The Bitcoin market (BTC) took a optimistic flip in final week, rising by 1.10% in response to CoinmarketCap information. Though there are nonetheless expectations as to a brand new value correction, the results of macroeconomic developments, as we will see with the current statements by the American president Donald Trump, throw extra uncertainty on the long run trajectory of the primary cryptocurrency.

Can Bitcoin Bulls face a power check with a resistance of $ 98,000 – can they unravel?

Following a chronic market correction, Bitcoin recorded spontaneous market beneficial properties final week reaching an area peak of $ 95,000. At present, Crypto Asset is negotiated about $ 86,000 with little indication of its future motion.

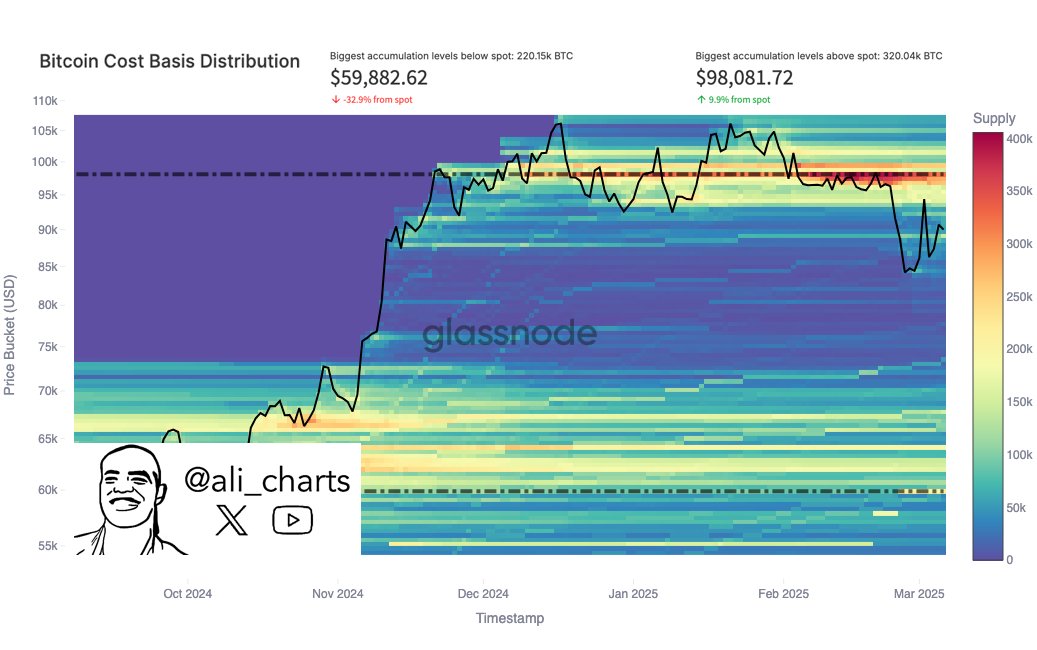

In accordance with the upper analyst of the Ali Martinez market, the motion of bitcoin costs is at present blocked between two key accumulation ranges in response to its fundamental price distribution (CBD) – Bitcoin Holdings allocation in response to the worth from which completely different buyers have acquired their BTC. The CBD helps to determine the foremost ranges of assist and resistance by displaying the place massive quantities of bitcoin have been bought or bought.

Primarily based on CBD information, Ali Martinez explains to make extra beneficial properties, Bitcoin will face key resistance at $ 98,081. This prediction stems from buyers who beforehand acquired 320,040 BTC on this value area and are prone to promote after a value rebound to depart the market with little or zero losses. Nevertheless, if Bitcoin Bulls could make enough buy stress to cross past this stage of resistance, it opens the way in which to a yield larger than $ 100,000 and maybe a brand new summit of all time.

Alternatively, if BTC resumes its correction pattern, Martinez underlines that the following important stage of assist based mostly on accumulation information is $ 59,882 throughout which 220 150 BTC had been accrued earlier than.

If Bitcoin decreases to those assist ranges, it’s prone to endure a stable rebound as a result of lengthy -term holders are prone to purchase extra BTC to defend their positions. Curiously, this evaluation aligns with different market info suggesting that the BTC is prone to endure extra correction. Nevertheless, it needs to be famous that any decisive break beneath $ 59,882 would set off an enormous quantity of panic sale.

BTC Prospect Worth

On the time of writing the editorial employees, BTC is negotiated at $ 85,995 following a minor drop of 1.98% within the final day. In the meantime, its day by day buying and selling quantity is down 6.38%, which signifies a lower in market curiosity. In the midst of Constructive occasions such because the creation of a reserve of American strategic bitcoin, the BTC market stays in a reasonably unstable state, as indicated by the larger response of the market to final week's occasions.

Star picture of Morningstar, tradingView graphic

Editorial course of As a result of the is centered on the availability of in -depth, exact and neutral content material. We affirm strict provide requirements, and every web page undergoes a diligent evaluation by our workforce of excessive -level know-how consultants and skilled editors. This course of ensures the integrity, relevance and worth of our content material for our readers.