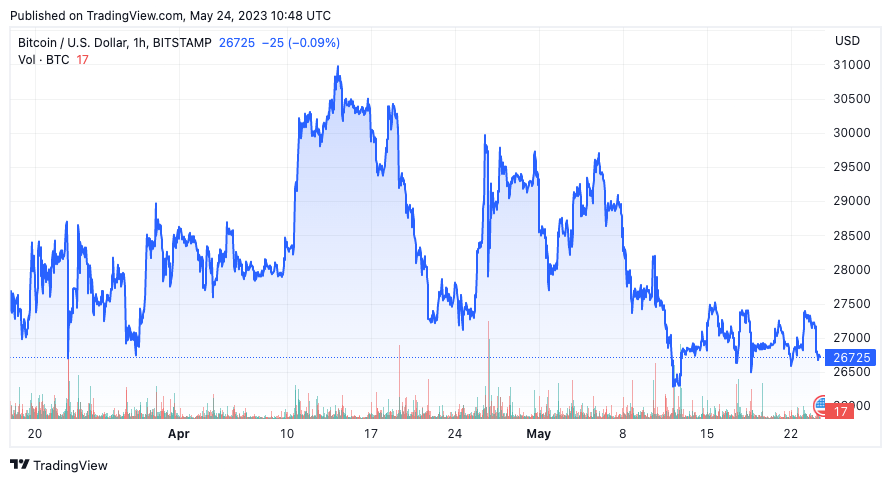

The Bitcoin market was quiet for many of Might, with costs hovering in a comparatively secure vary between $26,000 and $28,000.

Nevertheless, beneath this seemingly quiet floor, a number of on-chain metrics level to potential shifts in market sentiment and investor conduct.

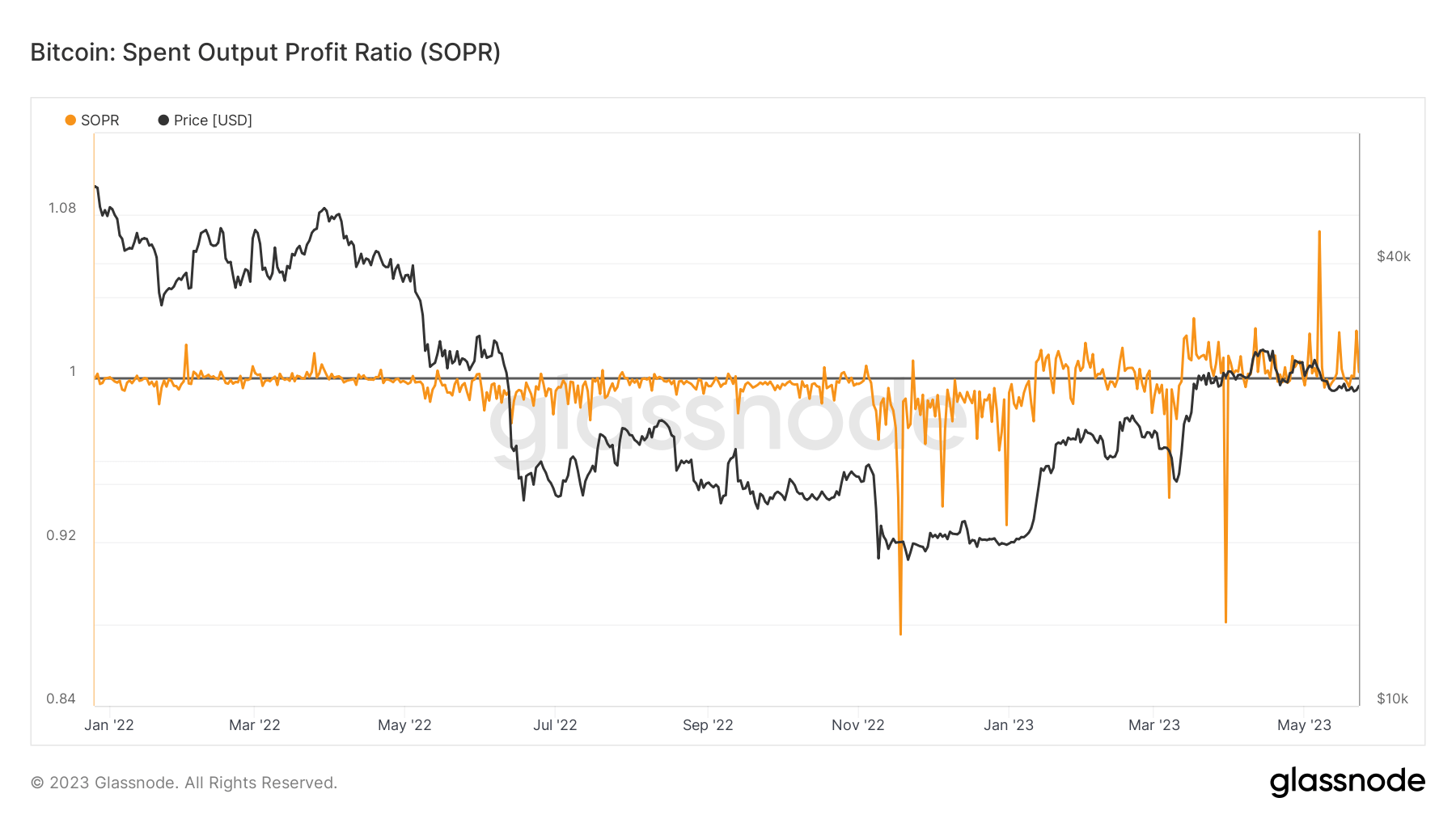

The Spent Output Revenue Ratio (SOPR) is a useful indicator of market profitability and losses. A SOPR worth higher than 1 means that, on common, cash moved on-chain throughout that interval are offered at a revenue. Conversely, a SOPR worth of lower than 1 implies that cash are, on common, offered at a loss.

The SOPR tends to fall and is step by step approaching the important threshold of 1. Though this may occasionally appear regarding, you will need to be aware that falling SOPR values may point out a market part the place traders are holding their belongings, anticipating favorable market situations. or larger costs sooner or later.

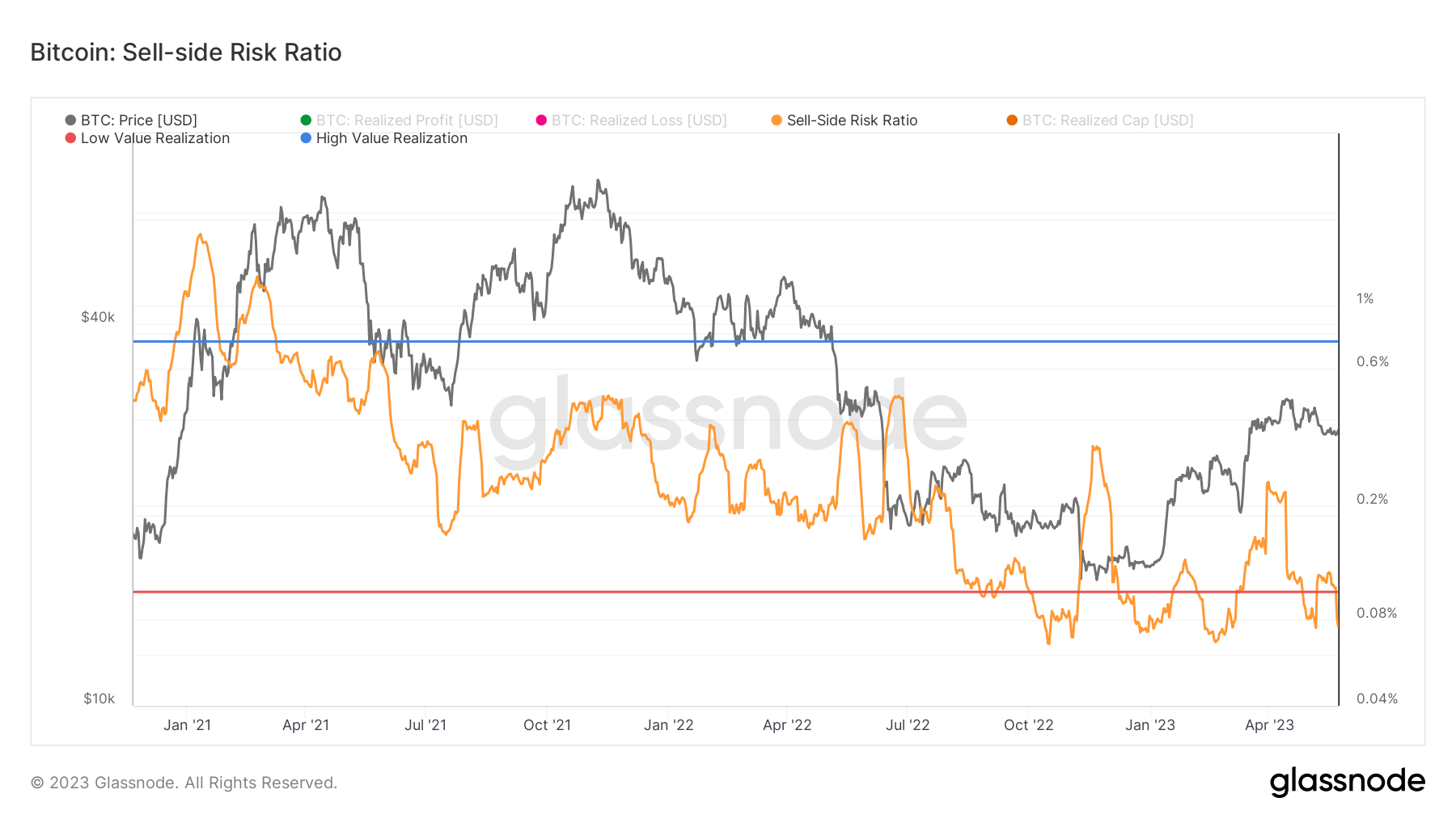

The sell-side threat ratio gives useful perception into the general sell-side stress available in the market, by evaluating the overall USD worth spent by on-chain traders towards the overall realized market capitalization. When the ratio is low, it signifies that the general promote threat available in the market is comparatively minimal. This implies a interval of low worth realization and diminished market volatility, typically related to market consolidation and sideways traits.

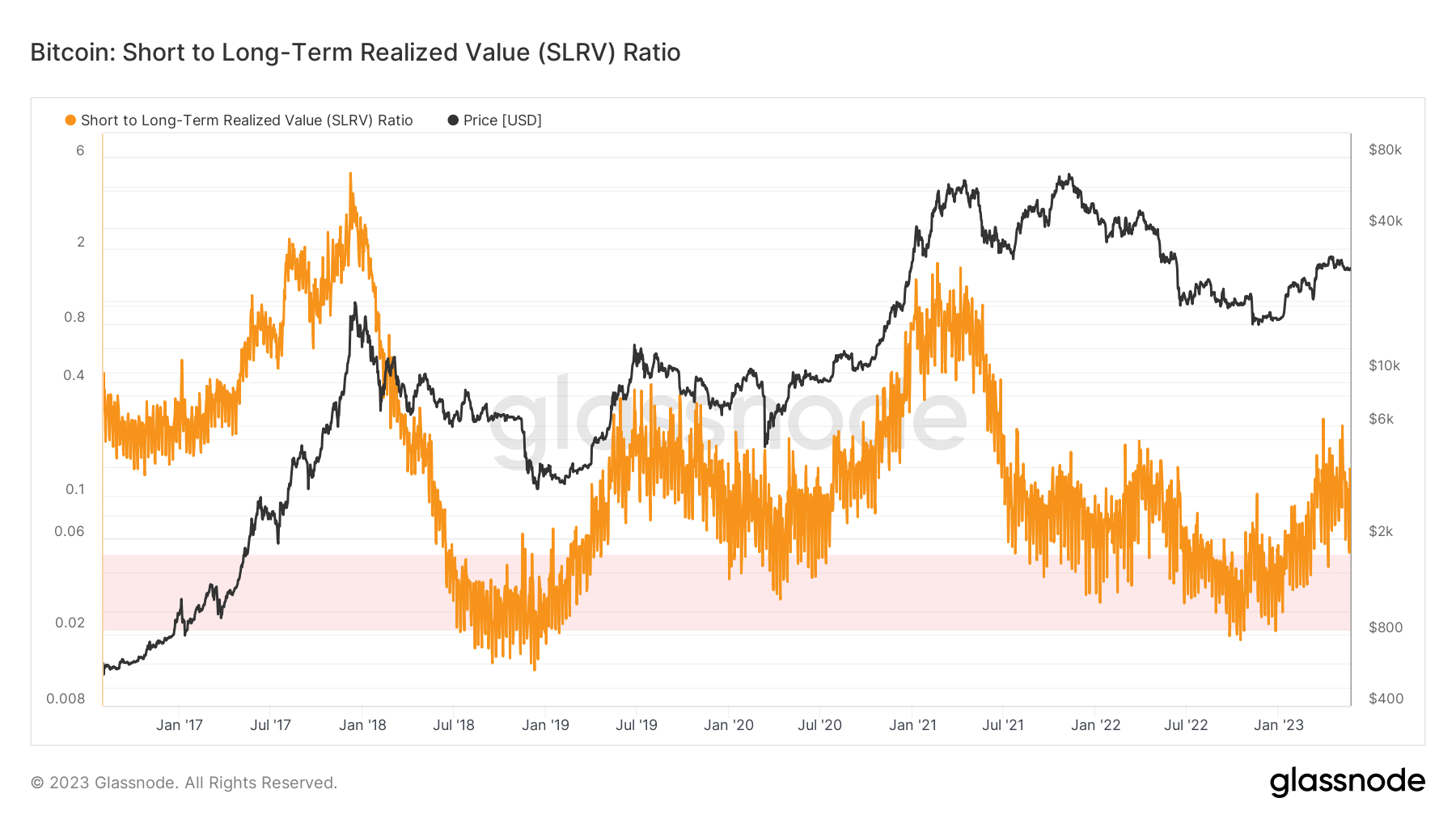

The ratio of short-term and long-term realized worth assesses short-term buying and selling exercise versus long-term holding. A low SLRV ratio suggests restricted short-term exercise and curiosity in Bitcoin or the emergence of a rising base of long-term holders. This may occasionally point out an accumulation part and a comparatively low promote threat surroundings.

A forexcryptozone evaluation earlier immediately revealed that whales holding greater than 10,000 BTC gathered for many of April and went into one other accumulation frenzy.

For the reason that starting of Might, the SLRV ratio has proven a downward pattern. That is consistent with earlier findings and additional confirms the broader market pattern of low threat promoting, creating fertile floor for accumulation.

The present state of the Bitcoin market presents an uneventful facade, however nearer evaluation of on-chain metrics reveals refined nuances that might form its future worth actions. The falling SOPR, low promote threat ratio and SLRV ratio point out a market surroundings characterised by diminished volatility, consolidation and a possible accumulation part.

Regardless of latest immobility, on-chain metrics level to potential upcoming volatility for Bitcoin appeared first on forexcryptozone.