- Shanghai’s upcoming Ethereum improve is sparking curiosity, however scrutiny may harm ETH’s future.

- The Cobo founder warns that the non-public keys of staked ETH addresses could also be susceptible.

- Validators are nonetheless supporting the improve and merchants are exhibiting optimistic sentiments in direction of ETH.

Shanghai’s upcoming improve to Ethereum is attracting curiosity from the crypto group, however nearer scrutiny may harm ETH’s future. The Cobo founder warned that the non-public keys of staked ETH addresses may very well be susceptible to publicity.

In line with Shenyu, the founding father of Cobo, a digital asset custodial service supplier, the non-public keys to Ethereum addresses which have staked their ETH could also be in danger. This information is regarding for the group and motion might should be taken to mitigate potential harm.

To mitigate the danger of personal key publicity, the Cobo founder recommends that centralized staking suppliers assess their non-public key storage strategies, assess the standing of approved personnel, and set up contingency plans. This might assist forestall potential harm to the Ethereum group.

Moreover, Shenyu suggested warning, citing the same incident when launching Arbitrum’s AirDrop, the place a number of non-public keys have been uncovered. This additional underscores the significance of taking preventative measures to guard non-public keys and forestall potential hurt to the Ethereum group.

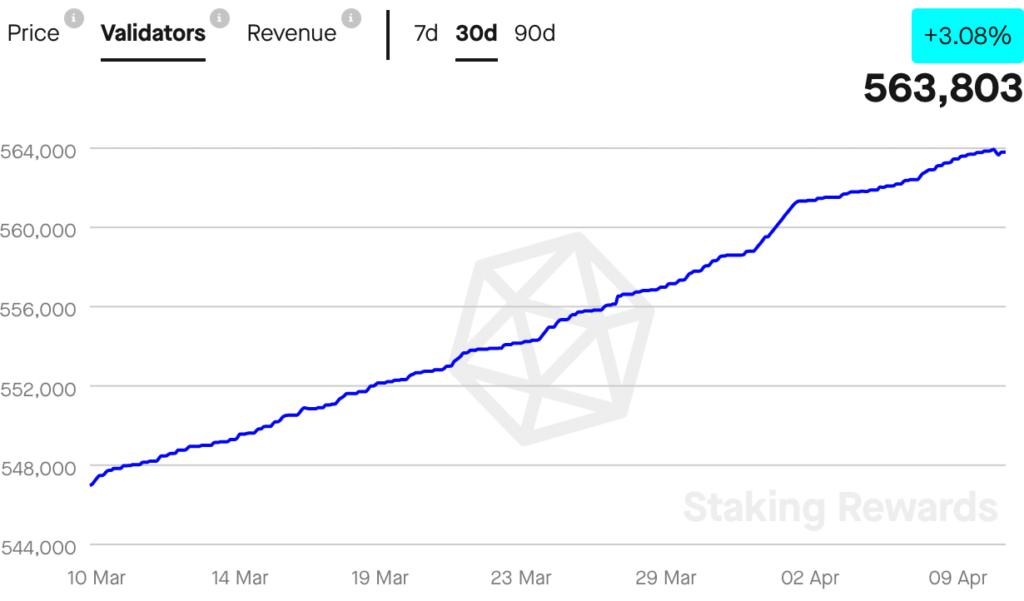

Regardless of rising issues, validators on the Ethereum community are nonetheless supporting the upcoming replace. In line with information from Staking Rewards, the variety of validators on the community has elevated by 3.08% over the previous 30 days.

At the moment, there are 563,803 validators on the Ethereum community, collectively producing $2.34 billion in income. This means that the group stays assured in the way forward for Ethereum, regardless of the potential dangers related to the Shanghai improve.

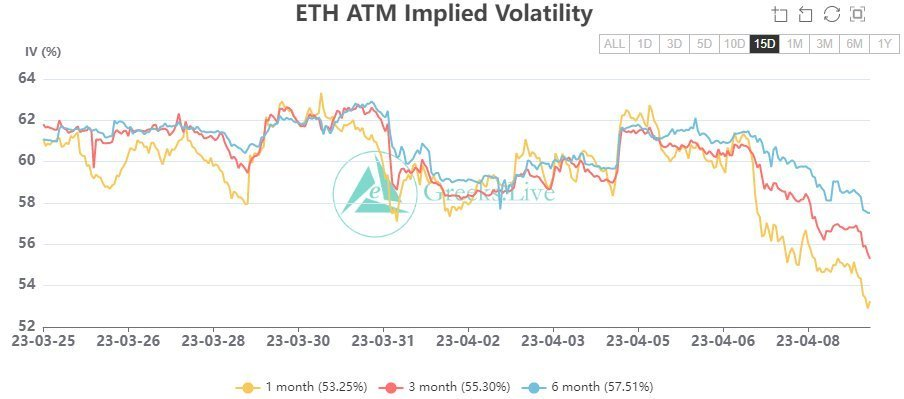

Furthermore, merchants are additionally exhibiting optimistic sentiment in direction of ETH, presumably because of the lower in implied volatility of Ethereum (IV) choices. In line with Greeks Reside, Ethereum’s IV has decreased by 8% over the previous two weeks. A drop in IV for Ethereum means that the market views Ethereum’s worth as much less dangerous and unsure.