- Bybit hacks fears in regards to the vulnerabilities of centralized exchanges security

- The commerce charges of US President Donald Trump improve the uncertainty of the market

- Trump's crypto guarantees might have began to be nice, however they might finally turn into catastrophic

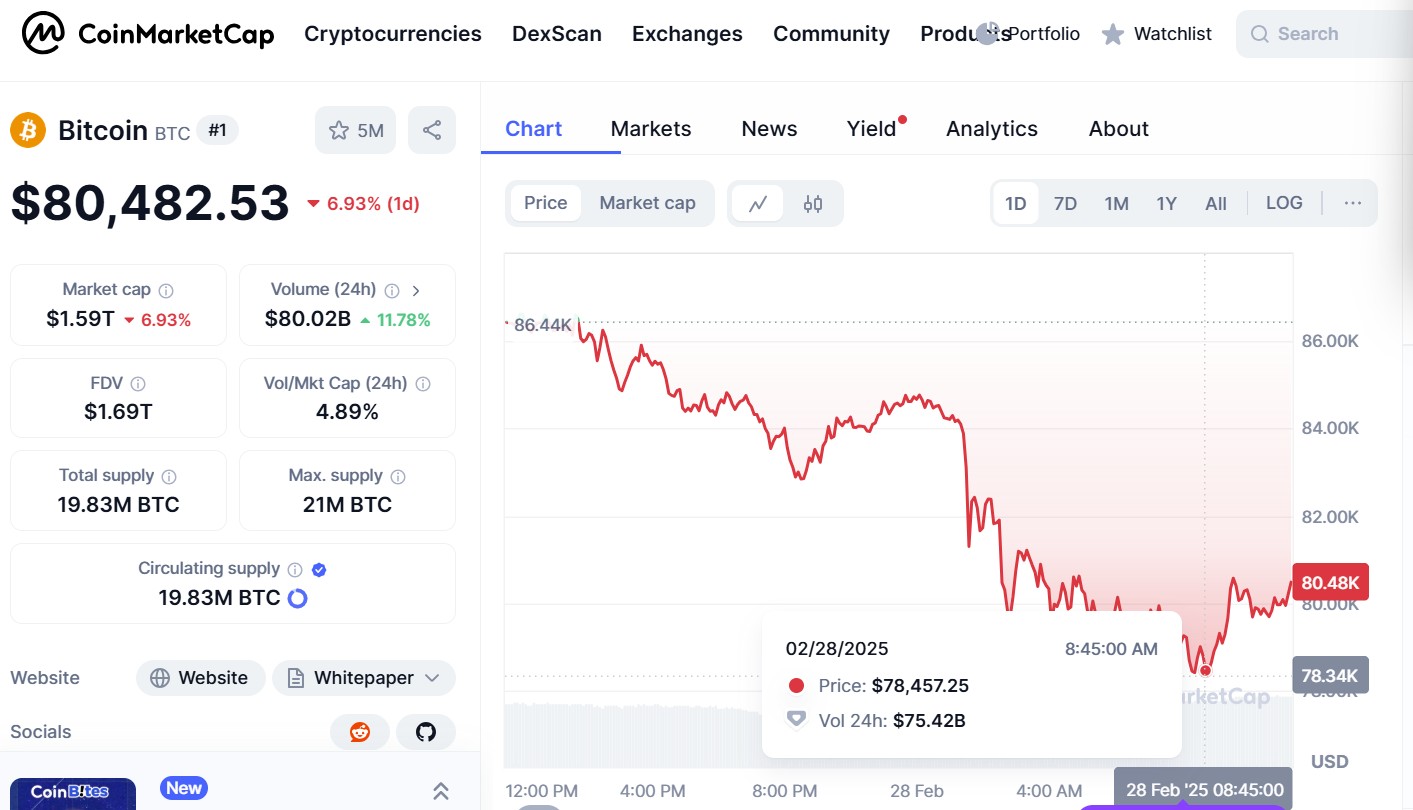

Three issues contribute to the autumn within the costs of cryptography, which noticed Bitcoin fall from 7.50% over 24 hours to $ 78,000, in keeping with the COO of Unity Pockets.

It is a important drop within the summit of all Bitcoin, which reached $ 109,000 in January inauguration of US President Donald Trump.

In response to James Toledano, plainly optimism across the post-electoral crypto market has created a bubble and that “post-breach actuality now settles-and tough,” he stated to forexcryptozone.

Within the opinion of Toledano, bybit's hacking on the Crypto Alternate final Friday – which led to the flight of practically $ 1.5 billion in Ethereum – is without doubt one of the contributory components affecting the cryptography costs.

Propulating buyers' confidence has led to panic withdrawals and a market -scale sale in all areas. Whereas the CEO of Bybit, Ben Zhou, rapidly responded to piracy, the scenario elevated “fears regarding the vulnerabilities of centralized exchanges – which solely solidifies the case for self -discussion companies”, continued Toledano.

Dom Harz, co-founder of Bob (“Construct on Bitcoin”), a layer 2 hybrid, stated that forexcryptozone The flight to Bybit is a “gross reminder of the elemental issues of the business”, including:

“We had been hypnotized by value ideas, so -called frenzy and media glasses, forgetting that crypto was presupposed to be a brand new monetary system – a foundation on decentralized protocols that make funds accessible to all. Bybit simply gave us a reminder of $ 1.5 billion that we’re removed from this actuality. »»

Trump costs

The continual market sale follows the announcement of Trump's gross sales price earlier this week.

Throughout his electoral marketing campaign, the American president made guarantees regarding the crypto, declaring that America would be the “cryptographic capital of the planet”.

Since getting into the White Home, he has appointed pro-Crypto people to reshape authorities companies, specifically Paul Akins as an incoming president of the American securities fee and trade (sec).

Mark Uyeda is at the moment the appearing president of the dry.

Trump additionally signed an govt decree to ascertain a cryptographic working group to supply regulatory readability. The working group can also be anticipated to look at the potential of a nationwide crypto inventory.

Nevertheless, regardless of these levels, Trump's commerce wars – which might quickly hit the EU, the most important business block on the planet, with a value of 25% – is an growing uncertainty of the market.

In response to Toledano, Trump's costs “hurt the world financial system” and that many in cryptographic house really feel dissatisfied by the American president.

“The promise was nice and the fact seems to be doubtlessly catastrophic,” he added. “It makes me ask me if Trump understands that the monetary verticals are linked and an increasing number of convergent.”

Most necessary financial danger

The third contributing issue affecting market costs – in keeping with Toledano – are questions across the total governance of america.

An article by Chatham Home means that the best financial danger of the presidency of Trump is a lack of confidence in American governance. He reads

“I’m hardly ever frightened by the summits and the hollows introduced by the crypto, however after I mix what is occurring with the standard volatility of actions, I feel there are considerations in the meanwhile,” stated Toledano.

(Tagstotranslate) Bitcoin Information (T) Donald Trump (T) Traffs Industrial