- Exercise on the PancakeSwap DEX has elevated, resulting in a rise in quantity on the BNB channel.

- CAKE was oversold at an RSI of 29.12, however an absence of liquidity won’t reverse the value development.

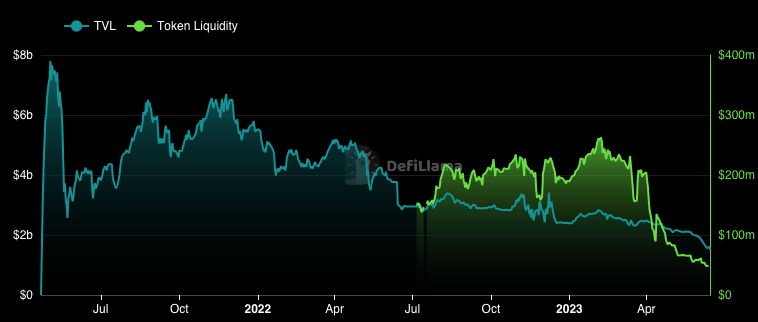

- Uniswap surpassed PancakeSwap’s TVL regardless of widespread decline in metric.

Below uncommon circumstances, the each day energetic customers (DAU) of PancakeSwap (CAKE) exceeded that of Uniswap (UNI). In response to knowledge from Token Terminal, Uniswap’s DAU was 59,600 whereas PancakeSwap had 123,100 energetic customers.

Often called two of the very best decentralized exchanges (DEXs), Uniswap has essentially the most variety of buying and selling pairs. Nonetheless, PancakeSwap has confirmed to be the popular platform for customers eager about tokens working as a part of the Binance Sensible Chain.

PancakeSwap overtakes the chief

Due to this fact, the rise in DAU means that the variety of distinctive public addresses that transacted on PancakeSwap exceeded Uniswap transactions.

One of many principal causes for that is PancakeSwap’s improve to v3, which gave elevated entry to liquidity suppliers. Consequently, this resulted in a 65% enhance in general BNB Channel quantity between April and early June.

Though Uniswap has matched the progress of PancakeSwap with its v4 launch, the value motion of their respective tokens has not been comparable. Up to now 24 hours, the worth of CAKE has decreased by 4.18%. UNI, however, is up 2.41% on the time of this writing.

CAKE is about to hit all-time low

In response to the technical outlook, the each day worth of CAKE has been declining since its worth reached $2.80 on April 28. Whereas the situation could also be just like many property available in the market, CAKE’s efficiency has been a lot worse.

As indicated by the Relative Energy Index (RSI), the token has been languishing under the oversold area for a whole month. Between April 23 and Might 28, CAKE’s RSI was under 30.

Nonetheless, bullish motion at $1.54 on Might 29 pushed the RSI to 40 on June 4. However sadly, he couldn’t overcome the resistance he encountered the subsequent day. At press time, the RSI was again at 29.12.

This studying represents that CAKE is oversold. Normally, bullish motion at this level might set off a reversal. However CAKE appeared to lack the required money for such a transfer. Thus, CAKE’s bearish momentum could proceed to persist within the close to time period.

In the meantime, the automated market maker couldn’t beat Uniswap when it comes to whole worth locked (TVL). Within the DEX class, Uniswap and Curve Finance (CRV) prime the charts.

Moreover, virtually each mission noticed a drop in TVL, together with PancakeSwap.

At press time, the mission’s TVL was 1.51 billion. This means a waning curiosity in utilizing sensible contract protocols working beneath the DEX.

Disclaimer: The views, opinions and knowledge shared on this worth prediction are revealed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at his personal danger. Coin Version and its associates is not going to be answerable for any direct or oblique damages or losses.