Evaluation performed by CoinShares highlighted that the crypto markets noticed a fifth consecutive week of outflows, with the present week totaling a lack of $32.1 million.

CoinShares has obtained information from digital asset funding suppliers, comparable to Grayscale and ProShares, which cater to institutional and accredited buyers.

Head of Analysis at CoinShares, James Butterfillcommented that this was as a result of “unhealthy feeling targeted on BTC.

Crypto Markets Endure Fifth Consecutive Weekly Outflow

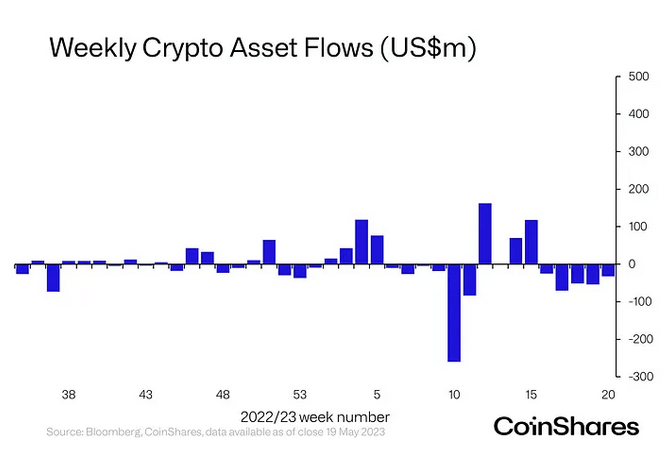

The chart under exhibits consecutive outflows of crypto belongings beginning in week 16. Complete outflows throughout this era amounted to $232 million.

For the reason that begin of 2023, there have been extra weeks of releases than inflows, with week 10 (starting Monday, March 6) representing the most important weekly releases this 12 months, topping round $270 million in that week. interval.

The start of March was characterised by financial institution failures, which noticed Silvergate, Signature Financial institution and Silicon Valley Financial institution canceled within the present excessive rate of interest setting.

After this era, Bitcoin worth rallied, rebounding from a low of $22,390 to shut the week beginning March 13 at $28,140, reaching $31,000 a month later. Analysts attributed this to a change in market sentiment in direction of sturdy belongings.

Extra not too long ago, tales of US regulatory hostility and uncertainty surrounding the US debt ceiling debates have taken their toll on cryptoassets normally.

Germany recorded the most important outflows

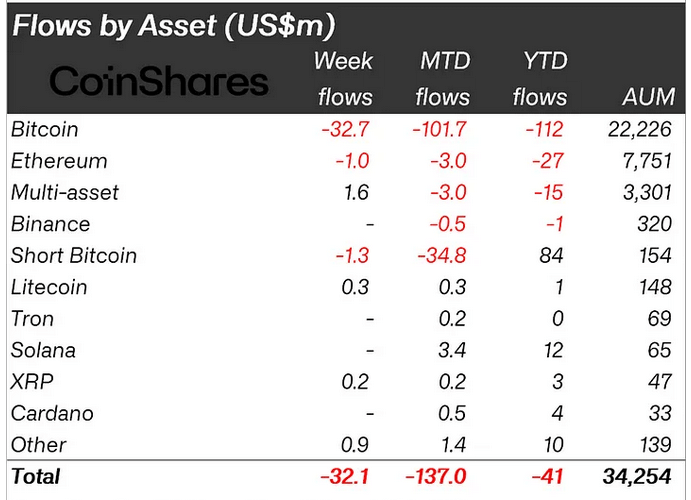

Flows by asset confirmed that Bitcoin accounted for the most important losses, hitting $32.7 million in week 20. Ethereum and Brief Bitcoin additionally suffered losses – albeit at considerably decrease charges of 1 million and $1.3 million, respectively.

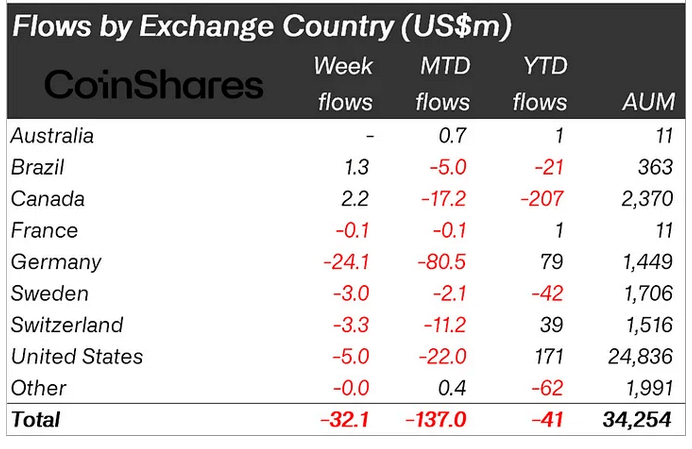

Additional evaluation by nation confirmed that Germany was accountable for essentially the most discharges, accounting for 75% of the weekly emptying. The US adopted with $5 million, adopted by Switzerland with $3.3 million.

CoinShares famous that the development in outflows was tied to additionally considerably decrease volumes for institutional buyers and spot markets.

“Volumes totaled $900 million for the week, 40% under this 12 months’s common. Volumes for the broader market on trusted exchanges hit their lowest stage since late 2020 at US$20 billion for the week. »

The submit 5 consecutive weekly releases indicating fragility within the crypto market appeared first on forexcryptozone.