- The bullish-bear shock causes the worth of KAVA to fluctuate between $1.17 and $1.27.

- The bearish strain threatens the uptrend of KAVA.

- Investor sentiment wavers as the worth of KAVA fluctuates.

At first of the day, the bears had the higher hand within the kava (KAVA) market, efficiently reducing the worth to a 24-hour low of $1.17 (help). After establishing help, the bulls swept the KAVA bears underneath the rug, sending the worth to a 24-hour excessive of $1.27.

The bullish momentum has been sturdy with the bulls sustaining management of the market at press time, resulting in a 0.24% rise to $1.20.

KAVA’s market capitalization elevated by 2.02% to $638,249,499 throughout the bull-bear battle, whereas 24-hour buying and selling quantity decreased by 9.57% to $178,190,221. This decline in buying and selling quantity means that buyers are cautious available in the market, taking earnings in anticipation of a reversal.

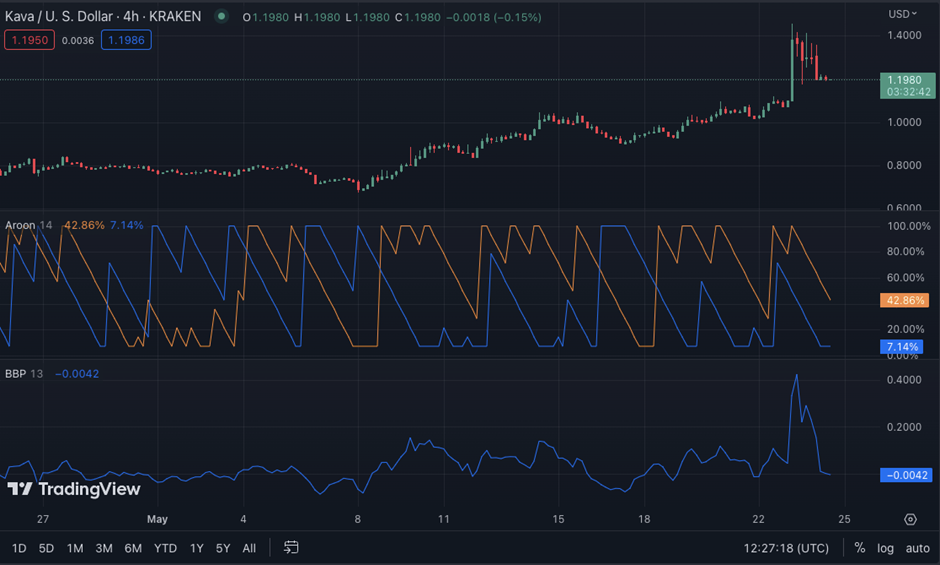

On the KAVA/USD value chart, the upside studying of Aroon is 50.00%, whereas the draw back studying of Aroon is 7.14%, indicating that the facility of the bulls is bigger than that of the bears, indicating a possible upward pattern quickly.

Nonetheless, because the Aroon stage shouldn’t be above 50, there may be nonetheless some uncertainty available in the market, which necessitates cease losses within the occasion of a pullback.

The bullish-bear energy moved into the unfavorable area with a studying of -0.0042, suggesting that the constructive sentiment within the KAVA market is waning. This transfer might point out that the bears are taking management and a downtrend is coming.

The Relative Energy Index (RSI) score of 56.78, which is transferring down under its sign line, signifies that the present pattern could also be operating out of steam.

If this RSI pattern continues and falls under the “50” stage, it might sign a shift in market sentiment from bullish to bearish. This transfer signifies that the bulls nonetheless have an opportunity to rebound because the shopping for momentum continues to be current available in the market.

The Fisher remodel additionally moved under its sign line, with a studying of 0.22, including to the reversal forecast. This motion signifies that the bears are gaining floor and {that a} doable downtrend is on the horizon.

In conclusion, KAVA value faces uncertainty as bearish momentum looms, signaling a possible downtrend. Traders ought to stay cautious of swings in market sentiment.

Disclaimer: The views, opinions and data shared on this value prediction are revealed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be chargeable for any direct or oblique damages or losses.