US Treasury yields have seen a notable rise this week, inflicting heightened apprehension available in the market. Notable will increase occurred on Wednesday and Thursday as considerations over the debt ceiling and hypothesis over rate of interest hikes pushed yields to document highs.

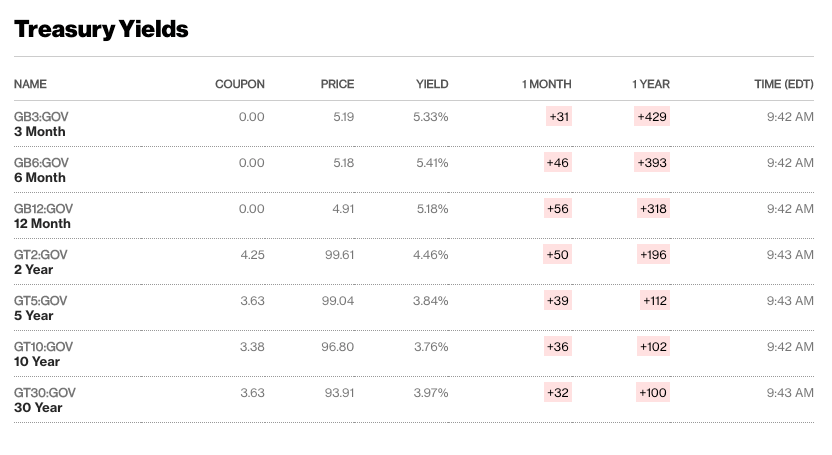

Within the early hours of Thursday, Might 25, the yield on the 12-month Treasury notice reached 5.18%, whereas that of the 6-month notice reached 5.41%. The yield on the 3-month invoice reached 5.33%. The ten-year Treasury notice rose to three.76%, whereas the 2-year Treasury notice rose seven foundation factors to 4.46%.

“Treasury payments” consult with US authorities securities that symbolize the debt obligations of the US authorities when it borrows cash to finance its operations. Treasury yields are the return on funding that buyers obtain by holding these securities. They’re an important reference within the monetary market, serving as an important indicator of market sentiment, inflation expectations and normal financial circumstances within the nation.

Whereas a number of elements contribute to the speed of return of Treasury yields, demand is an important. When buyers present greater demand, costs rise, resulting in decrease yields. Conversely, when demand falters, costs fall, resulting in greater yields.

As well as, market expectations relating to rates of interest and inflation can have a major impression on Treasury bond yields. If buyers anticipate rising rates of interest or inflation, returns are inclined to rise as a result of elevated danger related to holding mounted earnings securities.

The latest decline in demand for Treasuries can possible be attributed to 2 primary elements: considerations surrounding the debt ceiling and hypothesis about impending rate of interest hikes.

As the US approaches its debt restrict, uncertainty is rising concerning the authorities’s means to fulfill its monetary obligations. This uncertainty causes buyers to demand greater returns to compensate for the perceived danger. Moreover, the potential for rate of interest hikes launched by the Federal Reserve provides to market unease, as greater charges would have an effect on the worth of present mounted earnings investments.

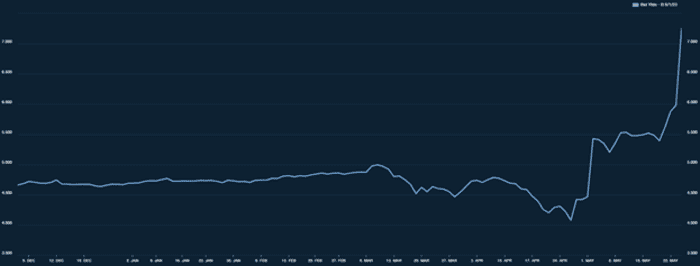

The market’s concern over the debt ceiling turns into evident on evaluation of the 1-month Treasury invoice. On Wednesday, Might 24, the 1-month invoice due June 1 hit a multi-decade excessive of seven.226%. This means that buyers have been shedding short-term bonds, fearing the prospect of a technical default on June 1 if debt ceiling negotiations fail.

The surge in Treasury yields has important implications for the broader monetary market. It will increase borrowing prices and results in greater rates of interest for all sorts of borrowing, which dampens client spending and enterprise funding. Rising Treasury yields can also put downward stress on the inventory market as excessive yielding mounted earnings investments change into comparatively extra engaging than equities.

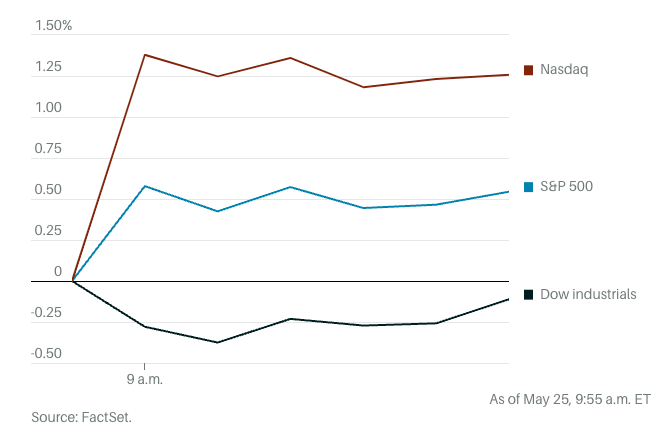

The inventory market is seeing heightened volatility as buyers weigh the financial well being of the market amid debt ceiling talks. All three main U.S. indexes fell on Wednesday evening after Fitch Scores positioned the U.S. AAA long-term ranking on adverse watch. Dow Jones Industrial Common futures fell 86 factors, or 0.3%, early Thursday. S&P 500 futures rose 0.6% and Nasdaq 100 futures rose 1.4%. Nonetheless, the optimistic motion seen on the S&P 500 and Nasdaq 100 futures may be attributed to the excellent efficiency of Nvidia (NVDA), which pushed expertise shares greater.

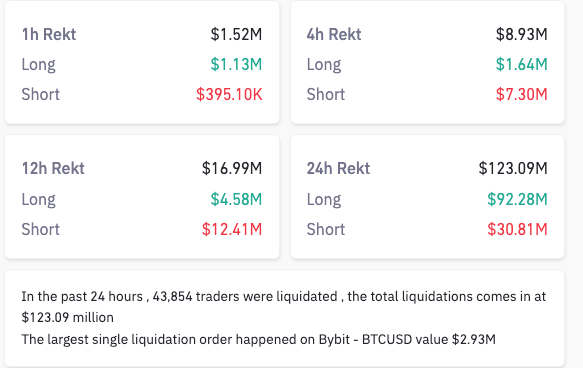

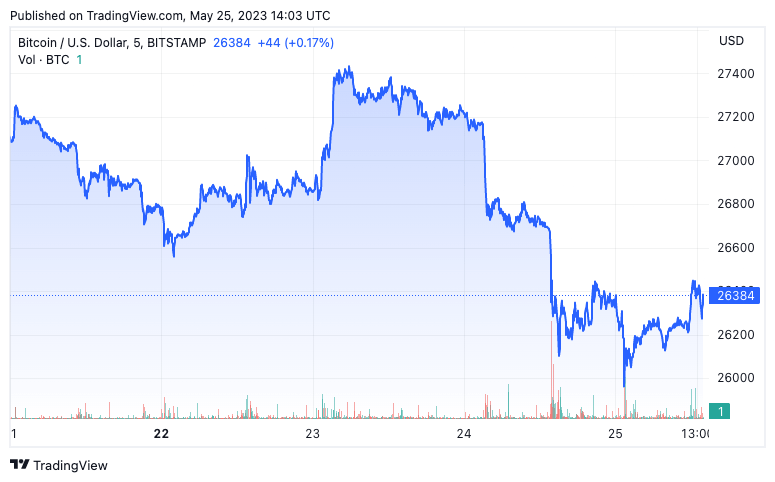

The cryptocurrency market can also be affected by rising Treasury yields. Bitcoin fell under $26,000, triggering a $120 million sell-off storm largely made up of lengthy positions.

The spike in liquidations suggests an inverse relationship between Treasury yields and BTC. As yields rise, investments sometimes shift away from riskier belongings comparable to Bitcoin. And whereas institutional buyers would possibly shift capital into fixed-income investments with rising returns, retail buyers would possibly fear concerning the worth volatility that might come from an extra rise in rates of interest.

After US Treasury yields soared and Bitcoin tumbled amid the debt cap, considerations about rising charges surfaced first on forexcryptozone.