- XRP is acting at a mediocre stage, with ups and downs right here and there.

- XRP recovers every crash with a peak of greater than 10%, suggesting one other peak.

- Bollinger bands might slim and market volatility might lower.

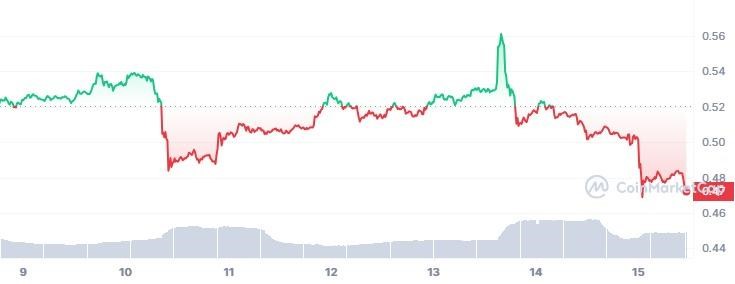

XRP has carried out poorly given its value swings over the previous seven days. It had its ups and downs in swing. Nonetheless, though the climb was powerful, typically XRP’s crashes had been brutal and vertical.

Trying on the chart beneath, XRP began the earlier week with a gap market value of $0.5203. Moreover, the token was capable of commerce above its opening value on June 9 and mid-June 10. Nonetheless, it was not lengthy earlier than XRP moved from $0.5357 to $0.4869 on the identical day, getting into the pink zone.

After spending greater than a day within the pink zone, XRP briefly entered the inexperienced zone with a peak. However his momentum was subdued by the bears. Nonetheless, the bulls had been sturdy on this event as they didn’t enable the token to sink deep into the pink zone. Consequently, XRP was just under the floor of the inexperienced zone.

On June 13, XRP broke above the pink zone from $0.5144 to a weekly excessive of $0.5611. This XRP rally was short-lived because the token began to stoop once more beneath the market open value.

After falling from the $0.52 stage, XRP is at the moment beneath the bear strongholds at $0.4708, additional dealing with the deeper pink zone.

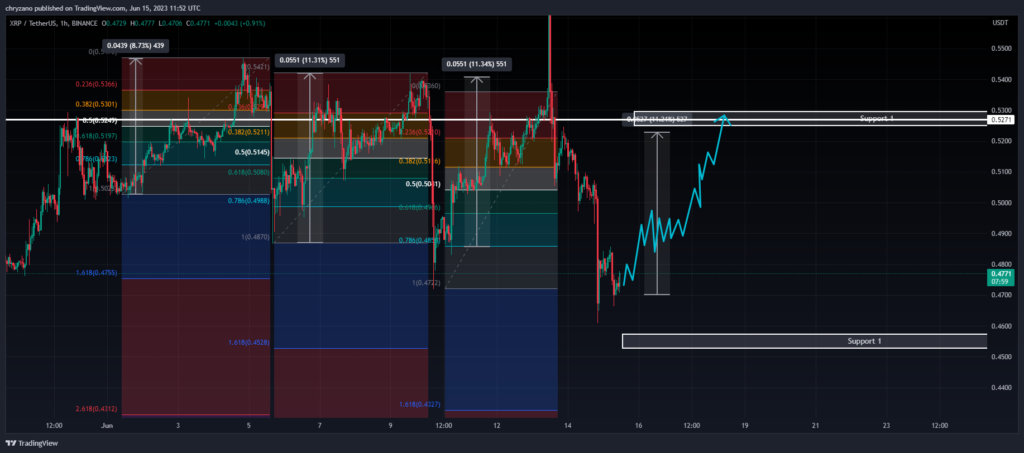

Given the above, the fib retracement exhibits how XRP rose after every crash. Moreover, by evaluating the angles of the trendlines for XRP with the horizontal axis, we are able to see that they’re growing. Every of those value will increase has a push of roughly greater than 10%. As such, if XRP follows the downward and upward pattern, it might be time for XRP to rise once more.

If XRP follows this sample, one would anticipate it to rise greater than 10%. Merchants trying to go lengthy might wish to enter the market as situations look favorable for a push.

For instance, XRP is at the moment retracing after touching the decrease Bollinger band, indicating a possible ascent in the direction of resistance 1 at $0.5271. In the meantime, the Bollinger Bandwidth indicator on the backside of the chart is shifting down. This implies that bandwidth might proceed to shrink and there could also be much less volatility available in the market within the coming days.

Consumers may have to think about having their entry level close to the easy shifting common of the Bollinger Band. The thesis above could possibly be supported by the truth that XRP beforehand rose when it broke above the center band.

Disclaimer: The views, opinions and knowledge shared on this value prediction are printed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at his personal threat. Coin Version and its associates won’t be responsible for any direct or oblique damages or losses.