- Santiment tweeted its newest Litecoin (LTC) information report yesterday.

- The report means that the introduction of LTC20 brought on a rise within the variety of micro LTC addresses.

- At press time, LTC was buying and selling at $80.33 after gaining 2.66% within the earlier 24 hours.

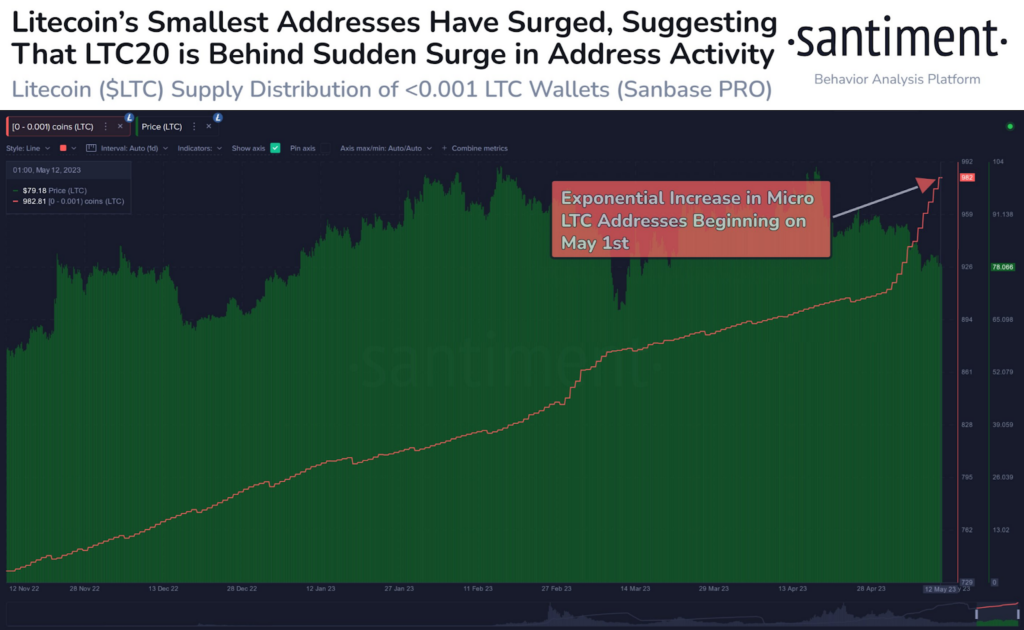

Blockchain intelligence agency Santiment has shared its newest Litecoin (LTC) info report in a Tweeter yesterday. The discharge follows the large spike in lively addresses on the Litecoin community and comes 3 months forward of the community’s subsequent halving occasion in August.

This spike in lively addresses in the end led to a rise in community exercise, in addition to a shift in provide distribution, the tweet added. Particularly, there was an exponential improve in micro LTC addresses, that are addresses with lower than 0.001 LTC, since Might 1, 2023.

In its report, Santiment attributed the rise of micro-wallets on the Litecoin community to the introduction of LTC20 – an experimental normal for non-fungible tokens (NFTs). This assumption was made contemplating that the rise in lively addresses on the community occurred at a time when LTC20 was a trending subject inside the LTC neighborhood.

At press time, LTC was buying and selling at $80.33 after a 2.66% 24-hour acquire based on CoinMarketCap. The altcoin was additionally in a position to outperform Bitcoin (BTC) and appreciated by 0.48% in opposition to the market chief. Sadly, LTC was outperformed by Ethereum (ETH) and fell 0.39% in opposition to the main altcoin.

LTC was additionally buying and selling close to its each day excessive of $80.74, suggesting that LTC worth may print a brand new each day excessive within the following hours. In the meantime, its 24-hour low was $77.85. With its market capitalization of round $5.85 billion, LTC was ranked the thirteenth largest undertaking. This put it behind TRON (TRX) and forward of Binance USD (BUSD).

Disclaimer: Views and opinions, in addition to all info shared on this worth evaluation, are revealed in good religion. Readers ought to do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be held accountable for any direct or oblique injury or loss.