- The LUNA crash highlights the dangers related to algorithmic stablecoins.

- The altcoin collapsed from $115 to $0, wiping $60 billion from its market worth.

- TerraUSD didn’t depend on the standard mannequin of getting bodily property as backup.

A well-known crypto researcher on X recalled the notorious occasions surrounding the LUNA crash just a few years in the past, which uncovered many crypto customers to vital losses. Introducing his thread, the researcher described the incident as a LUNA crash that shook the crypto world. He considers this a traditional case of the dangers related to algorithmic stablecoins.

In keeping with the researcher, LUNA abruptly collapsed from $115 to $0, wiping $60 billion from its market worth. One particular person misplaced virtually $10 million, highlighting the extent of potential dangers related to crypto investing.

Associated: Terraform Labs Chapter Listening to: Influence on LUNA, LUNC and USTC Costs

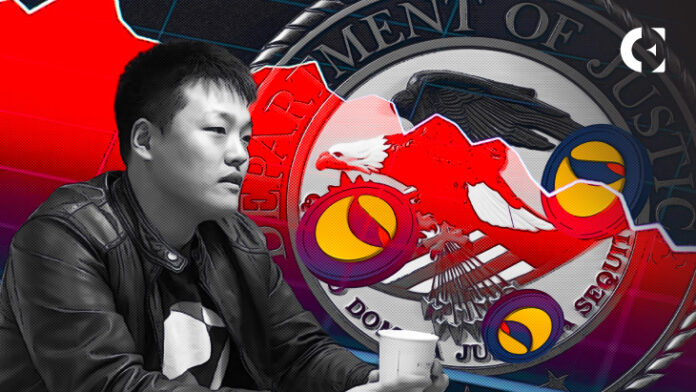

Recalling the LUNA scandal, the researcher described Terra, the infrastructure behind LUNA, as a blockchain protocol and fee platform designed for algorithmic stablecoins. Terraform Labs, co-founded by Do Kwon and Daniel Shin, launched in 2018 and was famend for UST, its Terra stablecoin and related reserve asset LUNA.

Terraform's revolutionary method has attracted a number of traders. The stablecoin answer didn’t depend on the standard mannequin of getting bodily property as backup. As an alternative, UST has maintained its worth via complicated algorithms and market mechanisms. Over time, Anchor Protocol, a DeFi answer constructed on the Terra blockchain, has change into the cornerstone of the Terra ecosystem, providing as much as 20% annual yield on UST deposits.

Associated: Montenegro Supreme Court docket to evaluate Do Kwon's extradition resolution

Anchor's answer turned engaging and attracted a good portion of UST. The protocol represented 75% of the stablecoin provide however raised considerations about its long-term viability. The protocol introduced these fears to fruition in Might 2022 after whales withdrew over $2 billion in US {dollars} and bought them in the marketplace. This triggered a depeg within the stablecoin, with the worth crashing to $0.91.

The depegging of UST led to large FUD within the Terra ecosystem, resulting in a sell-off of LUNA and the next delisting of LUNA and UST by crypto exchanges. Given these setbacks, the Terra blockchain suspended operations, triggering an ecosystem collapse that resulted in a $60 billion loss and vital authorized implications for events concerned, together with Voyager, Celsius, and Three Arrows Capital.

Different occasions following the collapse of TerraUSD concerned Kwon's arrest and imprisonment amid ongoing extradition proceedings between South Korea and the US. The researcher factors out that the UST fallout is a vital lesson for traders relating to the dangers related to algorithmic stablecoins and the attract of excessive returns.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses arising from using the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.