- Santiment shared his newest information report for PEPE by way of a tweet this morning.

- In line with the report, the on-chain metrics had foreshadowed PEPE’s current sell-off.

- The knowledge revealed that there could possibly be one other PEPE discharge within the close to future.

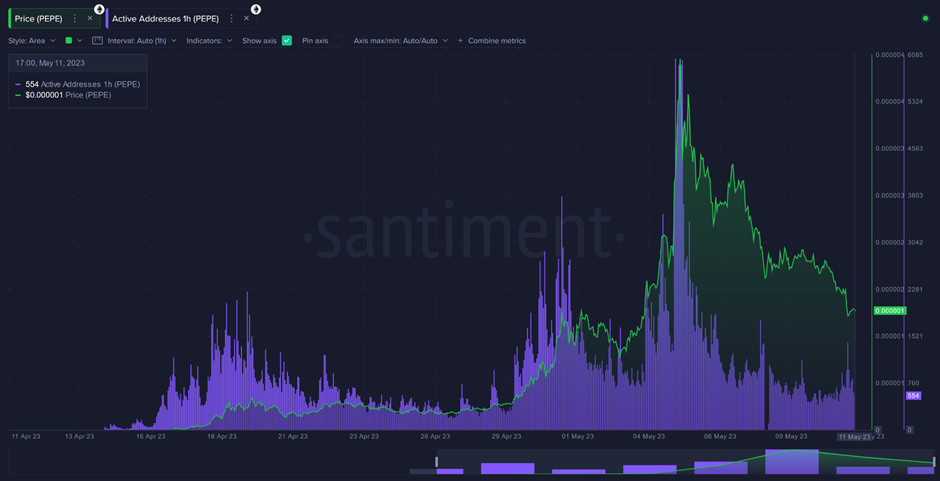

Blockchain intelligence agency Santiment shared its newest Pepe Data Report (PEPE) in a Tweeter This morning. This report comes after the value of PEPE fell considerably following its +1,200% rally between April 29 and Might 5 of this yr.

In line with data from Santiment, keen buyers had tried to purchase the current drop within the crypto value in hopes that it might proceed its spectacular bullish streak. Sadly, these efforts to purchase the dip weren’t very efficient as main addresses continued to promote their PEPE holdings, the report provides.

This induced the coin’s value to plummet virtually as rapidly because it rose, dropping round 65% from its all-time excessive (ATH) on Might 5. In line with the report, the measure of the corporate’s social dominance had completely predicted the altcoin’s value decline.

The indicator had proven that PEPE’s social dominance had gone from 5% to between 1 and a couple of% hours earlier than he set his ATH. This instructed that merchants began shifting their focus from PEPE to different altcoins.

As well as, the variety of distinctive addresses holding PEPE additionally skyrocketed, resulting in its highest value. Nevertheless, a better have a look at this on-chain metric revealed that enormous addresses began promoting their holdings shortly earlier than the crypto value peaked.

Santiment additionally warned that a rise within the variety of massive addresses holding 100 million PEPE or extra might be an early indication of a second near-term dump. Nevertheless, this second sale shouldn’t be as violent because the earlier one.

At press time, PEPE was buying and selling at $0.000001116 at press time and was down over 36% in response to CoinMarketCap. The altcoin had additionally weakened in opposition to the 2 crypto market leaders over the previous 24 hours, and was down 33.80% in opposition to Bitcoin (BTC) and 33.60% in opposition to Ethereum (ETH).

Disclaimer: Views and opinions, in addition to all data shared on this value evaluation, are printed in good religion. Readers ought to do their very own analysis and due diligence. Any motion taken by the reader is strictly at his personal threat. Coin Version and its associates is not going to be held chargeable for any direct or oblique injury or loss.