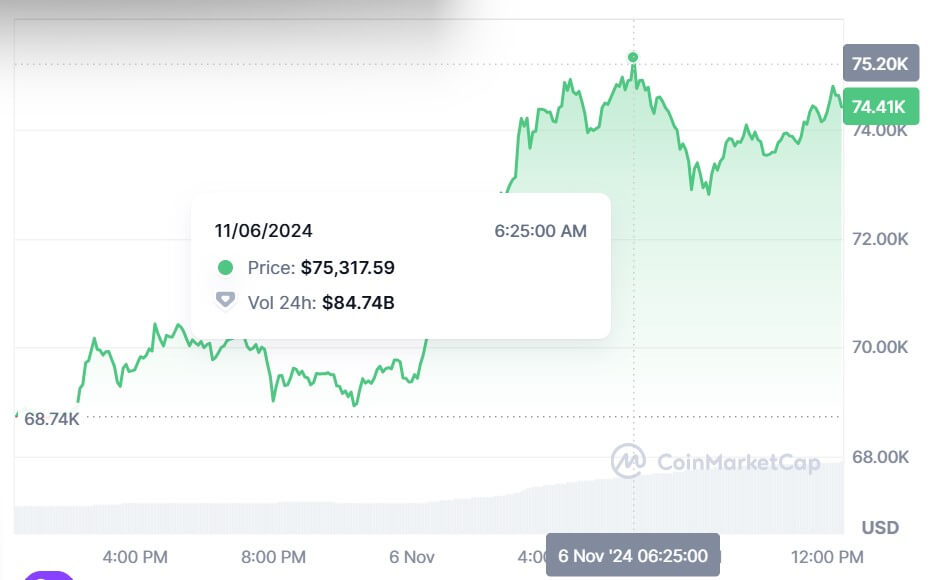

- Bitcoin hit a excessive of $75,317 early this morning.

- In September, Bernstein analysts predicted that Bitcoin would attain between $80,000 and $90,000 by the tip of 2024 if Trump gained.

- Unity's COO instructed CoinJournal that it was “deceptive” to say that Trump's victory within the US election was the one purpose why the value of Bitcoin elevated.

Bitcoin hit an all-time excessive of over $75,000 early this morning as voting outcomes signaled Donald Trump's victory within the White Home.

Information from CoinMarketCap exhibits that Bitcoin hit a excessive of $75,317 round 6:25 a.m. this morning. Earlier than the election outcomes have been introduced final night time, Bitcoin was buying and selling at round $69,000.

Nonetheless, because the night progressed and into the early morning, Bitcoin continued its upward trajectory earlier than reaching its new all-time excessive.

Bitcoin's final all-time excessive was in March, when it hit $73,000.

AP Information knowledge exhibits Trump gained 277 of the election outcomes, in comparison with 224 for Vice President and presidential candidate Kamala Harris.

Will the value rise proceed?

As this new excessive comes amid the US election outcomes, many are questioning if this upward motion will proceed. In September, Bernstein analysts predicted that Bitcoin might attain between $80,000 and $90,000 by the tip of 2024 if Trump wins the presidential election.

In line with James Toldeano, COO of self-custody pockets Unity, folks want to know that knowledge based mostly on the 2012, 2016, and 2020 US elections don’t reveal constant patterns for the crypto market relating to election outcomes.

“Some appeared on the 2020 election and noticed the value bounce from $13,760 earlier than the November 1 election to $19,698 after the December 1 election, and instantly claimed it was the election that led to the rise,” Toldeano instructed forexcryptozone.

In actuality, Toldeano added, a number of elements have contributed to the value rise, together with US stimulus funds, rising curiosity from corporations like MicroStrategy in shopping for Bitcoin, and other people viewing Bitcoin as a protected funding throughout the Covid pandemic.

“Though the elections passed off at the moment, it’s disingenuous to say that they immediately triggered the value rise,” he stated.

In the long run, it gained't be the election that strikes the crypto market, however “broader macroeconomic occasions, technological developments, a shift in market sentiment, and elements past the following president's management,” defined Toldeano.

Professional-crypto

Former US President Donald Trump was discovered to be extra supportive of cryptocurrencies than Harris.

Final Might, Trump promised that if re-elected, he would free Ross Ulbricht, the creator of the Silk Highway. Ulbricht has already served 11 years in jail. In August, Trump additionally promised to make America the “crypto capital of the planet.”

In September, Trump turned the primary US president to make use of the Bitcoin community. He achieved this after sending a Bitcoin transaction to PubKey, a crypto-themed bar in New York Metropolis earlier than his marketing campaign rally on Lengthy Island.

Alternatively, Harris has remained mum on her stance on crypto, though she has acknowledged that her administration would assist a crypto regulatory framework if she turns into the following US president.

“The brand new President Trump has the ability to save lots of crypto in the US the place pressing change is required,” Jesper Johansen, CEO and founding father of Northstake, an Ethereum staking market, instructed forexcryptozone.

“The primary precedence of the brand new administration ought to be to outline staking as a chance for American buyers,” Johansen continued. “The query stays: is staking a commodity or a safety?

Johansen stated $6 billion is in Ethereum exchange-traded funds (ETFs), which aren’t staked, which means buyers are lacking out on financial alternatives. In line with Johansen, this could possibly be one of many explanation why the adoption of Ethereum ETFs has not been as well-liked as that of Bitcoin ETFs.

“As soon as these elementary points are resolved, modifications are wanted inside the SEC to make sure that crypto is considered as a automobile for innovation, slightly than one thing to be feared,” he added.

Earlier than the election, Trump introduced that he would take away Gary Gensler, chairman of the US Securities and Change Fee (SEC); Nonetheless, it stays to be seen whether or not it will occur, because the SEC is an unbiased federal company.

On the time of publication, Bitcoin is buying and selling at round $74,000.