An evaluation of the newest crypto information and costs concerning IOTA (MIOTA), Avalanche (AVAX) and Stellar (XLM).

IOTA, Avalanche and Stellar crypto property intimately

It needs to be talked about that IOTA is an open supply mission, which consists of a cryptographic, next-generation token, already distributed, subsequently not exploitable.

Avalanche is a decentralized open-source proof-of-stake blockchain with sensible contract performance.

Stellar, however, is an open-source foreign money alternate protocol based in early 2014 by Jed McCaleb and Joyce Kim.

IOTA: the brand new Coordicide replace

IOTA, a DLT mission with a improvement middle in Berlin, had excessive hopes for an progressive “Web of Issues” resolution and large worth positive aspects sooner or later after an enormous ramp-up in late 2017.

Ultimately, every little thing went fallacious and the mission got here to a halt: most traders needed to watch the value of IOTA crash since then. Nevertheless, at this time IOTA with a brand new decentralization referred to as “Coordination“ may trigger its worth to blow up.

The Coordicide replace is actually a IOTA 2.0 replace, an important step of which is the decentralization of the community. Certainly, the central coordinator of the Tangle was a giant drawback for IOTA, which needed to be eliminated over time.

At present, no date has been set for the whole closure of the central coordinator. To this point, Coordicide continues to be being examined within the shimmer check community; if these are profitable, it could quickly be the best time for the mission.

THE “Stardust” replace is designed to encourage using sensible contracts. Moreover, Shimmer additionally assessments the connection to the Ethereum digital machine (EVM).

The crypto neighborhood round IOTA, which has been anticipating the Coordicide replace for a number of months, stays optimistic that the mission will quickly have the ability to ship on the lofty guarantees made 5 years in the past.

IOTA, with its decentralization and excessive scalability offered by Tangle, is ready to be some of the thrilling tasks of 2023.

In reality, throughout the subsequent bull market, the value of MIOTA may rise additional, given {that a} bear market explosion appears unlikely.

Nevertheless, IOTA might carry out higher sooner or later throughout bullish phases. In any case, it’s tough to foretell whether or not the value will attain its all-time excessive once more from the start of 2018.

Rising Demand for Avalanche (AVAX) Crypto Subnets: Larger Increase than IOTA and Stellar?

Based on current knowledge, the demand for Avalanche subnets has grown quickly in 2023. In reality, the NFT buying and selling quantity hit its highest degree in a yr.

The Avalanche (AVAX) ecosystem has grown considerably for the reason that begin of 2023, and the rise in community improvement exercise is a testomony to this.

Based on a tweet from an analyst, the variety of lively builders working underneath numerous contracts topped 60 in March, the very best year-over-year. Because it reads:

An excessive amount of crypto fade $AVAX and the robust narrative on which it’s primarily based:

– Rising improvement (Hypersdk)

– Partnerships with main video games and AWS

– To develop $BTC.b deposits

– C chain progress

– Enlargement in Layer Zero OTF and CosmosFade at your individual threat. 🔺🧪 pic.twitter.com/Oy0R7XuuJQ

— Emperor Osmo🧪 (@Flowslikeosmo) March 18, 2023

Subnets are Avalanche’s most well-liked scaling resolution as a result of they permit customers to construct and run their very own blockchain networks. Based on Avalanche explorer, there are presently roughly 56 subnets on the Avalanche community.

GameFi has turn out to be one of many quickest rising areas of the Avalanche ecosystem. The platform has lately entered into excessive profile partnerships to extend its attraction within the play-to-win panorama.

Blockchains, or application-specific subnets, are an important incentive for gaming platforms, comparable to utilizing a local token for transaction charges, which may in the end decrease the price of gaming .

Final month, Avalanche introduced a partnership with the Indian streaming platform Locomotive to launch a “Loco Legends” NFT recreation market utilizing its subnets.

The platform has additionally partnered with Japanese gaming pioneer GRE earlier this month, which selected Avalanche due to its experience within the Web3 world.

Moreover, blockchain-based video games on the platform have seen promising progress. Based on DappRadar, prime video games comparable to DeFi Kingdoms, Pizza Recreation, and Avaxtars noticed weekly progress of 19.5%, 5.48% and 211.7% of their distinctive lively customers.

Zoom on the value of Stellar (XLM): upward development?

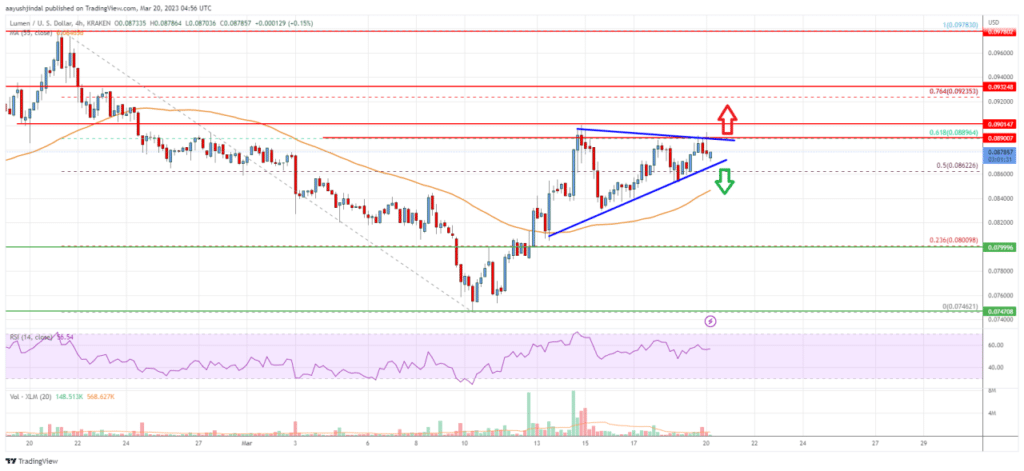

Stellar (XLM) worth is dealing with vital resistance close to the $0.090 zone in opposition to the US greenback. In reality, XLM worth is now buying and selling above $0.082 and the 55 easy transferring common (4-hours).

Moreover, a key contract triangle is forming with resistance close to $0.0890 on the 4-hours chart. The pair may begin an honest rise if it breaks by means of the $0.0890 and $0.090 resistance ranges.

Subsequently, XLM worth should keep above the $0.084 assist to rise additional, and the XLM/EUR pair broke the $0.080 resistance zone to enter a constructive zone.

Bullish merchants pushed the value above the 50% Fib retracement degree of the primary decline from the $0.0978 excessive to $0.0746 low. On the upside, the value faces resistance close to the $0.0890 space.

It’s subsequently near the 61.8% Fib retracement degree of the primary decline from the $0.0978 excessive to $0.0746 low. Turning to the important thing contraction triangle, we see that the following main resistance is close to the $0.0900 degree.

A transparent transfer above the $0.0900 degree may ship the value in direction of the $0.0932 degree. Additional positive aspects may drive the value down. $0.1000 degree and even $0.1020 within the subsequent few days.

Preliminary assist on the draw back is close to the $0.0865 degree. The following main assist is close to the $0.0840 degree, whereas the most important assist is close to the $0.0800 space.

Additional losses may take the value in direction of the short-term degree of $0.0745, under which the value may even retest $0.0720 within the coming days.