- In eight years, Bitcoin has generated returns exceeding seven instances these of gold and eight instances these of shares.

- DCA (greenback price averaging) is an effective choice for inexperienced persons and specialists alike, however it’s not with out its flaws.

- That is the popular funding technique for almost all of crypto traders, with 59% utilizing it as their main method.

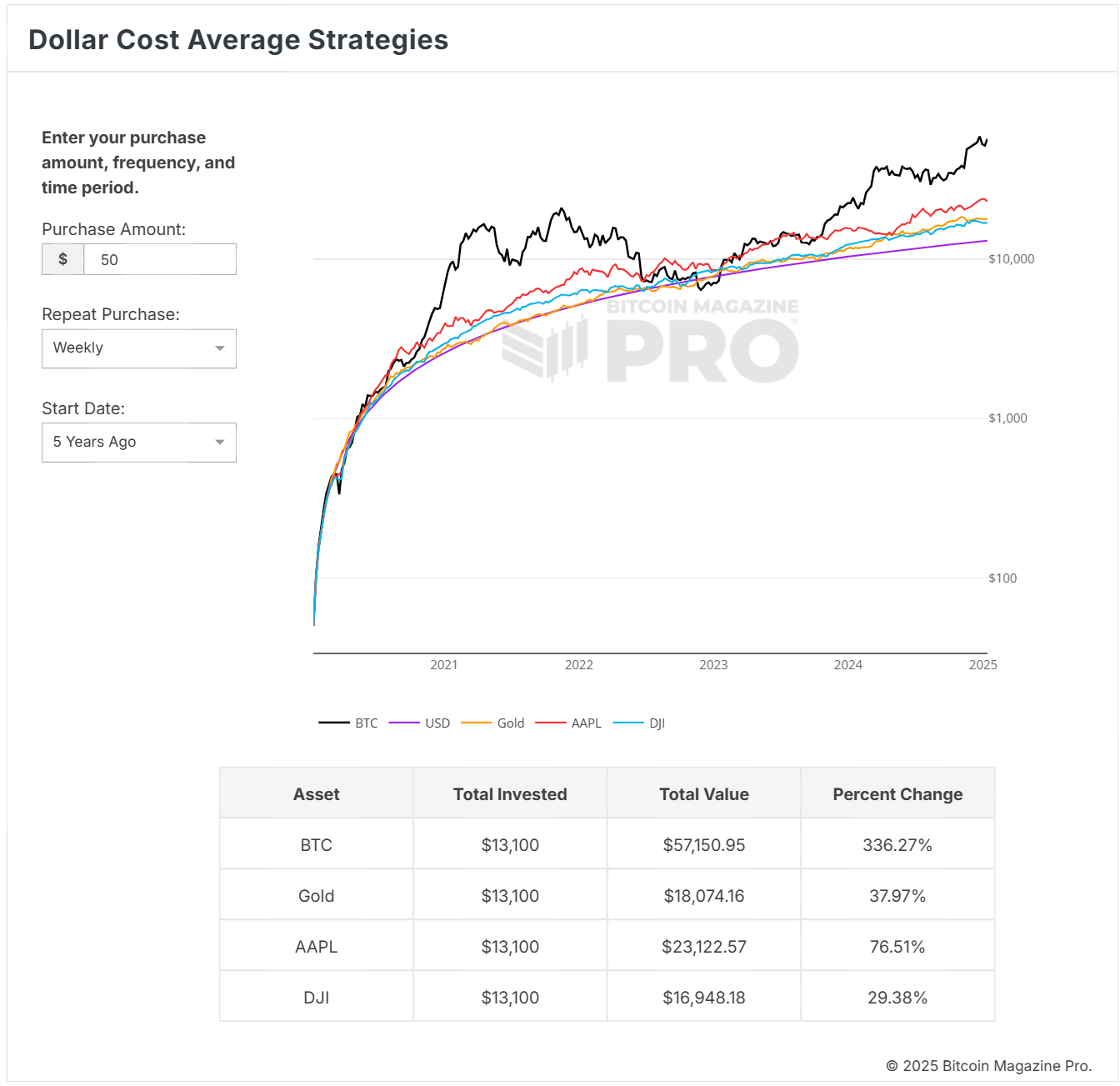

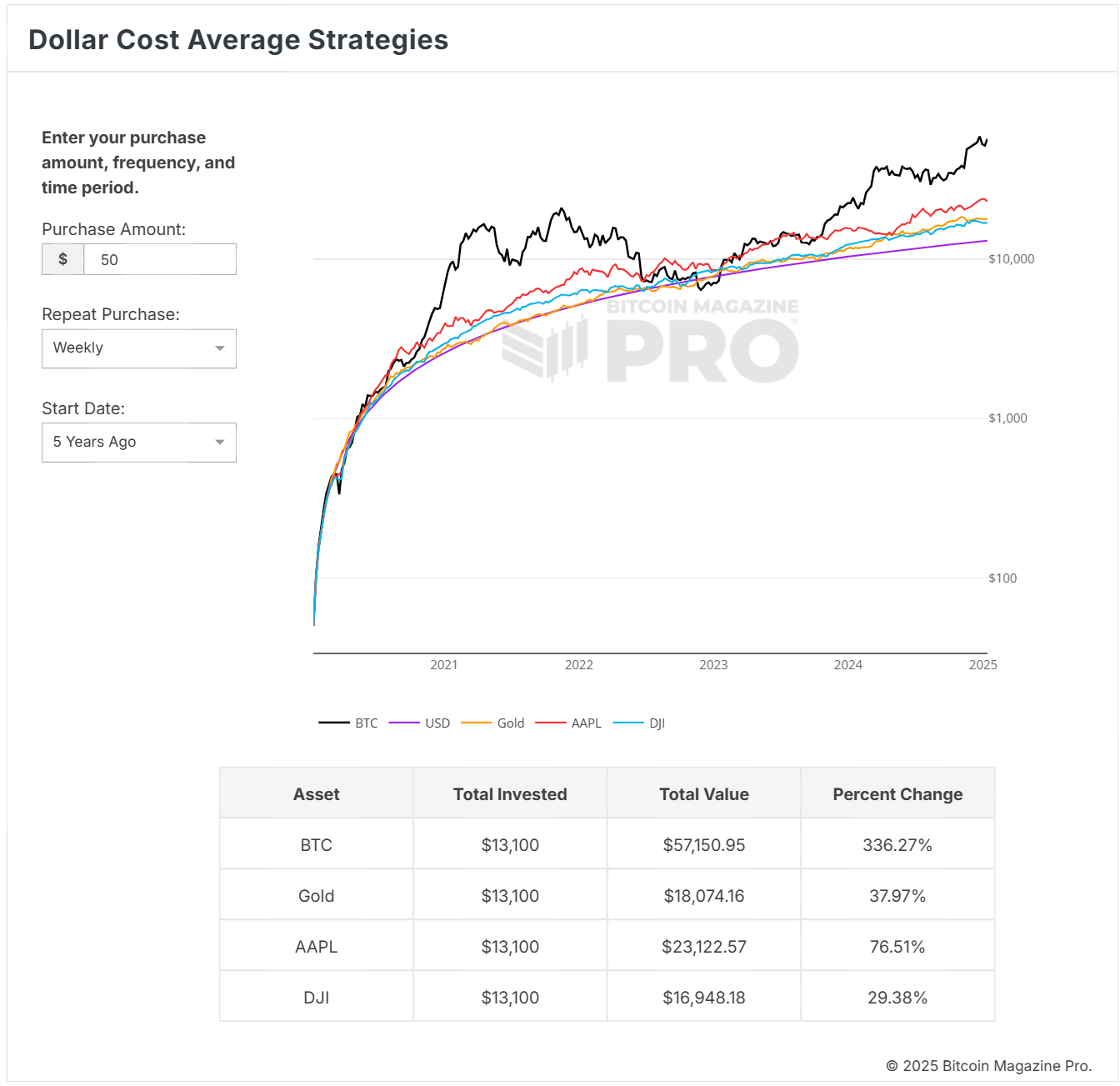

With the value of Bitcoin hovering round 93,000, there isn’t a scarcity of conversations about its ever-increasing worth. What should you joined us in 2017 and DCAed (systematically make investments a predetermined sum of money in a particular asset, no matter its present market worth) $25 per week?

Spoiler alert: you’ll have some huge cash now. Furthermore, throughout these 8 years, Bitcoin would surpass gold and shares by way of return on funding.

Let's break it down. As of 2017, should you spent $25 per week on DCA, you’ll now have an funding of roughly $10,450. As such, your funding would yield roughly $16,946.00 in gold or roughly $15,358.23 in shares.

Nonetheless, for Bitcoin, that may be a whopping $133,689.39! That is 8 instances greater than the return on shares and seven instances greater than that of gold. Though it is a hypothetical state of affairs, it exhibits the big development of Bitcoin over time and the potential of greenback price averaging.

If you wish to see for your self and mess around with completely different time frames and funding ranges, try this chart right here.

What’s DCA used for?

The first use of DCA is to cut back market volatility, as investing a set quantity at common intervals helps mitigate the impression of market fluctuations.

It is usually appropriate for inexperienced persons as a result of it simplifies investing, making it accessible even to those that would not have intensive market information or expertise. Moreover, DCA eliminates the necessity for fixed market monitoring and obsession with whether or not the market is doing effectively.

As such, it has develop into a preferred technique, with final yr's survey exhibiting {that a} important 59% of crypto traders prioritize price averaging as their main funding technique.

Observe, nonetheless, that DCA presents no ensures of any form and it’s possible you’ll miss out on greater returns if the market rises constantly throughout your funding interval. So it's not for everybody.

That being stated, should you determine to experiment with DCA in crypto, begin by deciding on the cryptocurrency during which you want to make investments. Then set up your funding funds and the frequency of your contributions. Moreover, you’ll want to conduct an intensive evaluation of your monetary state of affairs, in addition to any needed analysis.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t liable for any losses ensuing from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.