- Tether is changing into essentially the most safe asset within the crypto world, based on Reuters.

- Buyers are specializing in safe tokens amid the US banking disaster, the information platform shared.

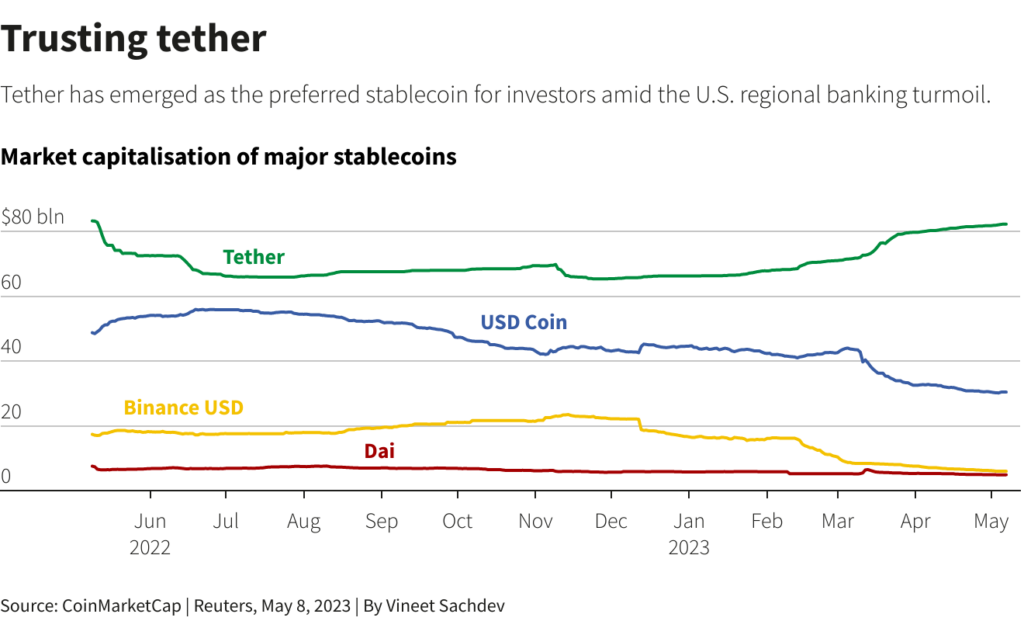

- The market worth of Tether has elevated considerably and is backed by a greenback reserve.

Tether, a digital stablecoin, is changing into essentially the most safe asset within the cryptocurrency world, Reuters reported. In line with the information launch, amid a rising banking disaster within the US and elevated regulatory scrutiny over cryptocurrency corporations, crypto traders are turning to tokens and cash which are thought of comparatively protected.

Since March, Tether, which is a stablecoin tied to a fiat foreign money such because the US greenback, has develop into the perfect performing stablecoin, with its market worth seeing a big enhance.

Moreover, Tether’s worth is backed by a reserve of {dollars} and has a hard and fast provide of round 85 billion tokens, sustaining a 1-to-1 parity with the US greenback. On account of excessive demand, the coin’s worth has remained above 1 since mid-April, reaching 1.002 final week.

Anders Kvamme Jensen, the founding father of Oslo-based international brokerage AKJ, mentioned:

The banking disaster is fueling “hyper-bitcoinization” – the inevitable endgame that the greenback will likely be nugatory.

Jensen added that this has resulted in a wave of traders turning to main cryptocurrencies similar to Bitcoin and Ether.

Secure cash like Tether are thought of a retailer of worth and a instrument for transferring funds between cryptocurrencies and are additionally used as collateral for by-product transactions. Tether’s premium value is because of rising confidence in its peg and SEC scrutiny safety.

In the meantime, Tether competitor USDC suffered losses resulting from its publicity to a failed financial institution and regulatory stress on fintech and crypto corporations. Tether is owned by iFinex Inc and is taken into account much less US-focused, decreasing regulatory danger.

Moreover, it turned the third largest token on CoinMarketCap, with a market capitalization of $82 billion and a share of 6.83%.