Analyzing flows between miners and exchanges is essential to understanding market sentiment, particularly in the case of assessing whether or not miners are liquidating or accumulating. A rise in Bitcoin flows to exchanges has traditionally preceded a rise in promote orders, typically inflicting costs to fall as promoting stress builds.

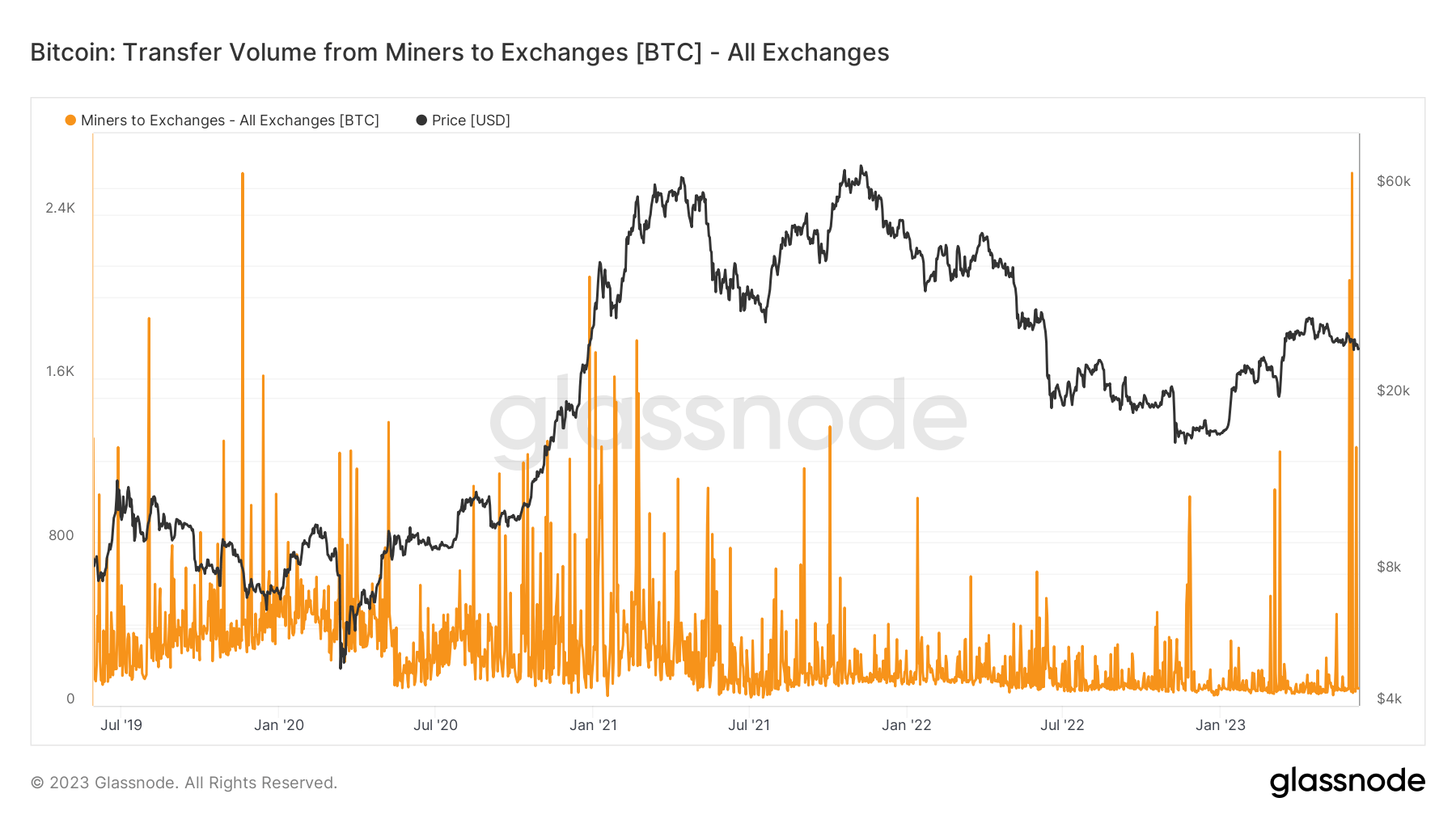

On June 3, miners transferred an enormous quantity of BTC to exchanges, sparking a market-wide debate concerning the supply of those inflows and their potential affect in the marketplace. Information from Glassnode confirmed simply over 2,606 BTC was transferred on June 3, making it the very best switch since March 26, 2019. On the time, miners had been sending over 4,083 BTC to scholarships.

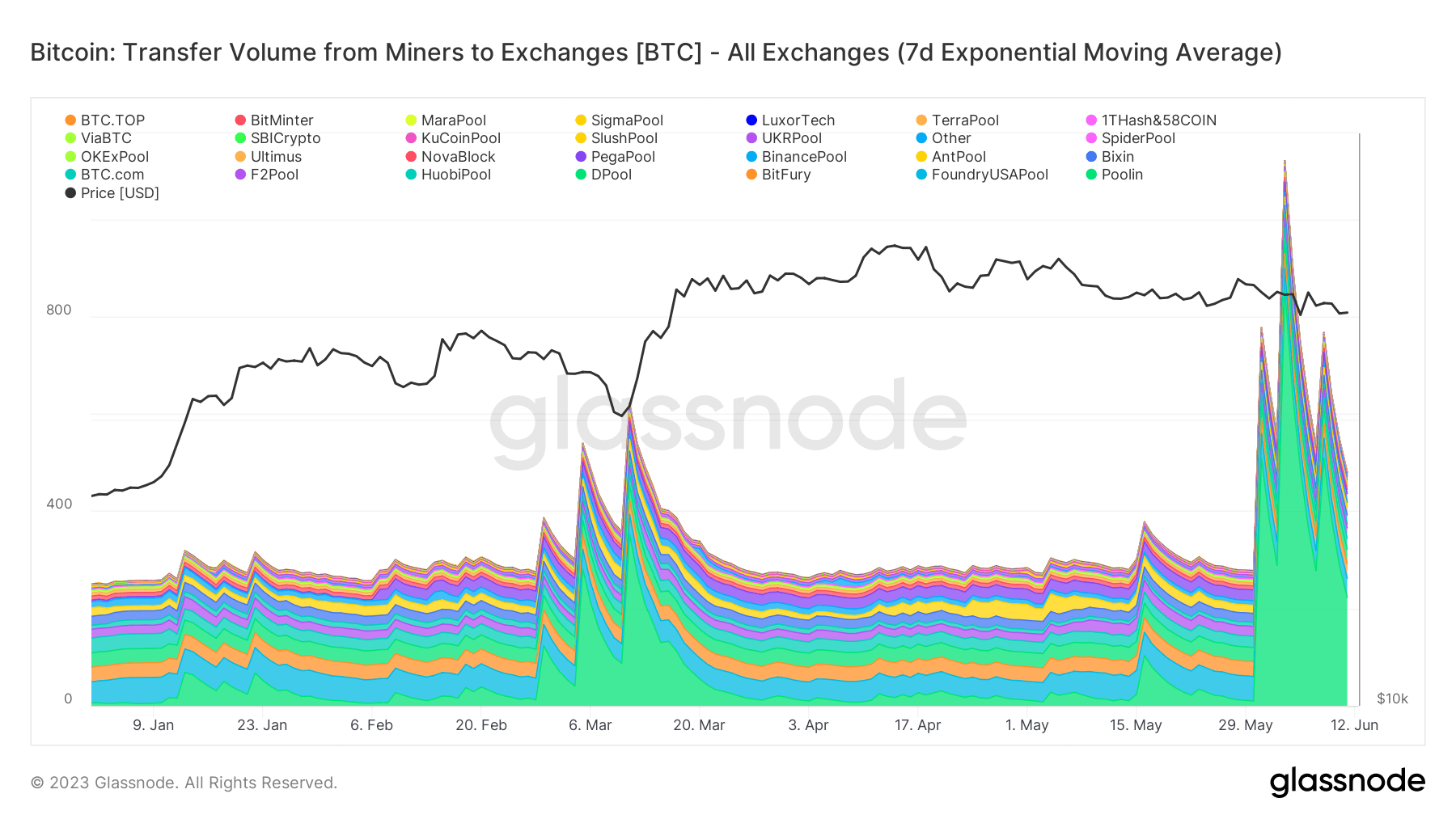

forexcryptozone The evaluation revealed that the principle driver of the mass exodus was Poolin, one of many largest mining swimming pools out there. A couple of third of all Bitcoin transferred from miners to exchanges on June 3 may be attributed to Poolin, because the pool transferred 853.4 BTC.

The transfer is not an remoted occasion – it is a continuation of a Poolin development that began in late Could.

Since Could 31, Poolin has despatched a mean of 433.5 BTC to exchanges every day, culminating with the big outflow on June 3. For comparability, the second largest contributor, Foundry USA, transferred 45.5 BTC on the identical day and maintained day by day switch quantity. between 40 and 50 BTC for the reason that finish of Could.

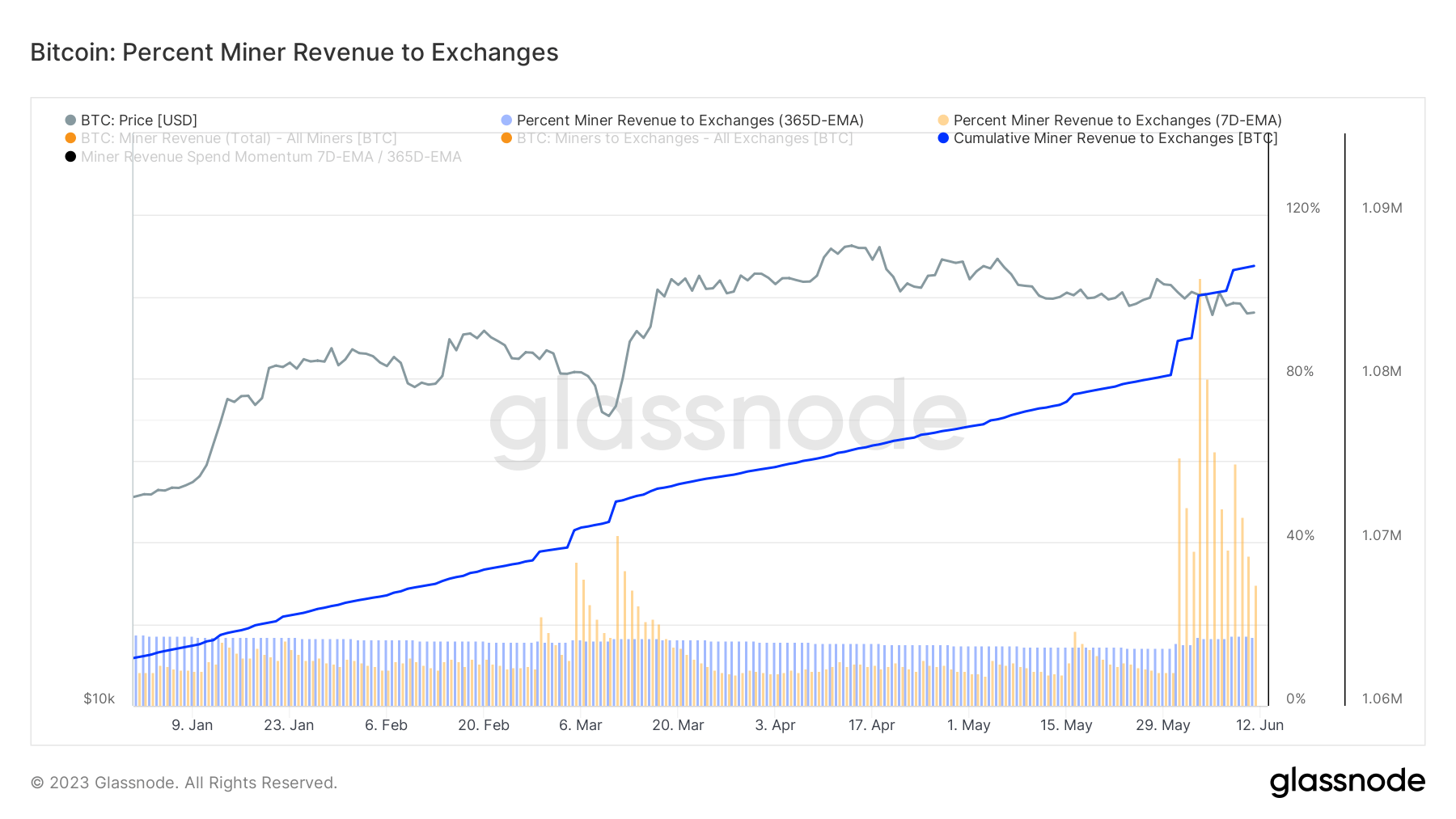

The rise in miner transfers has led to a pointy improve within the proportion of miner earnings despatched to exchanges. forexcryptozone The evaluation revealed that the 7-day exponential shifting common (EMA) of miner earnings to exchanges reached 104.5% on June 3.

An EMA is an important monetary metric that provides extra weight to latest information, smoothing the info line and revealing development adjustments extra successfully. This EMA worth is the very best recorded since November 17, 2014, when it reached 131.7%.

The value of Bitcoin has remained comparatively steady, hovering between $26,800 and $27,300 from Could 31 to June 4. The sharp drop on June 5 was extra probably a response to information concerning the SEC lawsuit in opposition to Binance and Coinbase quite than elevated promoting stress on the alternate from miners, as the worth rebounded inside 24 hours.

This implies that miners could select to liquidate their cash through over-the-counter (OTC) strategies or maintain them on exchanges in anticipation of extra favorable market circumstances.

The put up What is going on on behind the scenes of the mass youngster exodus in June? appeared first on forexcryptozone.