The current collapse of Silicon Valley Financial institution (SVB) and USD Coin (USDC) has dampened the hype round non-fungible tokens (NFTs) whereas benefiting decentralized finance (DeFi) exercise, such because the current DappRadar report revealed.

Over the weekend of March 11-12, DeFi buying and selling quantity topped $58 billion throughout all platforms – whereas March 11 noticed the bottom variety of energetic NFT merchants since November 2021, in response to the DappRadar report.

DeFi surge

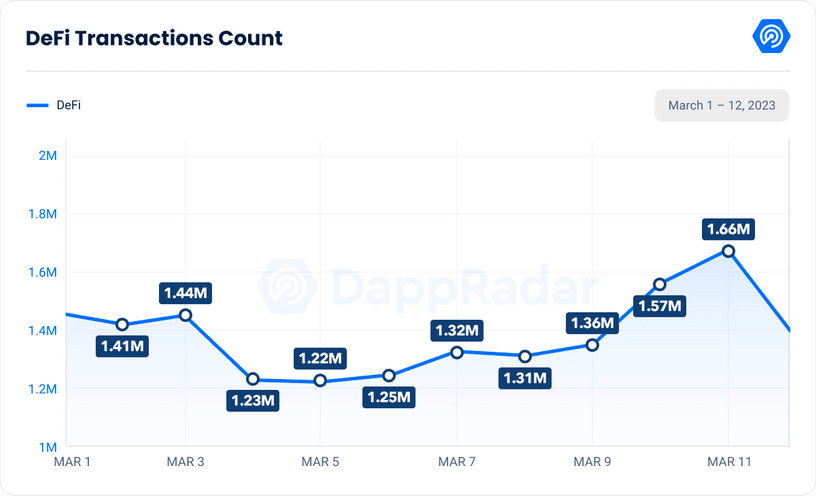

On March 11, after the SVB crash and USDC pullout, the overall worth locked (TVL) in DeFi fell to $71.61 billion from $79.28 billion, a lower of 9, 6%. The variety of transactions additionally elevated by 23%, from 1.3 million to 1.6 million.

After SVB’s USDC reserves have been made accessible to the general public on March 13, the DeFi market additionally stabilized and led DeFi TVL to succeed in $81.15 billion, marking a peak of 13%.

The variety of Distinctive Energetic Wallets (UAWs) interacting throughout DeFi protocols additionally noticed a 13% enhance between March 8 and March 11, from 421,026 to 477,094.

DeFi winners

Of all of the DeFi protocols, Uniswap (UNI) turned the one which noticed essentially the most vital enhance in UAW numbers – whereas 1inch Community (1INCH) gained on the commerce quantity entrance.

Uniswap’s UAW rose to 67,000 on March 11 from 54,000 on March 10, marking a 24% enhance. Its buying and selling quantity additionally recorded a 96% enhance to $14.4 billion on March 11 from $7.34 billion on March 10.

1inch Community, however, noticed a 304% progress in its transaction quantity to $3.46 billion on March 11 from $855 million recorded on March 10. day — marking a rise of 11%.

NFT

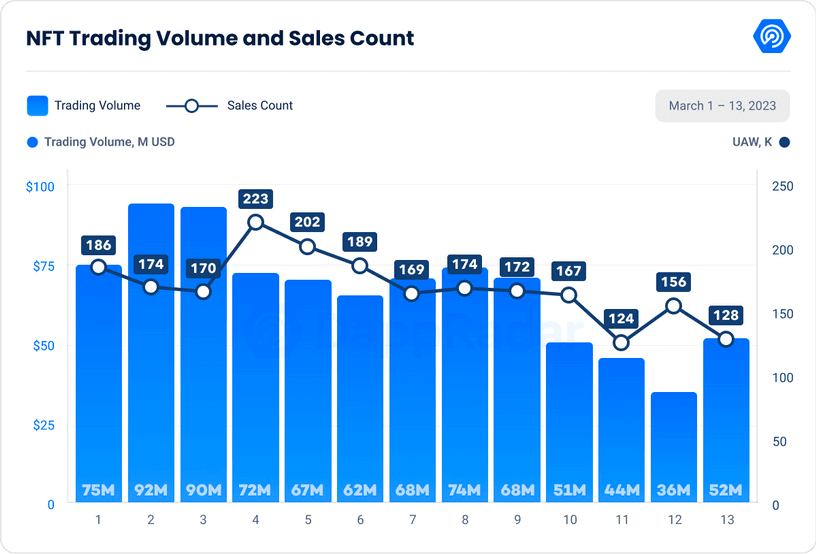

The NFT market has seen spectacular progress over the previous few months. The NFT sphere maintained its resilience by way of the coldest winter in crypto historical past and managed to completely return to pre-Luna crash ranges in February.

Nonetheless, the NFT sphere has been affected by the US banking turmoil. NFT buying and selling quantity has seen a 51% decline since early March, falling to 128,000 at present from 156,000 in February.

The variety of energetic NFT merchants was recorded at 12,000, which is the bottom since November 2021. It additionally recorded the bottom variety of transactions in a single day of the 12 months, at 33,112 transactions.

Curiously, the banking turmoil didn’t have an effect on NFT buying and selling quantity as a lot as dealer exercise. The report justified this contradiction by stating that Ethereum (ETH) NFT whales continued to rise throughout Blur Season 2.