- Spot BTC-ETH ETFs from Franklin Templeton and Hashdex have been authorized by the SEC.

- Bitcoin fell to $95.5k, whereas ETH dropped to $3.3k over the previous day.

- Spot BTC and ETH ETFs noticed $680 million and $60.4 million in outflows, respectively, on Thursday.

Bitcoin value fell under $100,000 after a 4% 24-hour drop, simply because the U.S. Securities and Trade Fee (SEC) gave approval to exchange-traded funds (ETFs) mixed BTC/ETH from Hashdex and Franklin Templeton. The value of Ethereum noticed an 8.4% decline throughout this era.

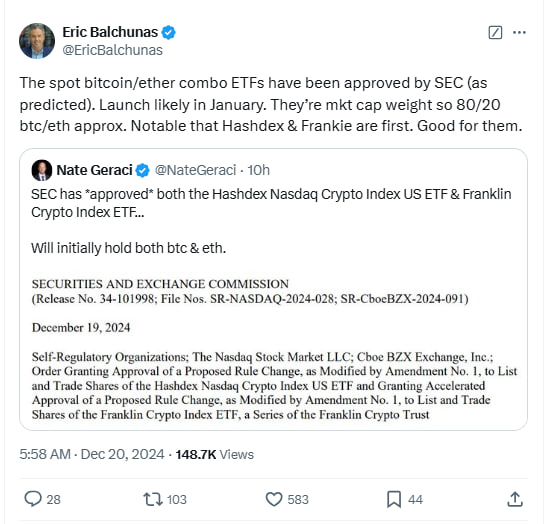

The SEC introduced on December 19 that it had approved Hashdex and Franklin Templeton to listing their BTC-ETH funding merchandise on the Nasdaq Inventory Trade and the Cboe BZX Trade. These new choices are named Nasdaq Crypto Index US ETF and Franklin Crypto Index ETF from Hashdex.

These ETFs will observe the spot costs of Bitcoin and Ether. The Franklin Templeton ETF tracks the Institutional Digital Asset Index, which displays the value actions of cryptocurrencies like BTC and ETH. The Hashdex ETF displays the US Nasdaq Crypto Settlement Worth Index.

The SEC launched a separate submitting confirming that Franklin Templeton's software had obtained “expedited” approval. Eric Balchunas, senior ETF analyst at Bloomberg, predicts that these funding merchandise may launch in January. The ETFs share substantial similarities with different Bitcoin and Ether ETPs that obtained approval earlier this 12 months.

File outflows hit BTC and ETH ETFs

Information from SoSoValue reveals that U.S. spot Bitcoin ETFs noticed a complete web outflow of $680 million on Dec. 19, marking the very best each day outflow in historical past and the primary single-day web outflow in 15 days . Spot Ethereum ETFs noticed a complete web outflow of $60.4677 million, their first web outflow in 18 days.

Additionally Learn: El Salvador Reduces Bitcoin Adoption Underneath IMF Mortgage Phrases

Bitcoin fell to $95.5,000 regardless of new ETF approvals, whereas Ethereum fell to a each day low of $3,330.87 from $3,717.66. Ethereum's buying and selling quantity elevated 11.55% to $57.8 billion, based on CoinMarketCap knowledge, however the cryptocurrency has struggled to keep up costs above $4,000 today. latest weeks.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t accountable for any losses ensuing from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.