized monetary services and products, DeFi internet hosting protocols require the ancillary providers supplied by Chainlink.

Unsurprisingly, Chainlink’s current enhance in growth exercise to fulfill rising demand for varied DeFi sensible contract platforms has highlighted this. In keeping with on-chain knowledge from Santiment, developer exercise on the Chainlink blockchain community has elevated by greater than 50% since early February.

As proven under, Chainlink’s Developer Exercise Rating dropped from 164.90 to 251.80 between February 2 and March 28. Improvement exercise signifies how a lot assets are dedicated to enhancing the community.

This will likely imply including new options, increasing community capabilities, or implementing bug fixes. A persistent enhance, as famous above, represents a bullish sign.

Traders can accumulate LINK, anticipating the worth added by elevated growth exercise to have a optimistic impression on its long-term worth efficiency.

Notably, earlier LINK worth will increase have usually been preceded by a spike in growth exercise. If this situation is met, LINK holders can anticipate one other worth spike within the subsequent weeks.