Premium Bitcoin (BTC) buying and selling on Binance.US is a symptom of an illiquid market and never proof that market makers are leaving the platform, based on blockchain analytics agency Kaiko.

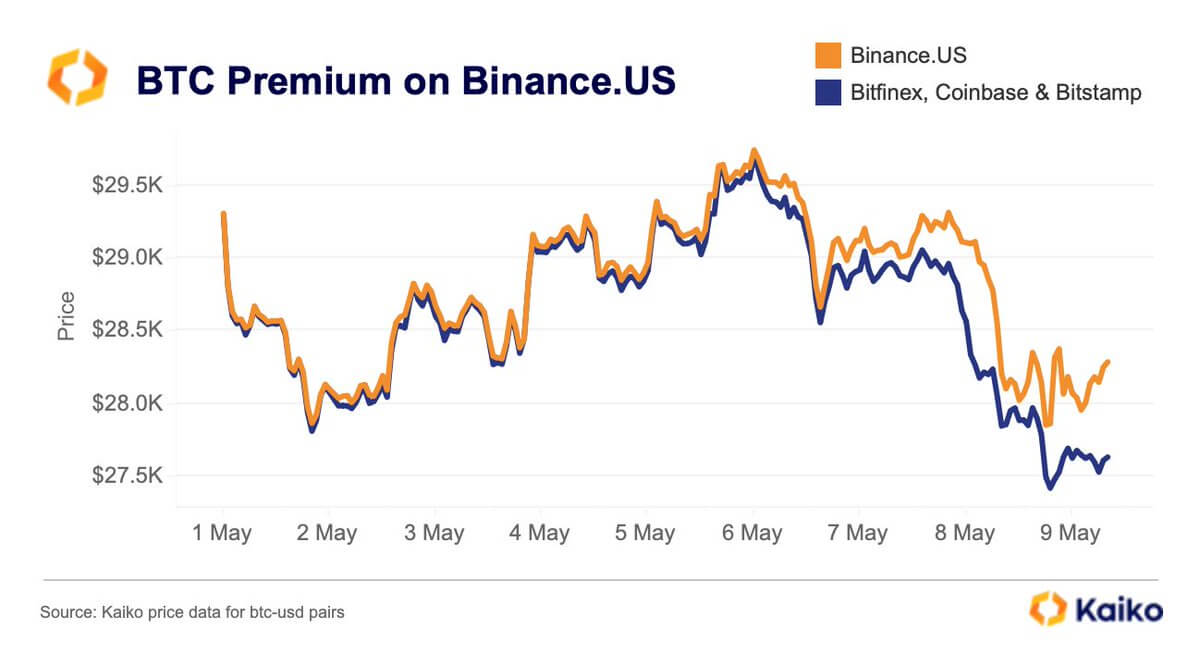

In its Could 9 report, the information aggregator defined why the flagship digital asset trades at a 2.5% premium on Binance.US in comparison with different US-based exchanges.

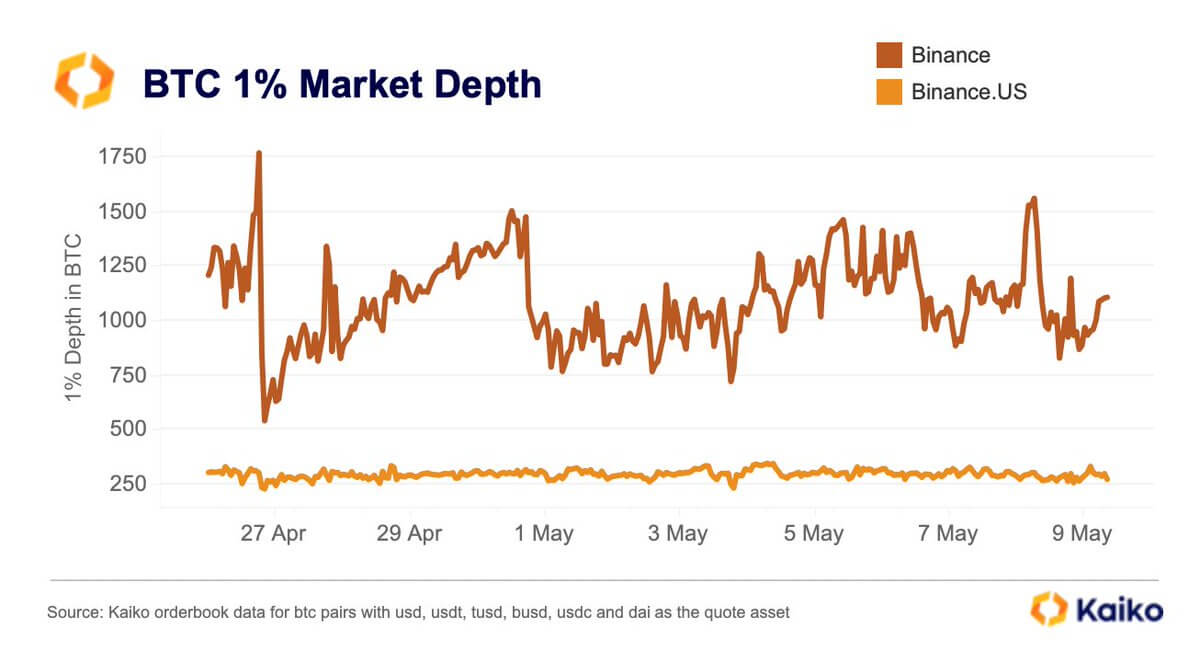

In line with the corporate, hypothesis that market makers would possibly depart the platform have been simply mere rumors as there is no such thing as a change in its market depth.

Since April, a number of members of the crypto group have Underline the rise in premium BTC buying and selling on the platform – many inferring that market makers and insiders may depart resulting from potential authorized motion.

Nevertheless, Kaiko dismissed these claims noting that the inventory market’s struggle for a banking associate may play a task within the exchanges.

Kaiko stated:

“The premium on Binance.US is extra doubtless associated to the alternate’s struggles to discover a banking associate because the closure of Signature and Silvergate. With growing demand for BTC basically, traders on Binance.US are doubtless contemplating withdrawal delays quicker for BTC in comparison with USD, and rush to commerce in BTC on the similar time, leading to a premium on the alternate.

In comparison with international alternate Binance, whose market depth of 1% BTC has alternated between a number of highs and lows, Binance.US’ depth has remained flat. Kaiko information famous that this could not be the case if a serious market maker left the platform.

Following the US banking disaster that claimed the lives of three main crypto-friendly banks in March, the crypto business has been uncovered to low liquidity dangers. On the time, forexcryptozone Perception reported that BTC’s order guide hit a 10-month low.

One other report famous that US-based exchanges and market makers have develop into much less liquid as they look like most affected by the Silvergate implosion.

The submit Bitcoin bounty on Binance.US is a symptom of an illiquid market: Kaiko appeared first on forexcryptozone.