The cryptocurrency market has been a whirlwind of exercise over the previous week, with Bitcoin (BTC) seeing probably the most notable surge, crossing the $30,000 mark for the primary time in two months, a milestone essential psychological issue that might restore confidence available in the market.

At press time, Bitcoin is buying and selling at $30,343.

Over the weekend, Bitcoin managed to carry the $30,000 degree, even breaking above $31,000 briefly. This worth rally was fueled by a flurry of stories round institutional adoption, which has been a key driver of Bitcoin’s worth for the reason that begin of the 12 months, because it alerts rising mainstream acceptance and elevated demand. potential for the digital asset.

This surge within the worth of Bitcoin has elevated the profitability of most holders. That is evident when analyzing on-chain knowledge, particularly UTXOs in revenue. Unspent transaction outputs (UTXO) are Bitcoin transaction outputs that haven’t been spent and may be considered particular person “cash” or cash that reside in a Bitcoin pockets. They’re essential when analyzing the market as they supply a snapshot of financial exercise on the Bitcoin community.

The Bitcoin provide revenue and loss estimate is essential as a result of it offers perception into market sentiment and potential future worth actions. One option to gauge that is to research what number of present UTXOs are in revenue or loss.

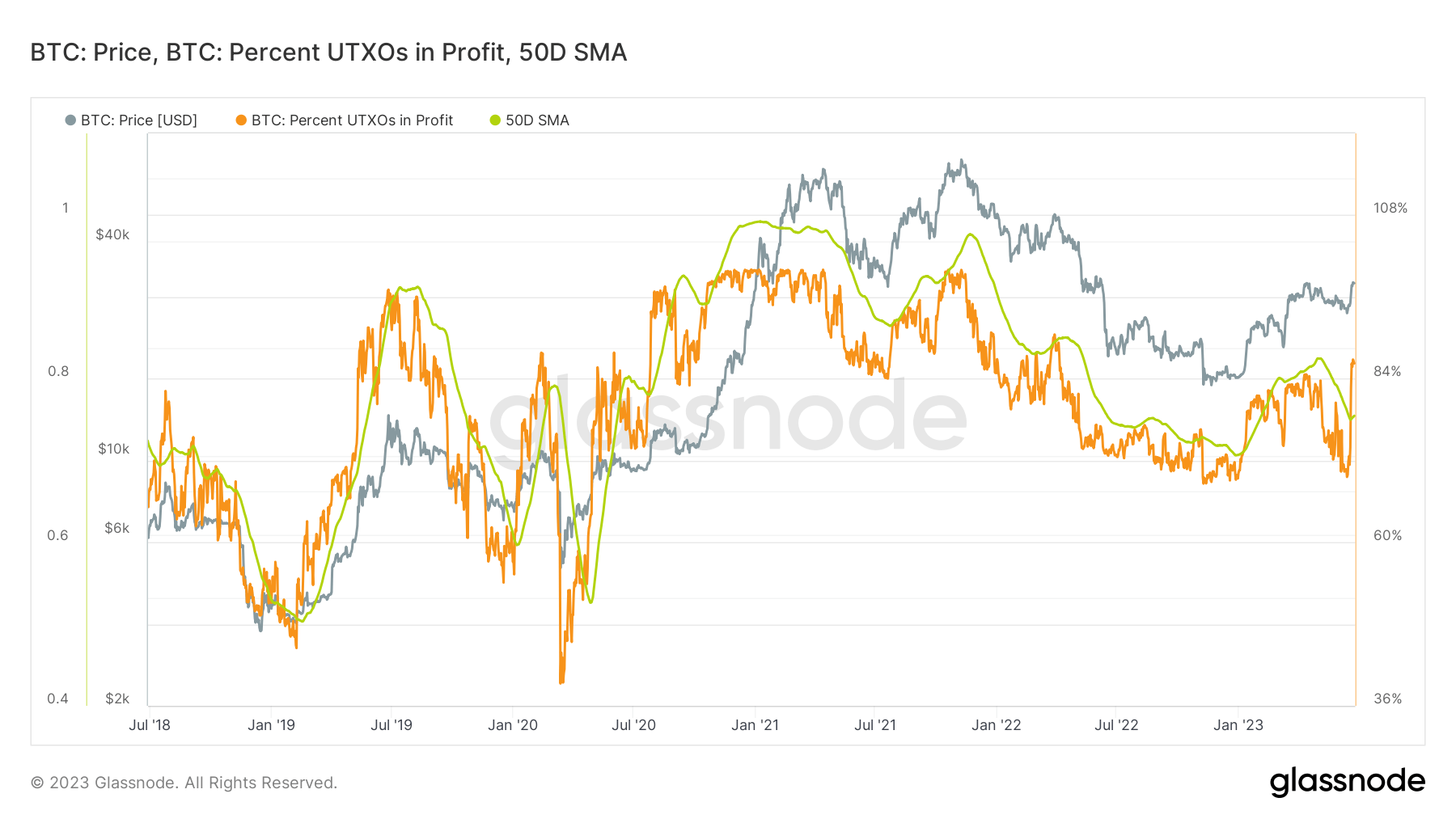

Glassnode calculates the variety of UTXOs in revenue/loss by counting all current UTXOs whose worth on the time of creation was decrease or greater than their present worth. To account for the rise within the variety of UTXOs over time, the information is normalized by the dimensions of the UTXOs to acquire the relative variety of UTXOs in revenue/loss, i.e. the proportion.

UTXO’s revenue share approaches 100% at any time when a earlier all-time excessive is damaged. In keeping with Glassnode, making use of the 50-day easy transferring common (SMA) to the information greatest matches the historic knowledge and creates a a lot better sign that signifies the tops of the worldwide and native Bitcoin cycle.

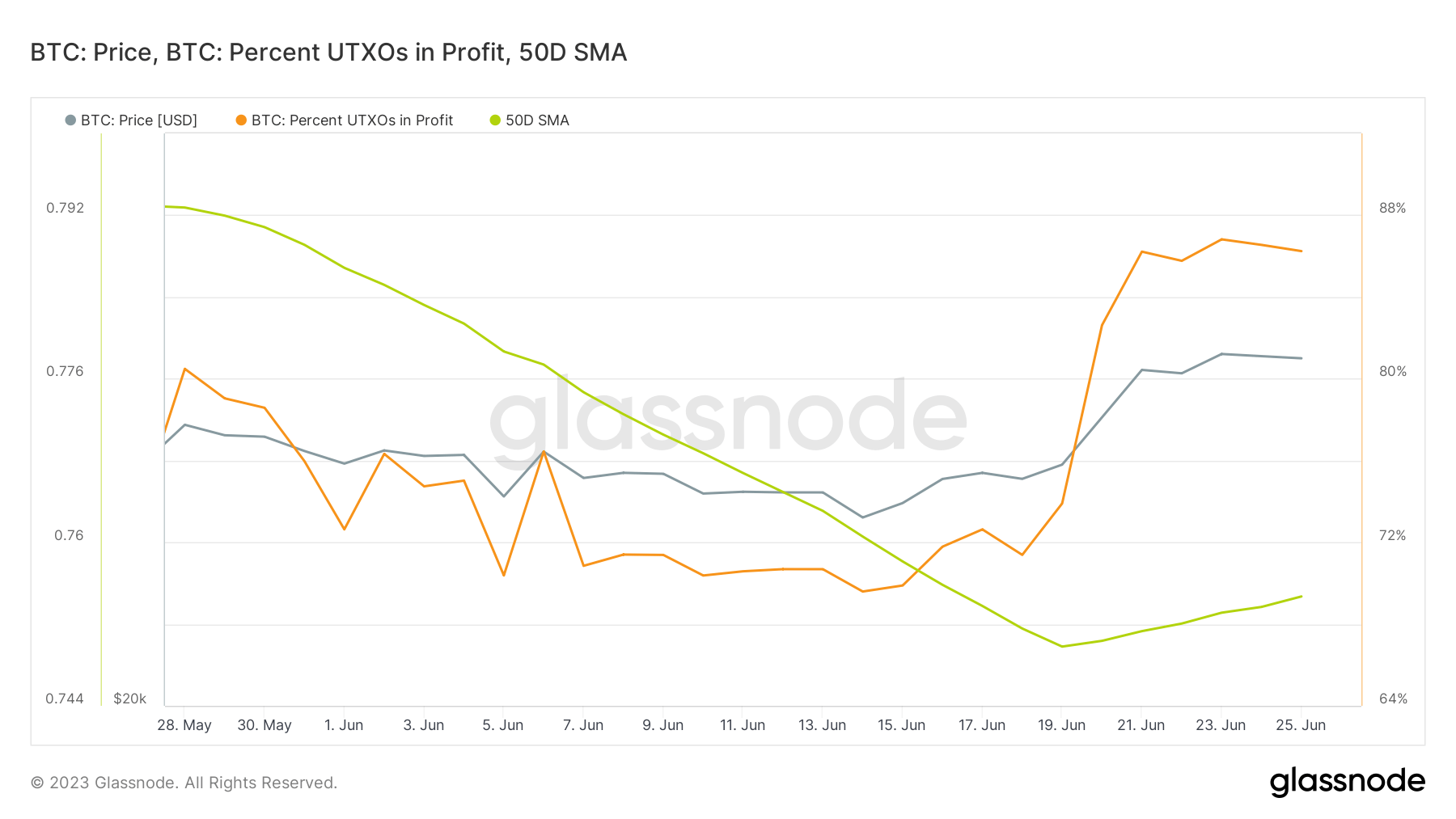

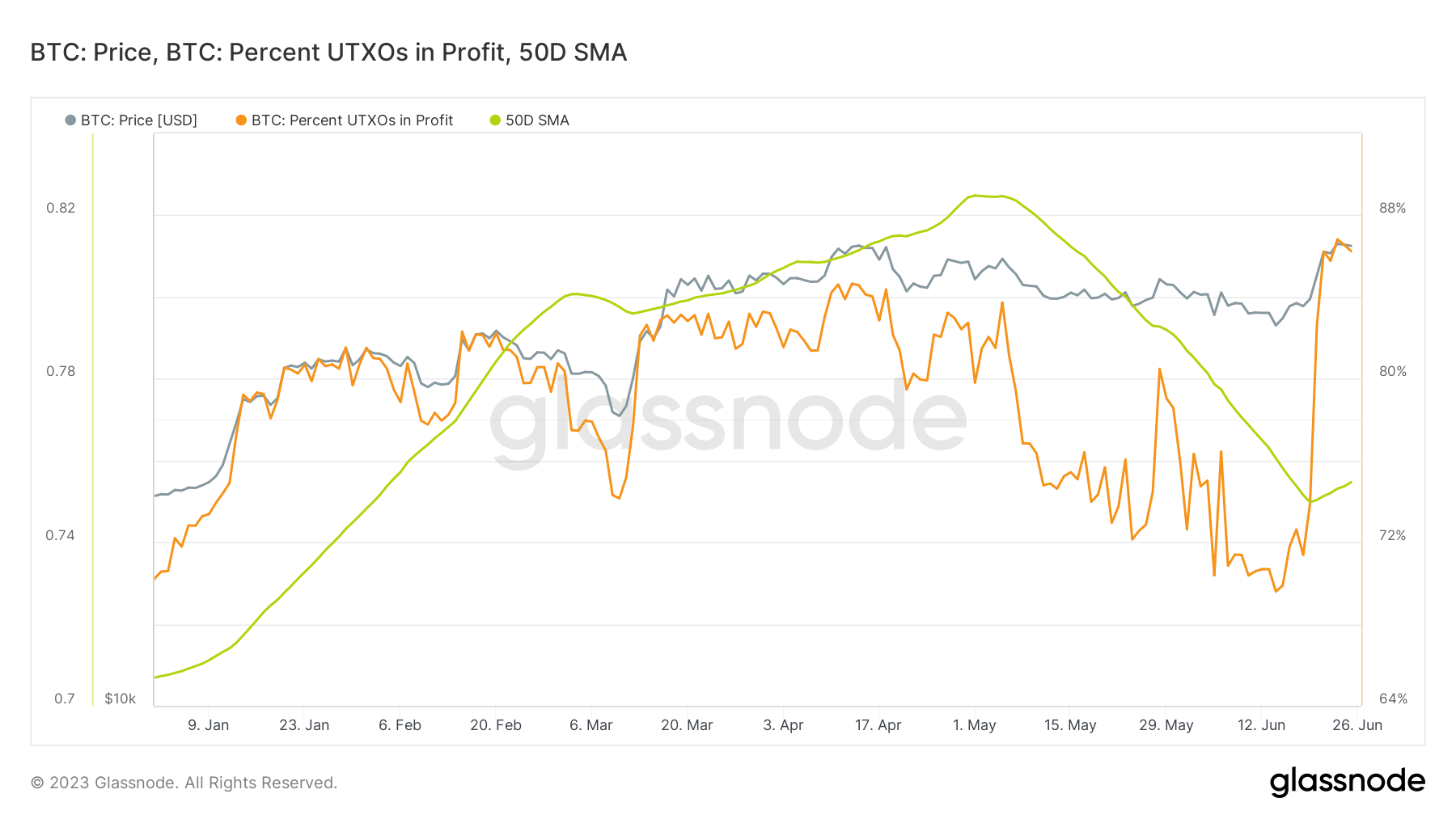

forexcryptozone evaluation revealed that 86.24% of UTXO Bitcoin is at the moment in revenue. It is a sharp rise from the 69.59% recorded on June 14 and a slight drop from the 14-month excessive of 86.8% recorded on June 23. This means that the majority Bitcoin holders are at the moment worthwhile, which might considerably have an effect on the long run trajectory of the market.

Nonetheless, the 50-day easy transferring common (SMA) for UTXO Bitcoin in revenue at the moment sits at 75%, a major decline from the 82.4% degree recorded in Might.

The SMA is a generally used technical indicator that helps easy out worth knowledge by making a consistently up to date common worth. On this context, it offers a clearer image of the general development of UTXO Bitcoin profitability over the previous 50 days. The decline within the SMA means that regardless of Bitcoin’s current worth surge, general UTXO profitability has been on a downward development over the previous two months.

This may very well be attributable to various elements, together with Bitcoin holders promoting at a loss or the creation of recent UTXOs at greater worth ranges. Nonetheless, with the current worth surge pushing UTXO’s share of earnings over 86%, it stays to be seen if this development will proceed.

Over 86% of bitcoin unspent earnings as BTC continues to commerce above $30,000 appeared first on forexcryptozone.