The information exhibits that Bitcoin buyers will not be exhibiting a “purchase the dip” mentality, regardless of the cryptocurrency’s value seeing current success.

The Bitcoin market exhibits little interest in shopping for this dip

In keeping with knowledge from the on-chain analytics firm Sanimentthe kind of FUD presently current within the Bitcoin market has traditionally offered good alternatives for the asset.

The indicator of curiosity right here is “social quantity”, which measures the full quantity of textual content paperwork on social media which can be presently speaking a couple of given matter or time period (just like the identify of a cryptocurrency) .

The textual content paperwork listed here are a group of textual content posts that Santiment has gathered from some fashionable social media web sites reminiscent of Reddit, Twitter, and Telegram.

To know if one in all these messages talks a couple of topic or not, the metric performs a verify towards the time period and finds if there may be a minimum of one point out current in stated doc.

The requirement of being a single point out implies that posts that comprise the time period a number of instances nonetheless have the identical weight as those who accomplish that solely as soon as. The reasoning behind this restriction is that it gives a extra correct illustration of the market development, as a couple of customers can not simply skew the determine.

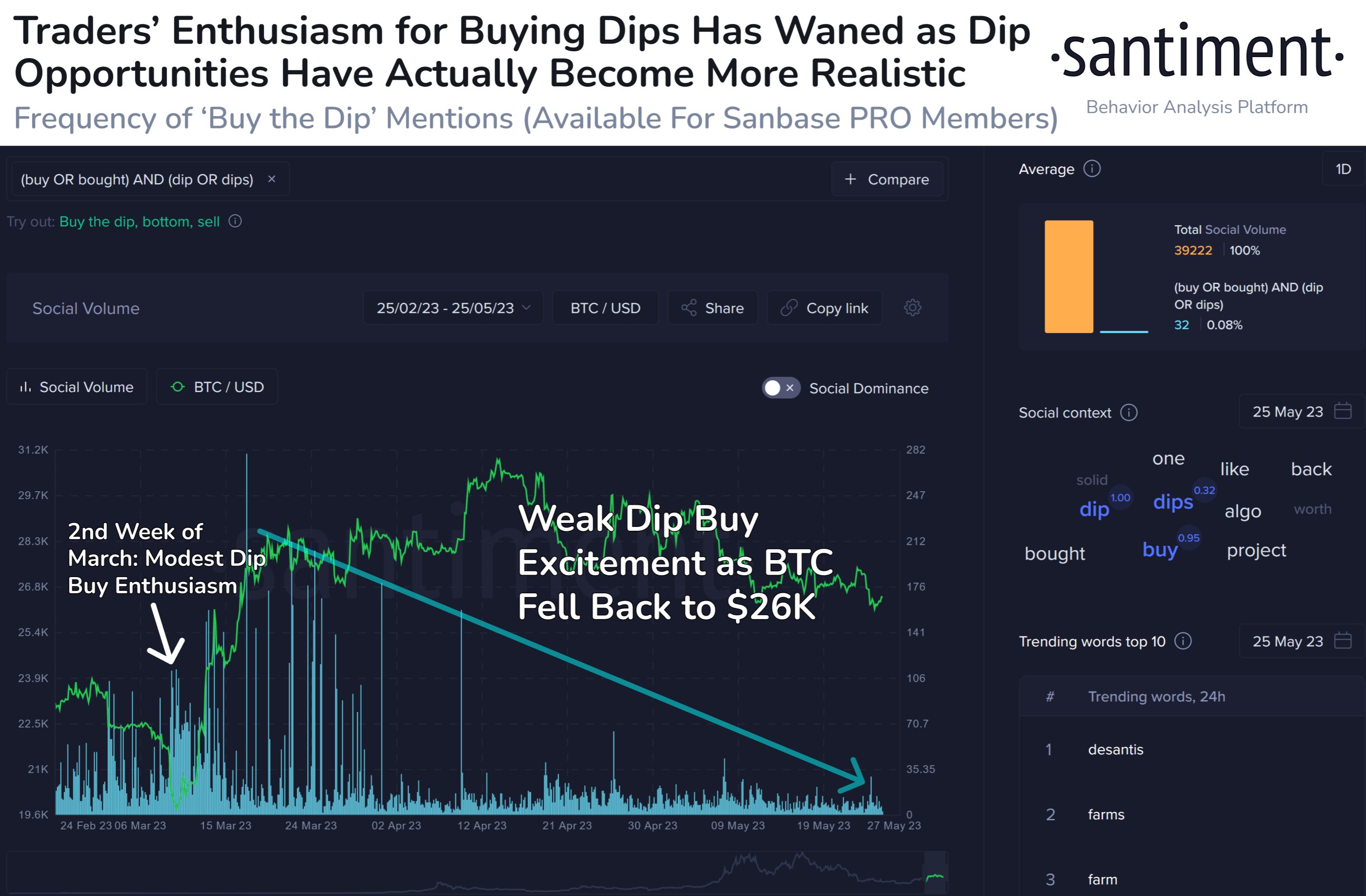

Now, this is a chart that exhibits how a lot of the cryptocurrency’s whole social quantity (i.e. industry-related threads) is contributed by dip-related threads:

The worth of the metric appears to have declined in current weeks | Supply: Santiment on Twitter

As seen within the chart above, the social quantity of phrases associated to the purchase dip has just lately declined, regardless of the value of Bitcoin seeing a decline under the $27,000 stage.

In March, when the asset dipped under the $20,000 stage, the worth of the indicator noticed some spikes, however they had been nonetheless solely at reasonable ranges. When the value rallied and had a robust rally, that is when the metric began to surge.

This might recommend that there was little enthusiasm out there when the precise formation of the underside passed off, whereas the hurdles within the rally had been hailed because the time to purchase.

Lots of the spikes additionally occurred when this leg of the rally broke above the $28,000 stage, which means the value was going towards the gang mentality on this occasion.

Traditionally, Bitcoin has usually grow to be extra prone to transfer within the course the bulk doesn’t anticipate, the extra the bulk predicts the opposite course.

Provided that the social quantity of those draw back associated phrases has remained low throughout the current value decline, it seems that buyers are afraid to purchase at present ranges.

“We see the frequent paradox of merchants who purchase small value dips within the quick time period, however are afraid to purchase the larger ones in the long term,” Santiment notes. “Traditionally, such a FUD has been good to capitalize on.”

BTC value

As of this writing, Bitcoin is buying and selling round $26,400, down 1% up to now week.

Appears to be like like BTC continues to be caught within the low $26,000 ranges | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.web