- The Bollinger band indicator on ChainLink (Hyperlink) is contracting by predicting {that a} main volatility part may very well be imminent.

- A excessive correlation with Bitcoin means that the hyperlink might lower extra earlier than a bull motion.

- ChainLink has skilled robust development regardless of a drop in costs with 22 new integrations.

ChainLink (Hyperlink) is a focus for retailers and analysts since its sudden drop in early February.

Since February 3, Hyperlink has anchored between $ 17 and $ 22 with indicators reporting a attainable escape in the course of the consolidation weeks.

Bollinger bands set out the signaling of a attainable rupture

One of the vital revealing indicators of an imminent value change for Chainlink was the stress in his Bollinger strips on the 12 -hour desk.

The technical indicator of Bollinger strips, which measures volatility, has grown significantly round Hyperlink's value, a mannequin that traditionally precedes the actions of the key market.

As famous by the eminent analyst Ali Martinez, this compression might imply that the hyperlink is on the purpose of a web rally or a big drop, in keeping with the subsequent market resolution.

Bollinger teams tighten on the #ChainLink $ Hyperlink 12 -hour desk, reporting {that a} excessive volatility motion may very well be imminent! pic.twitter.com/np4yjvanyk

– Ali (@ali_charts) February 17, 2025

A rise in chain buying and selling exercise (hyperlink)

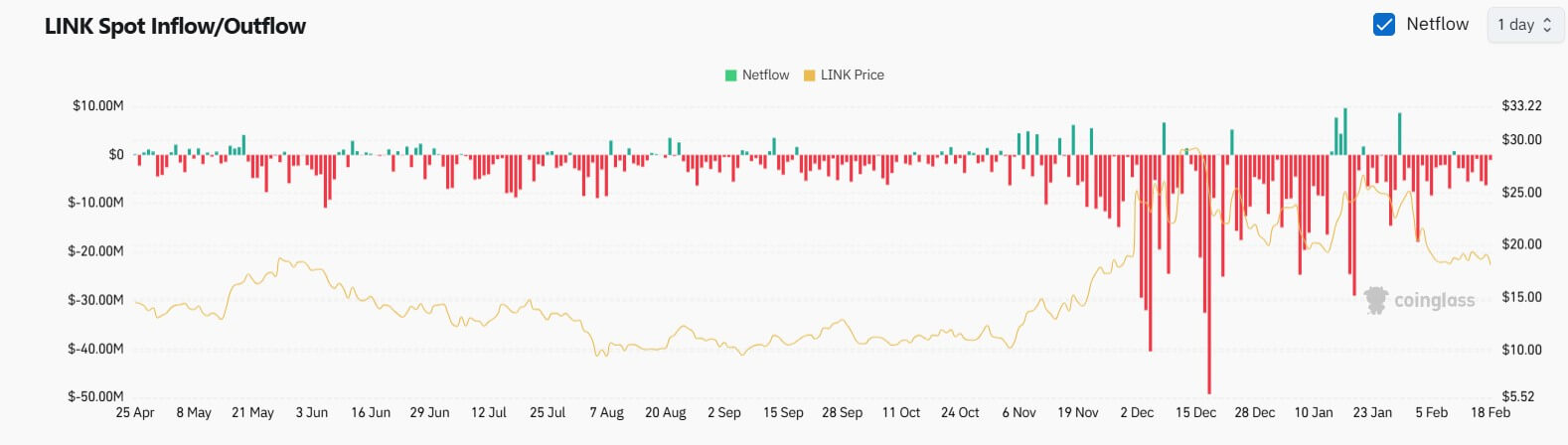

The market has additionally skilled a rise in linking exercise, with occasional entrances and outputs displaying an lively dedication to bull and reducing merchants.

Coinglass knowledge reveals fluctuations in Hyperlink's web inputs and outputs, highlighting a rise in market exercise.

This lively commerce, related to Bollinger Serre bands, means that merchants place themselves for what they consider may very well be a big market change.

Though there is a rise in market exercise, the well being metric metrics point out a 78% drop in whale transactions since November, these main holders controlling 67% of Hyperlink's provide. This discount in exercise by necessary gamers suggests cooling the acquisition stress, which might exacerbate the value motion within the quick time period within the quick time period.

Nonetheless, with 59% of holders nonetheless in revenue, there’s an underlying confidence within the basic rules of Hyperlink.

Correlation of Chainlink with Bitcoin

Curiously, ChainLink maintains a correlation of 0.97 with the Bitcoin costs actions, in keeping with the evaluation of Intotheblock.

Given the present Bitcoin trajectory, which alludes to a different correction to the extent of help of $ 92,000, Hyperlink ought to observe the plunge, doubtlessly skilled one other 30% drop above all rallying to its high of all time .

This correlation underlines the interdependence of the cryptography market, the place the principle belongings similar to Bitcoin can significantly affect the efficiency of others as Hyperlink.

Chain liaison networks development regardless of the drop in costs

Regardless of the value correction part, the ChainLink community has skilled substantial development with 22 new integrations in numerous blockchains like Arbitrum and Base. This enlargement solidifies the position of Chainlink as a frontrunner within the provide of the tokenization of lively worlds from the true world by way of its dependable oracle providers.

Dedication to interoperability and sensible use circumstances by merchandise similar to knowledge flows and transversal interoperability protocol (CCIP) suggests a sturdy base for future development.

As well as, the re-election of Donald Trump, nicknamed the primary Professional-Crypto president, might finally repel Chainlink (hyperlink) on an upward development, particularly with its steady enlargement of the community.

(Tagstotranslate) Information of Cristocape (T) Cryptocape Information Information