The entire worth of locked belongings (TVL) on liquid staking protocols is near that of decentralized exchanges (DEX), in keeping with knowledge from Defilama.

The 81 liquid staking protocols tracked by DeFillama have a cumulative TVL of $19.31 billion – Lido being the dominant participant within the trade.

In the meantime, the entire worth of belongings locked on 799 DEX protocols stands at $19.48 billion, in keeping with knowledge from DeFillama.

Patrick, DeFi analyst underline that the “turnaround” might occur any day.

Liquid staking protocols permit customers to earn staking rewards whereas offering them with liquidity for different crypto-based actions. Examples of this protocol embrace Lido, Frax Ether, Rocket Pool, and so on.

Earlier within the 12 months, liquid staking protocols grew to become the second largest DeFi class once they usurped the lending protocols class. On the time, there was large curiosity in liquid staking protocols because of the deliberate improve of Shapella.

Liquid staking protocols enhance after Shapella

Because the Shappella improve, the highest 10 liquid staking protocols have seen their TVL enhance by a median of 10% over the previous seven days. For context, the variety of Staked Ethereum on Lido (LDO) crossed 6 million – value $12.93 billion – on April 18, in keeping with knowledge from DeFillama.

by forexcryptozone the info helps the rising worth of liquid staking platforms. Based on the info, the market capitalization of trade protocols has grown to $4.44 billion previously seven days.

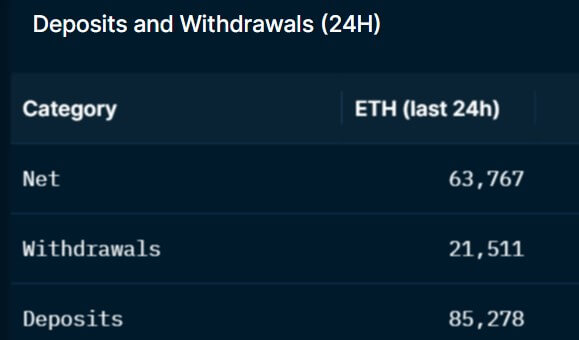

The dashboard from blockchain analytics agency Nansen confirmed extra Ethereum being deposited than withdrawn for the primary time for the reason that community accomplished the Shapella improve.

Based on the dashboard, greater than 85,000 ETH had been deposited within the final 24 hours, whereas lower than 22,000 ETH had been withdrawn in the identical interval.

In the meantime, blockchain analyst Lookonchain reported that some addresses withdrawing their staked ETH re-staked them instantly. Chain sleuth reported two whales which have staked over 50,000 ETH tokens by the liquid staking protocol, Agility.

Publish-Liquid TVL staking protocols might “reverse” TVL DEXs rapidly appeared first on forexcryptozone.