- The Federal Reserve Financial institution of Chicago publishes a letter on the 2022 crypto cycles.

- The financial institution’s letter covers particulars of main crypto platforms that crashed in 2022.

- Collapsed corporations embrace Celsius, Voyager Digital, BlockFi, Genesis and FTX.

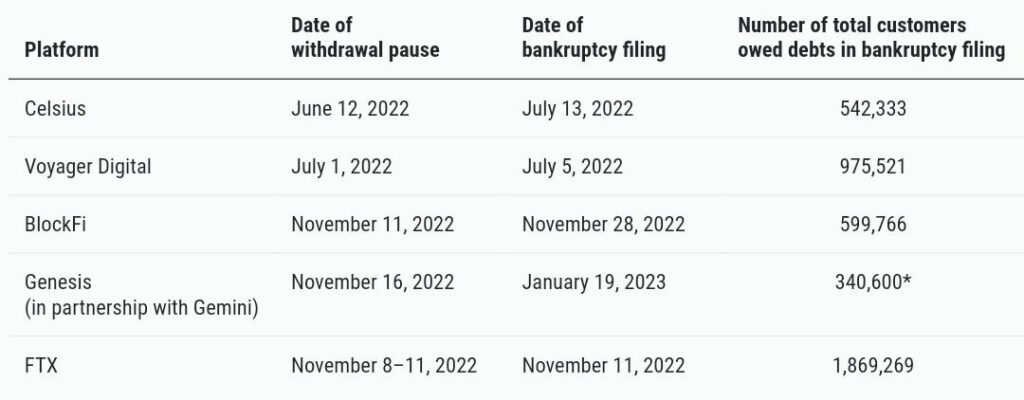

The Federal Reserve Financial institution of Chicago (Chicago Fed) launched a letter combining main crypto trades that passed off in 2022. The financial institution highlighted attention-grabbing background, information, and when these corporations filed for chapter. The letter walks customers by way of Celsius, Voyager Digital, BlockFi, Genesis, and FTX.

The Chicago Fed talked about that on account of large consumer withdrawals and funding losses, a number of crypto-asset platforms skilled a big decline in 2022. These platforms supplied a variety of merchandise and cryptocurrency-related providers, reminiscent of custody, buying and selling and high-yield investments. .

Nevertheless, the Chicago Fed talked about that since clients might withdraw cash at any time when they needed whereas the platforms used it for speculative and harmful investments, their enterprise fashions had been in danger. A big incident involving purchasers withdrawing 1 / 4 of their cash in a single day occurred on the FTX platform.

Promise of excessive yield funding merchandise

Prospects of those platforms have been significantly interested in high-yield funding merchandise. Purchasers in search of profitable returns had been interested in them as a result of they promised increased assured rates of interest than these supplied by standard funding selections.

The principle funding choices included stablecoins and non-stable cryptoassets, with rates of interest starting from 7.4% to 9%. Even increased than typical rates of interest had been supplied by some platforms on a number of of the lesser-known crypto-assets they traded.

What went incorrect?

Examination of chapter data revealed details about buyer withdrawals from different platforms. The failure of Three Arrows Capital (3AC) and the collapse of the stablecoin TerraUSD are among the many major causes of crypto executions.

Prospects rapidly withdrew their cash to keep away from potential losses. The platforms’ publicity to 3AC, which had lent billions of {dollars} to the hedge fund, was a serious supply of contagion. The large consumer outflows following the chapter of FTX in November 2022 have aggravated the liquidity issues of those platforms.

Chicago Fed information reveals there have been $1.4 billion and $0.58 billion in Celsius withdrawals between Might 9 and June 12, 2022. The very best withdrawals had been seen by FTX from November 6-11, 2022, with over $7.81 billion.

Regulatory motion is urgently wanted, as evidenced by the numerous incidence of crypto-asset platforms collapsing in 2022.

Talking of regulatory oversight, the Chicago Fed mentioned:

“The platforms’ providing of high-yield funding merchandise has been underneath regulatory scrutiny since at the very least 2021, when Coinbase introduced it obtained a warning from the U.S. Securities and Alternate Fee (SEC) {that a} potential funding product might be a safety.”

A unstable environment susceptible to panics and monetary crises has been produced by the dearth of deposit insurance coverage and the attract of excessive yield investments. To guard buyers and protect the steadiness of the crypto-asset market, policymakers should deal with these points.