- VeChain is displaying robust investor curiosity with 93.39% of its provide actively traded.

- Present worth motion signifies volatility, with key assist at $0.0216 for VET.

- Buying and selling quantity elevated by 2.72%, signaling bullish sentiment and potential upside momentum.

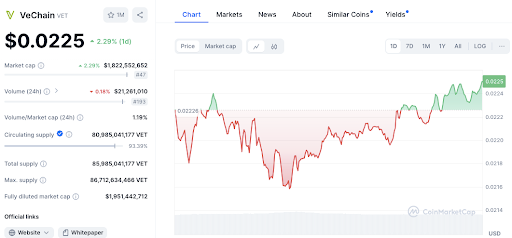

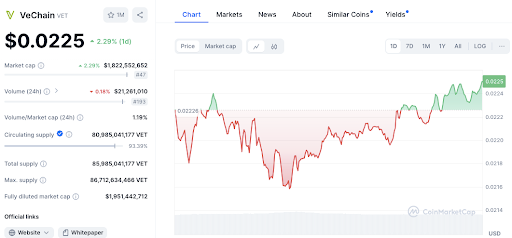

VeChain (VET) is presently buying and selling at $0.02242, up 0.70% within the final 24 hours. With a market capitalization of roughly $1.81 billion and a buying and selling quantity of roughly $21.61 million, VeChain continues to draw investor curiosity.

The value of VeChain has fluctuated within the quick time period. Earlier at the moment, VET fell under $0.0220 however rebounded to its present degree of $0.02242. These fluctuations present a market that actively reacts to varied elements.

The current decline to round $0.0216 has grow to be an important assist degree, with the worth rebounding from this level. This implies that traders view this degree as a shopping for alternative.

On the constructive aspect, VeChain is presently testing minor resistance round $0.0224. If this degree breaks out, the following essential goal may very well be round $0.0226, the place the worth final peaked. Monitoring these technical ranges is significant for anticipating potential short-term worth actions.

Analyze market sentiment and indicators

Market sentiment seems more and more bullish for VeChain, as proven by a 2.72% improve in buying and selling quantity over the previous 24 hours. This improve in quantity signifies rising market exercise and elevated purchaser curiosity, suggesting that traders are desperate to push the worth above present resistance ranges.

Additionally Learn: VeChain Value Rise: 5-Wave Impulse Sample Indicators $1 Goal

Moreover, with 93.39% of the whole provide presently in circulation, VeChain has a stable basis for worth stability. This degree of circulation signifies robust investor curiosity, as nearly all of tokens are actively traded, which may help keep away from vital worth fluctuations. Moreover, VeChain has a complete worth locked (TVL) of $486,086, additional highlighting its enchantment in decentralized finance.

Key indicators: RSI and MACD evaluation

The 1-day relative energy index (RSI) is 44.74, which exhibits that VeChain is neither overbought nor oversold. Subsequently, the asset seems to have room for additional worth actions with out dealing with an instantaneous correction. Nevertheless, the 1-day MACD is buying and selling under the sign line, suggesting potential short-term bearish momentum.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses arising from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.